Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounts Payable Accounts Receivable Additional Paid-in-Capital Allowance for Uncollected Accounts Bonds Payable Buildings Cash Common Stocks Deferred Tax Asset Deferred Tax Liability Discount on Bonds

Accounts Payable

Accounts Receivable

Additional Paid-in-Capital

Allowance for Uncollected Accounts

Bonds Payable

Buildings

Cash

Common Stocks

Deferred Tax Asset

Deferred Tax Liability

Discount on Bonds Payable

Equipment

Gains on Change in Fair Value of Contingent Consideration

Goodwill

Impairment Loss

Inventory

Land

Liability for Contingent Consideration

Loss on Change in Fair Value of Contingent Consideration

Mortgage Payable

No Entry

Note Payable

Other Contributed Capital

Operating Expense

Premium on Bonds Payable

Retained Earnings

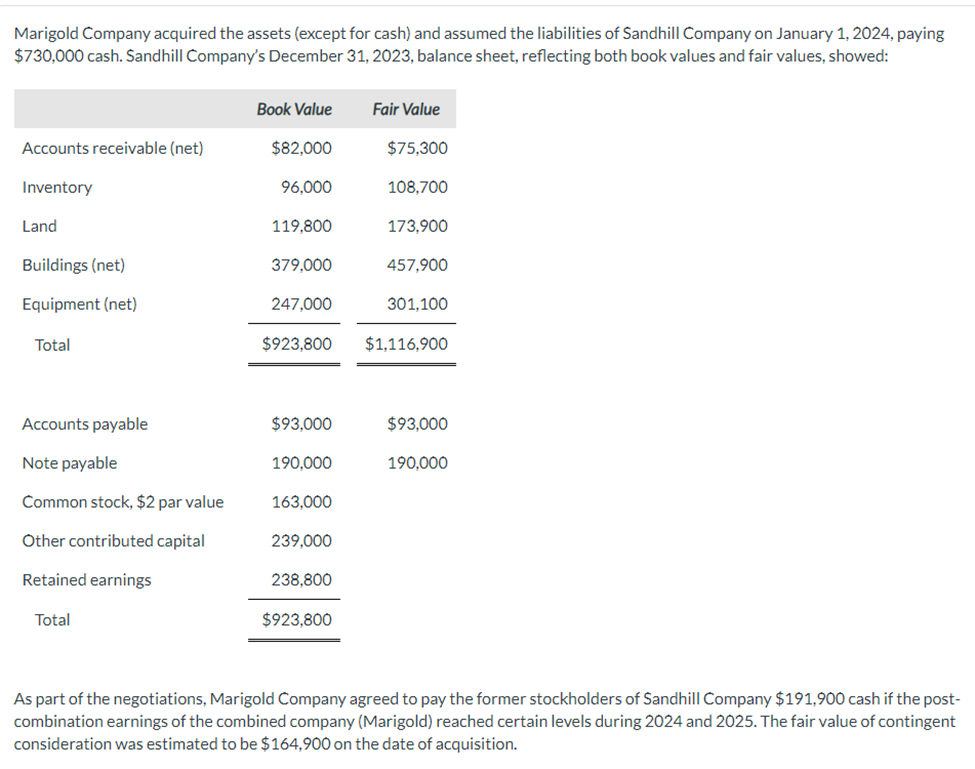

Marigold Company acquired the assets (except for cash) and assumed the liabilities of Sandhill Company on January 1, 2024, paying $730,000 cash. Sandhill Company's December 31, 2023, balance sheet, reflecting both book values and fair values, showed: As part of the negotiations, Marigold Company agreed to pay the former stockholders of Sandhill Company $191,900 cash if the postcombination earnings of the combined company (Marigold) reached certain levels during 2024 and 2025 . The fair value of contingent consideration was estimated to be $164,900 on the date of acquisition. Record the journal entry on the books of Pham Company to record the acquisition on January 1, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started