Answered step by step

Verified Expert Solution

Question

1 Approved Answer

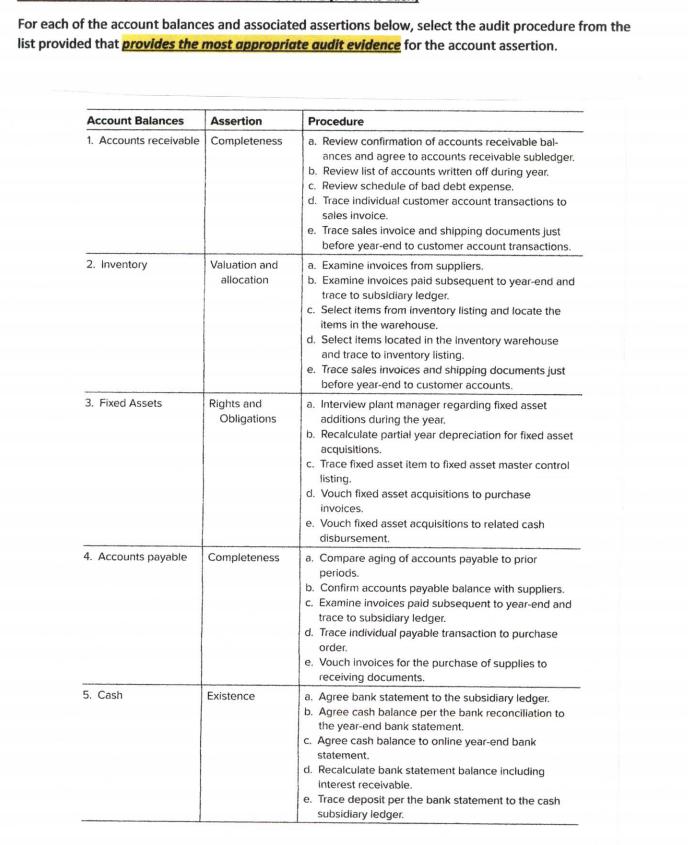

For each of the account balances and associated assertions below, select the audit procedure from the list provided that provides the most appropriate audit

For each of the account balances and associated assertions below, select the audit procedure from the list provided that provides the most appropriate audit evidence for the account assertion. Account Balances 1. Accounts receivable 2. Inventory 3. Fixed Assets 4. Accounts payable 5. Cash Assertion Completeness Valuation and allocation Rights and Obligations Completeness Existence Procedure a. Review confirmation of accounts receivable bal- ances and agree to accounts receivable subledger. b. Review list of accounts written off during year. c. Review schedule of bad debt expense. d. Trace individual customer account transactions to sales invoice. e. Trace sales invoice and shipping documents just before year-end to customer account transactions. a. Examine invoices from suppliers. b. Examine invoices paid subsequent to year-end and trace to subsidiary ledger. c. Select items from inventory listing and locate the items in the warehouse. d. Select items located in the inventory warehouse and trace to inventory listing. e. Trace sales invoices and shipping documents just before year-end to customer accounts. a. Interview plant manager regarding fixed asset additions during the year. b. Recalculate partial year depreciation for fixed asset acquisitions. c. Trace fixed asset item to fixed asset master control listing. d. Vouch fixed asset acquisitions to purchase invoices. e. Vouch fixed asset acquisitions to related cash disbursement. a. Compare aging of accounts payable to prior periods. b. Confirm accounts payable balance with suppliers. c. Examine invoices paid subsequent to year-end and trace to subsidiary ledger. d. Trace individual payable transaction to purchase order. e. Vouch invoices for the purchase of supplies to receiving documents. a. Agree bank statement to the subsidiary ledger. b. Agree cash balance per the bank reconciliation to the year-end bank statement. c. Agree cash balance to online year-end bank statement. d. Recalculate bank statement balance including interest receivable. e. Trace deposit per the bank statement to the cash subsidiary ledger.

Step by Step Solution

★★★★★

3.43 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Audit procedures for testing accounts receivables Completeness It is possible that the company for t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started