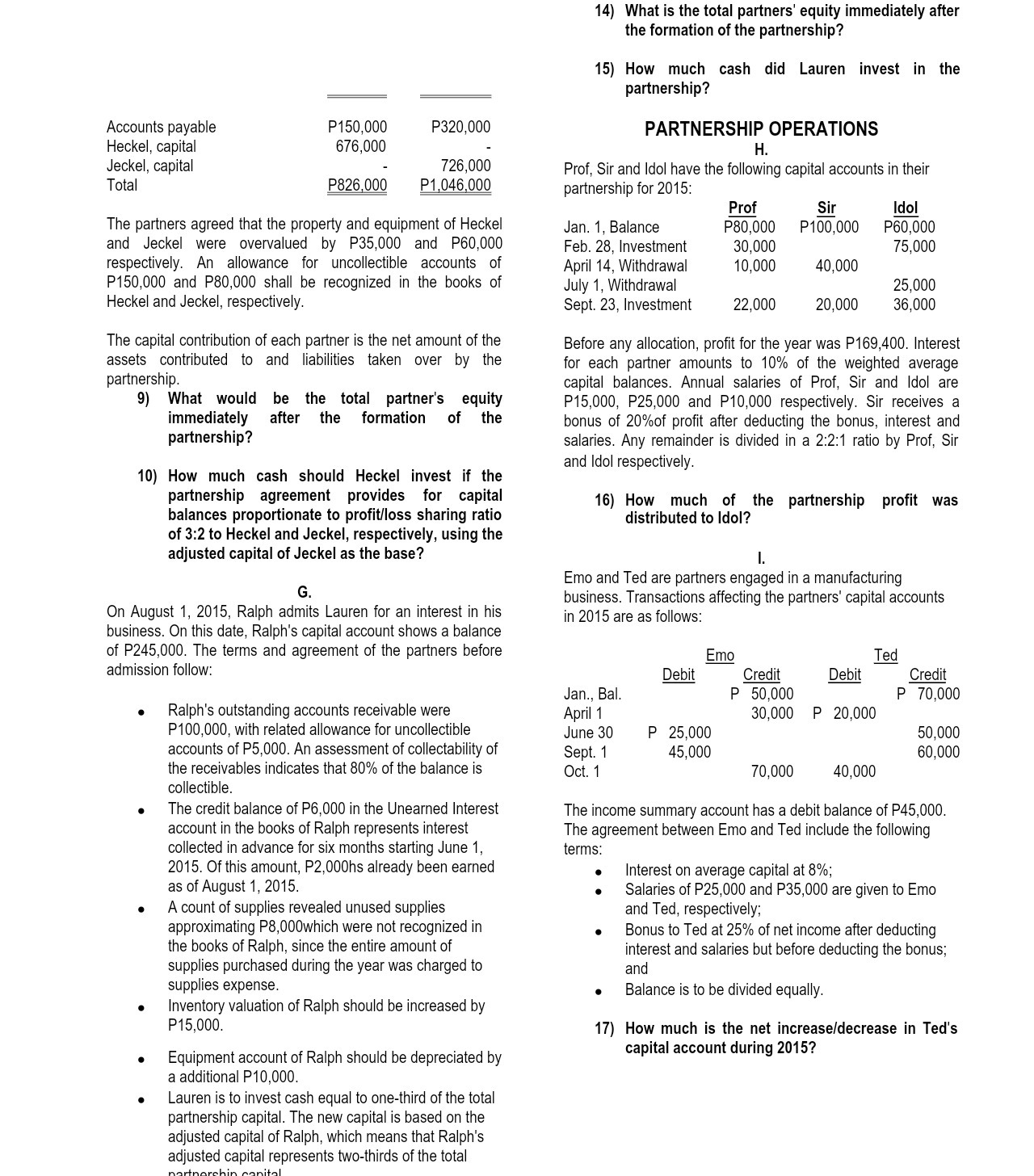

Accounts payable P150,000 P320,000 Heckel, capital 676,000 - Jeckel, capital - 726,000 Total P820000 P1 046,000 The partners agreed that the property and equipment of Heckel and Jeckel were overvalued by P35,000 and P60,000 respectively. An allowance for uncollectible accounts of P150,000 and P80,000 shall be recognized in the books of Heckel and Jeckel, respectively. The capital contribution of each partner is the net amount of the assets contributed to and liabilities taken over by the partnership. 9) What would be the total partner's equity immediately after the formation of the partnership? 10} How much cash should Heckel invest if the partnership agreement provides for capital balances proportionate to profiti'loss sharing ratio of 3:2 to Heckel and Jeckel, respectively, using the adjusted capital of Jeckel as the base? G. On August 1, 2015, Ralph admits Lauren for an interest in his business. On this date, Ralph's capital account shows a balance of P245,000. The terms and agreement of the partners before admission follow: a Ralph's outstanding accounts receivable were P100,000, with related allowance for uncollectible accounts of P5,000. An assessment of collectability of the receivables indicates that 80% of the balance is collectible. . The credit balance of P6,000 in the Unearned Interest account in the books of Ralph represents interest collected in advance for six months starting June 1, 2015. Of this amount, P2,000hs already been earned as of August 1, 2015. e A count of supplies revealed unused supplies approximating P8,000which were not recognized in the books of Ralph, since the entire amount of supplies purchased during the year was charged to supplies expense. . Inventory valuation of Ralph should be increased by P15,000. 0 Equipment account of Ralph should be depreciated by a additional P10,000. 0 Lauren is to invest cash equal to one-third of the total partnership capital. The new capital is based on the adjusted capital of Ralph, which means that Ralph's adjusted capital represents two-thirds of the total nqunorc-h in nanilql 14} What is the total partners' equity immediately after the formation of the partnership? 15} How much cash did Lauren invest in the partnership? PARTNERSHIP OPERATIONS H. Prof, Sir and Idol have the following capital accounts in their partnership for 2015: Pr_or s_ir m Jan. 1, Balance P80,000 P100,000 P60,000 Feb. 28, Investment 30,000 75,000 April 14, Withdrawal 10,000 40000 July 1, Withdrawal 25,000 Sept. 23, Investment 22,000 20,000 36,000 Before any allocation, prot for the year was P160400. Interest for each partner amounts to 10% of the weighted average capital balances. Annual salaries of Prof, Sir and Idol are P15,000, P25,000 and P10,000 respectively. Sir receives a bonus of 20%of prot after deducting the bonus, interest and salaries. Any remainder is divided in a 2:2:1 ratio by Prof, Sir and Idol respectively. 16} How much of the partnership profit was distributed to Idol? I. Emo and Ted are panners engaged in a manufacturing business. Transactions affecting the partners' capital accounts in 2015 are as follows: m m M M M Credit Jan.,Bal. P 50,000 P 70,000 April1 30,000 P 20,000 June30 P 25,000 50,000 Sept. 1 45,000 00000 Oct. 1 70,000 40,000 The income summary account has a debit balance of P45,000. The agreement between Emo and Ted include the following terms: 0 Interest on average capital at 8%; 0 Salaries of P25,000 and P35,000 are given to Emo and Ted, respectively; 0 Bonus to Ted at 25% of net income after deducting interest and salaries but before deducting the bonus; and 0 Balance is to be divided equally. 17} How much is the net increasetdecrease in Ted's capital account during 2015