Answered step by step

Verified Expert Solution

Question

1 Approved Answer

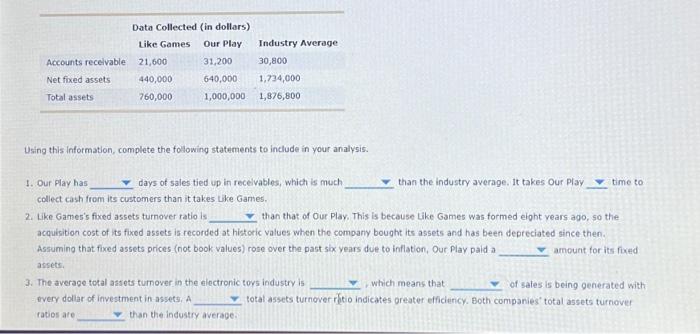

Accounts receivable Net fixed assets Total assets Data Collected (in dollars) Like Games Our Play 21,600 440,000 760,000 31,200 640,000 1,000,000 Industry Average 30,800 1,734,000

Accounts receivable Net fixed assets Total assets Data Collected (in dollars) Like Games Our Play 21,600 440,000 760,000 31,200 640,000 1,000,000 Industry Average 30,800 1,734,000 1,876,800 Using this information, complete the following statements to include in your analysis. 1. Our Play has days of sales tied up in receivables, which is much collect cash from its customers than it takes Like Games. 2. Like Games's fixed assets turnover ratio is than that of Our Play. This is because Like Games was formed eight years ago, so the acquisition cost of its fixed assets is recorded at historic values when the company bought its assets and has been depreciated since then. Assuming that fixed assets prices (not book values) rose over the past six years due to inflation, Our Play paid a amount for its fixed assets. 3. The average total assets turnover in the electronic toys industry is every dollar of investment in assets. A ratios are than the industry average. than the industry average. It takes Our Play time to which means that of sales is being generated with total assets turnover ratio indicates greater efficiency. Both companies' total assets turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started