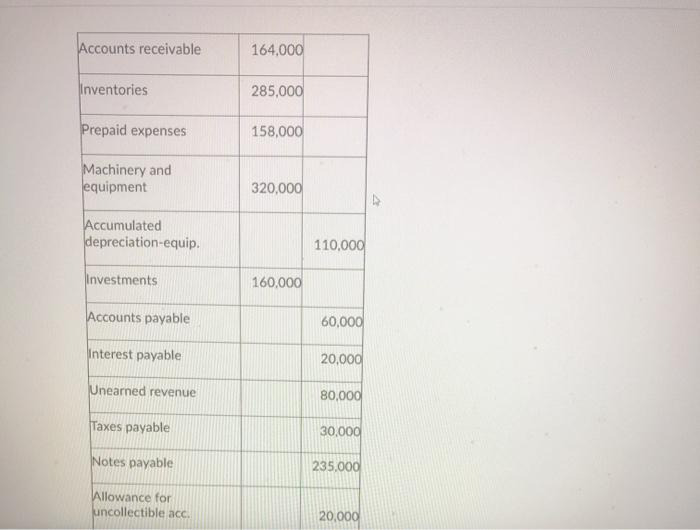

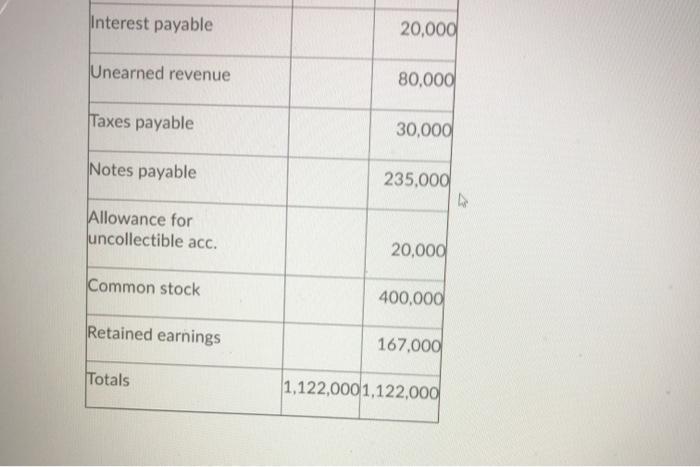

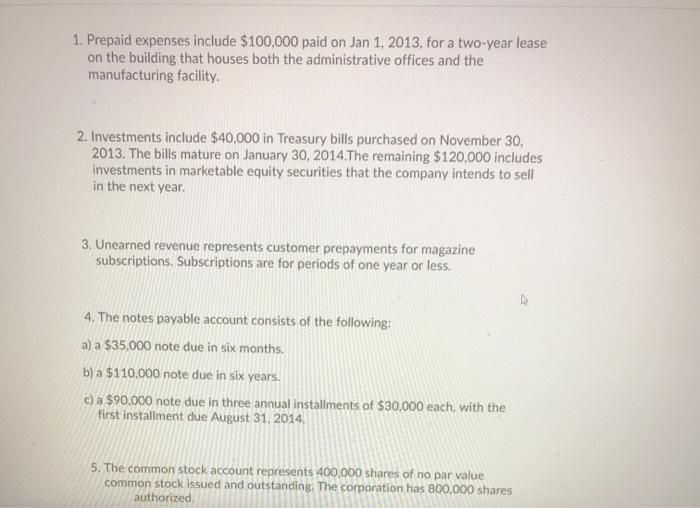

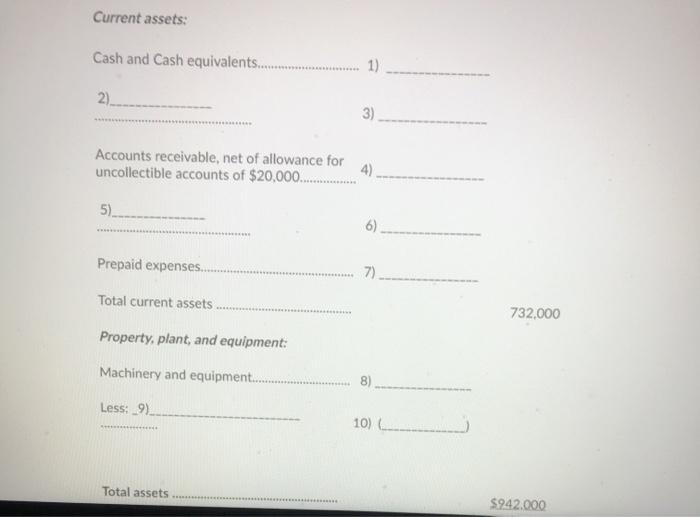

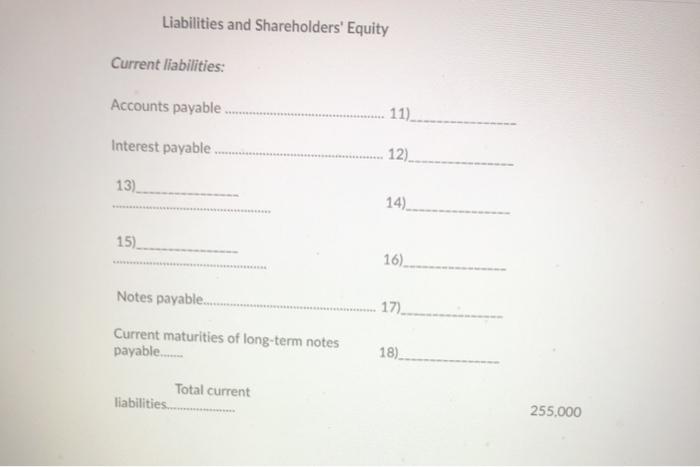

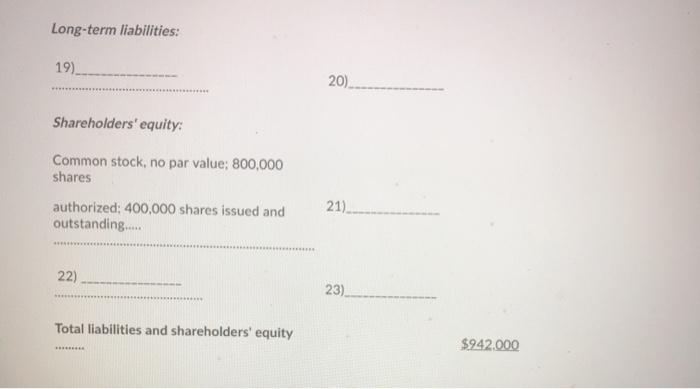

Accounts receivable 164,000 Inventories 285,000 Prepaid expenses 158,000 Machinery and equipment 320,000 Accumulated depreciation-equip. 110,000 Investments 160,000 Accounts payable 60,000 Interest payable 20,000 Unearned revenue 80,000 Taxes payable 30,000 Notes payable 235,000 Allowance for uncollectible acc 20,000 Interest payable 20,000 Unearned revenue 80,000 Taxes payable 30,000 Notes payable 235.000 Allowance for uncollectible acc. 20,000 Common stock 400,000 Retained earnings 167,000 Totals 1,122,000 1,122,000 1. Prepaid expenses include $100,000 paid on Jan 1, 2013, for a two-year lease on the building that houses both the administrative offices and the manufacturing facility. 2. Investments include $40,000 in Treasury bills purchased on November 30, 2013. The bills mature on January 30, 2014. The remaining $120,000 includes investments in marketable equity securities that the company intends to sell in the next year. 3. Unearned revenue represents customer prepayments for magazine subscriptions. Subscriptions are for periods of one year or less. 4. The notes payable account consists of the following: a) a $35,000 note due in six months. b) a $110,000 note due in six years. c) a $90,000 note due in three annual installments of $30,000 each with the first installment due August 31, 2014 5. The common stock account represents 400,000 shares of no par value common stock issued and outstanding. The corporation has 800,000 shares authorized Current assets: Cash and Cash equivalents............... 1) 2) 3) Accounts receivable, net of allowance for uncollectible accounts of $20,000.......... 5) 6) Prepaid expenses 7) Total current assets 732,000 Property, plant, and equipment: Machinery and equipment 8) Less: 9). 10) Total assets $942.000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable 11) Interest payable 12). 13) 14) 15) 16). 17) Notes payable.... Current maturities of long-term notes payable....... 18) Total current liabilities 255.000 Long-term liabilities: 19). 20). Shareholders' equity: Common stock, no par value; 800,000 shares authorized: 400,000 shares issued and outstanding... 21) 22) 23). Total liabilities and shareholders' equity $942.000 Accounts receivable 164,000 Inventories 285,000 Prepaid expenses 158,000 Machinery and equipment 320,000 Accumulated depreciation-equip. 110,000 Investments 160,000 Accounts payable 60,000 Interest payable 20,000 Unearned revenue 80,000 Taxes payable 30,000 Notes payable 235,000 Allowance for uncollectible acc 20,000 Interest payable 20,000 Unearned revenue 80,000 Taxes payable 30,000 Notes payable 235.000 Allowance for uncollectible acc. 20,000 Common stock 400,000 Retained earnings 167,000 Totals 1,122,000 1,122,000 1. Prepaid expenses include $100,000 paid on Jan 1, 2013, for a two-year lease on the building that houses both the administrative offices and the manufacturing facility. 2. Investments include $40,000 in Treasury bills purchased on November 30, 2013. The bills mature on January 30, 2014. The remaining $120,000 includes investments in marketable equity securities that the company intends to sell in the next year. 3. Unearned revenue represents customer prepayments for magazine subscriptions. Subscriptions are for periods of one year or less. 4. The notes payable account consists of the following: a) a $35,000 note due in six months. b) a $110,000 note due in six years. c) a $90,000 note due in three annual installments of $30,000 each with the first installment due August 31, 2014 5. The common stock account represents 400,000 shares of no par value common stock issued and outstanding. The corporation has 800,000 shares authorized Current assets: Cash and Cash equivalents............... 1) 2) 3) Accounts receivable, net of allowance for uncollectible accounts of $20,000.......... 5) 6) Prepaid expenses 7) Total current assets 732,000 Property, plant, and equipment: Machinery and equipment 8) Less: 9). 10) Total assets $942.000 Liabilities and Shareholders' Equity Current liabilities: Accounts payable 11) Interest payable 12). 13) 14) 15) 16). 17) Notes payable.... Current maturities of long-term notes payable....... 18) Total current liabilities 255.000 Long-term liabilities: 19). 20). Shareholders' equity: Common stock, no par value; 800,000 shares authorized: 400,000 shares issued and outstanding... 21) 22) 23). Total liabilities and shareholders' equity $942.000