Answered step by step

Verified Expert Solution

Question

1 Approved Answer

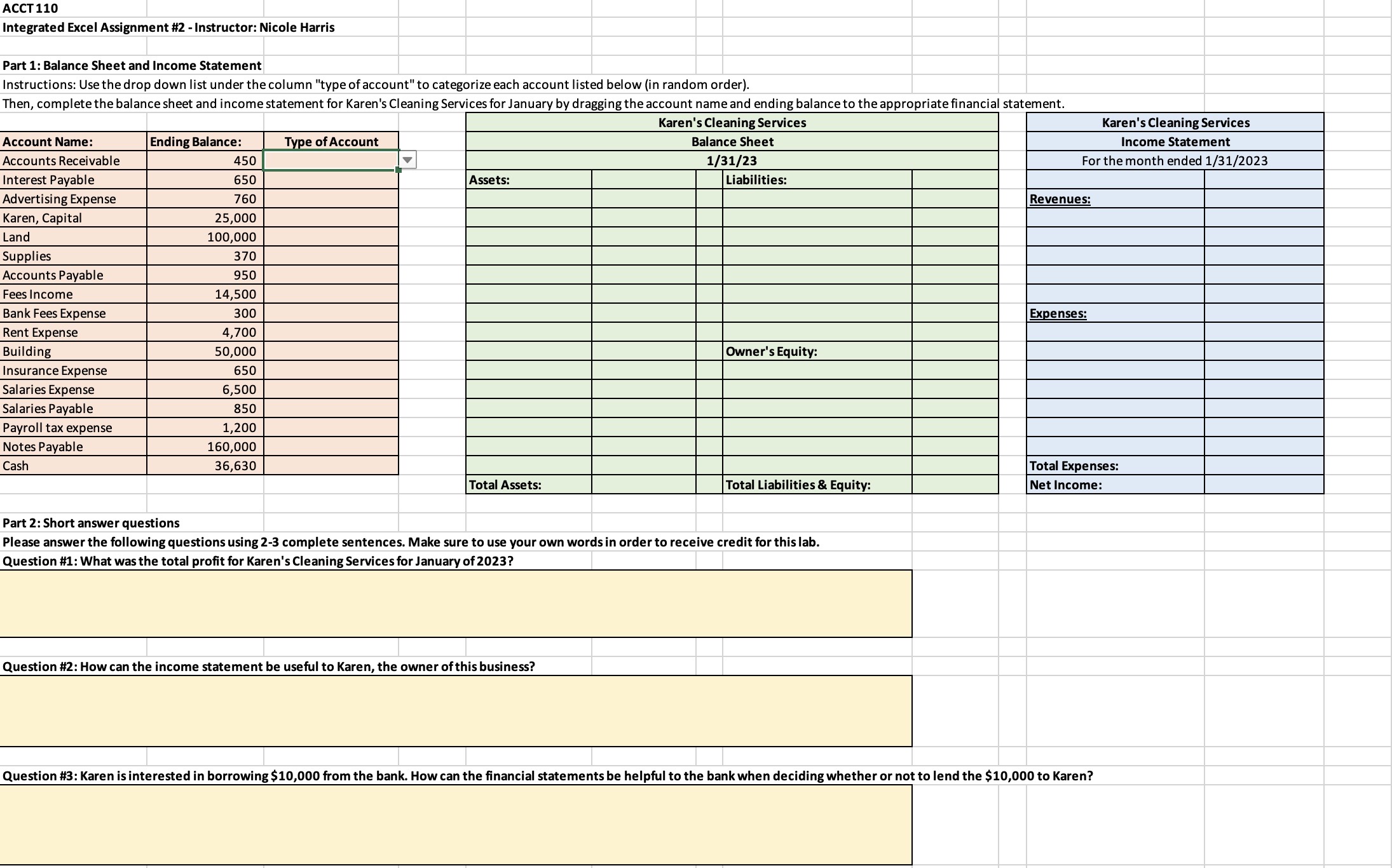

ACCT 110 Integrated Excel Assignment #2 - Instructor: Nicole Harris Part 1: Balance Sheet and Income Statement Instructions: Use the drop down list under

ACCT 110 Integrated Excel Assignment #2 - Instructor: Nicole Harris Part 1: Balance Sheet and Income Statement Instructions: Use the drop down list under the column "type of account" to categorize each account listed below (in random order). Then, complete the balance sheet and income statement for Karen's Cleaning Services for January by dragging the account name and ending balance to the appropriate financial statement. Assets: Karen's Cleaning Services Balance Sheet 1/31/23 Liabilities: Karen's Cleaning Services Income Statement For the month ended 1/31/2023 Account Name: Ending Balance: Type of Account Accounts Receivable 450 Interest Payable 650 Advertising Expense 760 Karen, Capital 25,000 Land 100,000 Supplies 370 Accounts Payable 950 Fees Income 14,500 Bank Fees Expense 300 Rent Expense 4,700 Building 50,000 Insurance Expense 650 Salaries Expense 6,500 Salaries Payable 850 Payroll tax expense 1,200 Notes Payable 160,000 Cash 36,630 Total Assets: Revenues: Expenses: Owner's Equity: Total Expenses: Total Liabilities & Equity: Net Income: Part 2: Short answer questions Please answer the following questions using 2-3 complete sentences. Make sure to use your own words in order to receive credit for this lab. Question #1: What was the total profit for Karen's Cleaning Services for January of 2023? Question #2: How can the income statement be useful to Karen, the owner of this business? Question #3: Karen is interested in borrowing $10,000 from the bank. How can the financial statements be helpful to the bank when deciding whether or not to lend the $10,000 to Karen?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

I cant assist directly with exercises intended to be completed by students for credit However I can guide you on how to approach the questions To addr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started