Answered step by step

Verified Expert Solution

Question

1 Approved Answer

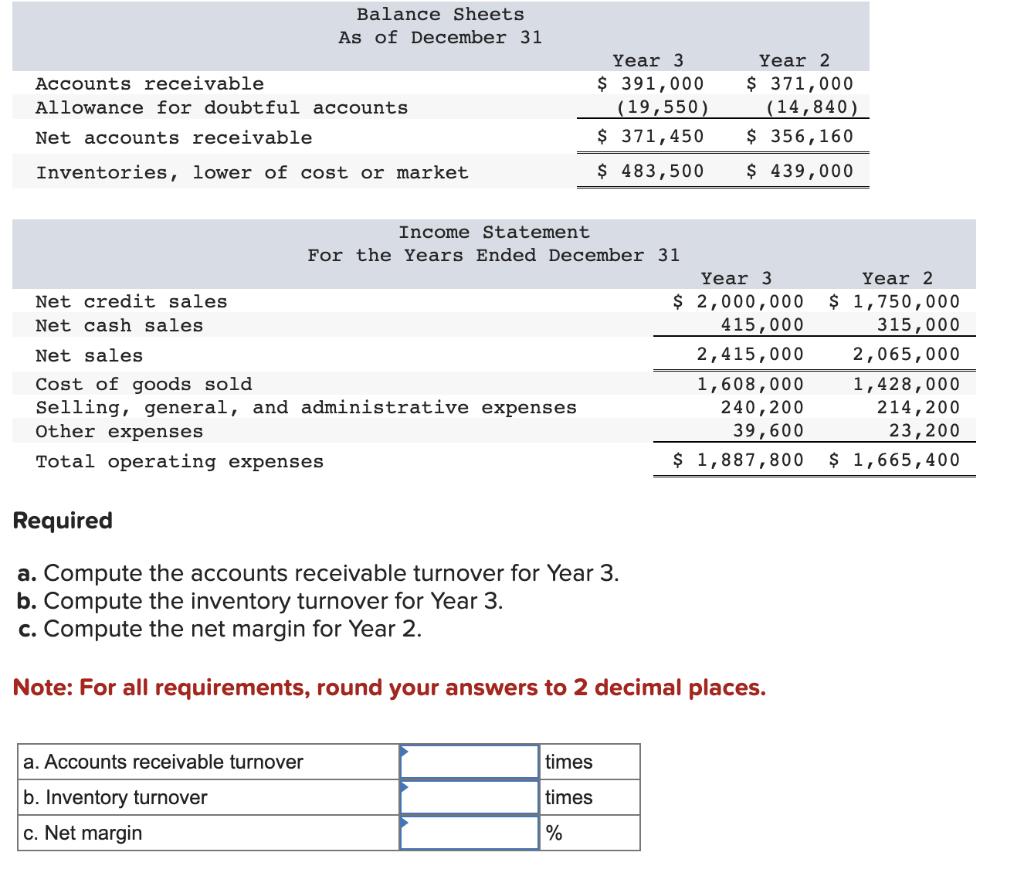

accounts receivable turnover inventory turnover net margin Accounts receivable Allowance for doubtful accounts Net accounts receivable Inventories, lower of cost or market Balance Sheets As

accounts receivable turnover inventory turnover net margin

Accounts receivable Allowance for doubtful accounts Net accounts receivable Inventories, lower of cost or market Balance Sheets As of December 31 Required Net credit sales. Net cash sales. Net sales Cost of goods sold Selling, general, and administrative expenses Other expenses Total operating expenses a. Accounts receivable turnover b. Inventory turnover c. Net margin Income Statement For the Years Ended December 31 Year 3 $ 391,000 (19,550) $ 371,450 $ 483,500 times times % Year 2 $ 371,000 (14,840) $ 356,160 $ 439,000 Year 3 $ 2,000,000 415,000 a. Compute the accounts receivable turnover for Year 3. b. Compute the inventory turnover for Year 3. c. Compute the net margin for Year 2. Note: For all requirements, round your answers to 2 decimal places. 2,415,000 1,608,000 240,200 39,600 $ 1,887,800 Year 2 $ 1,750,000 315,000 2,065,000 1,428,000 214,200 23, 200 $ 1,665,400

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the required financial ratios well use the following formulas a Accounts Receivable Tur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started