Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accrual adjustment entries! Need help before tutorial.. Parkes Ltd's annual accounting year ends on 30 June. It is 30 June 2016 and all of the

Accrual adjustment entries! Need help before tutorial..

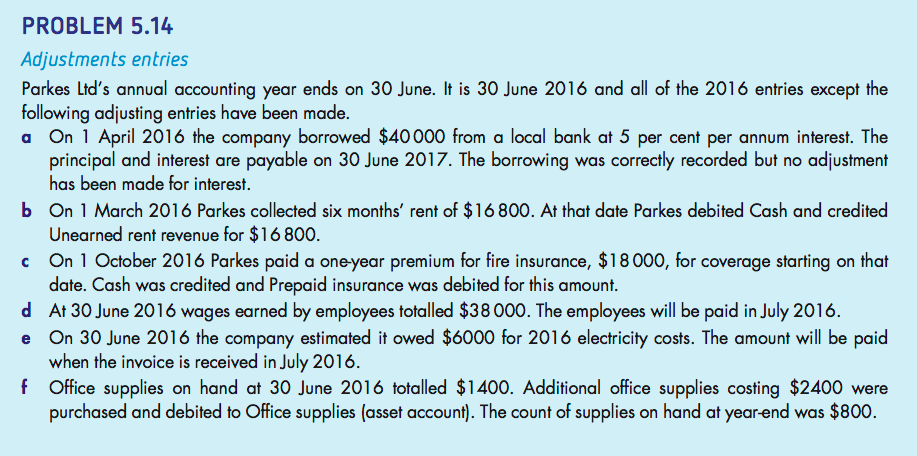

Parkes Ltd's annual accounting year ends on 30 June. It is 30 June 2016 and all of the 2016 entries except the following adjusting entries have been made. On 1 April 2016 the company borrowed $40000 from a local bank at 5 per cent per annum interest. The principal and interest are payable on 30 June 2017. The borrowing was correctly recorded but no adjustment has been made for interest. On 1 March 2016 Parkes collected six months' rent of $16800. At that date Parkes debited Cash and credited Unearned rent revenue for $16 800. On 1 October 2016 Parkes paid a one-year premium for fire insurance, $18000, for coverage starting on that date. Cash was credited and prepaid insurance was debited for this amount. At 30 June 2016 wages earned by employees totalled $38000. The employees will be paid in July 2016. On 30 June 2016 the company estimated it owed $6000 for 2016 electricity costs. The amount will be paid when the invoice is received in July 2016. Office supplies on hand at 30 June 2016 totalled $1400. Additional office supplies costing $2400 were purchased and debited to Office supplies (asset account). The count of supplies on hand at year-end was $800.]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started