Question

Accounts Payable Accounts Receivable Advertising Expense Amortization Expense Buildings Cash Computer Software Costs Copyrights Discount on Bonds Payable Equipment Franchises Goodwill Income Summary Intangible Assets

Accounts Payable Accounts Receivable Advertising Expense Amortization Expense Buildings Cash Computer Software Costs Copyrights Discount on Bonds Payable Equipment Franchises Goodwill Income Summary Intangible Assets Interest Expense Inventory Land Legal Fees Expense Loss on Impairment No Entry Notes Payable Organization Expense Paid-in Capital in Excess of Par - Common Stock Patents Patent Expense Prepaid Rent Recovery of Loss from Impairment Rent Expense Rent Receivable Rent Revenue Research and Development Expense Retained Earnings Trade Names Trademarks

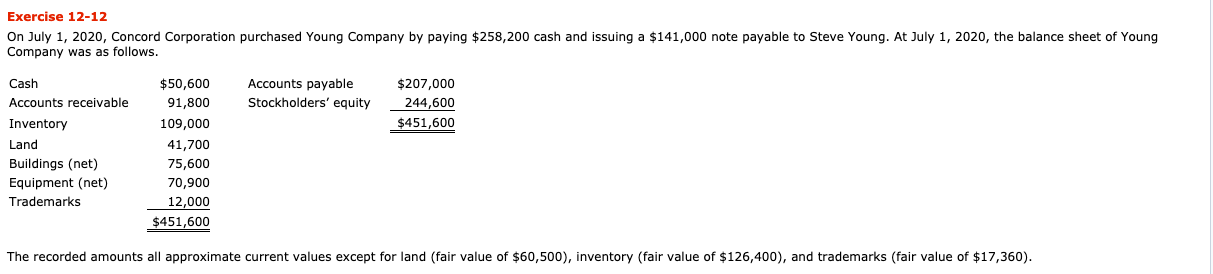

Exercise 12-12 On July 1, 2020, Concord Corporation purchased Young Company by paying $258,200 cash and issuing a $141,000 note payable to Steve Young. At July 1, 2020, the balance sheet of Young Company was as follows. Accounts payable Stockholders' equity $207,000 244,600 $451,600 Cash Accounts receivable Inventory Land Buildings (net) Equipment (net) Trademarks $50,600 91,800 109,000 41,700 75,600 70,900 12,000 $451,600 The recorded amounts all approximate current values except for land (fair value of $60,500), inventory (fair value of $126,400), and trademarks (fair value of $17,360). Prepare the July 1 entry for Concord Corporation to record the purchase. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Prepare the December 31 entry for Concord Corporation to record amortization of intangibles. The trademark has an estimated useful life of 4 years with a residual value of $3,760. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started