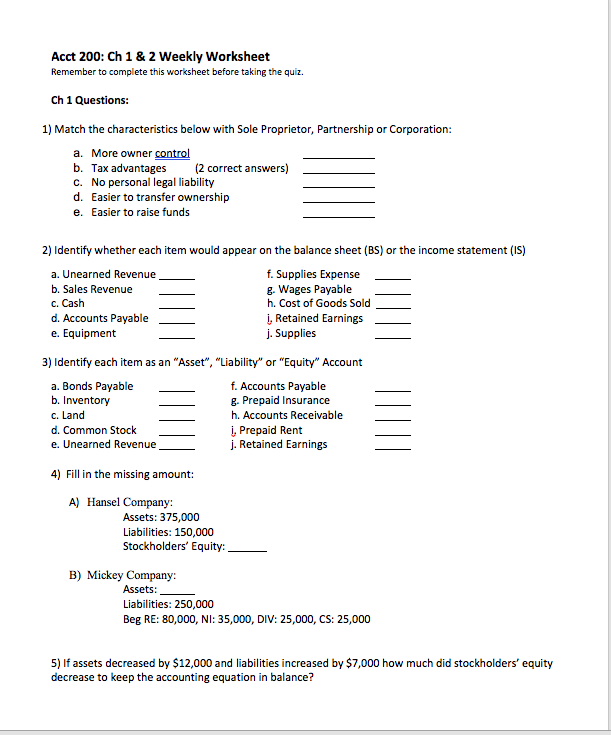

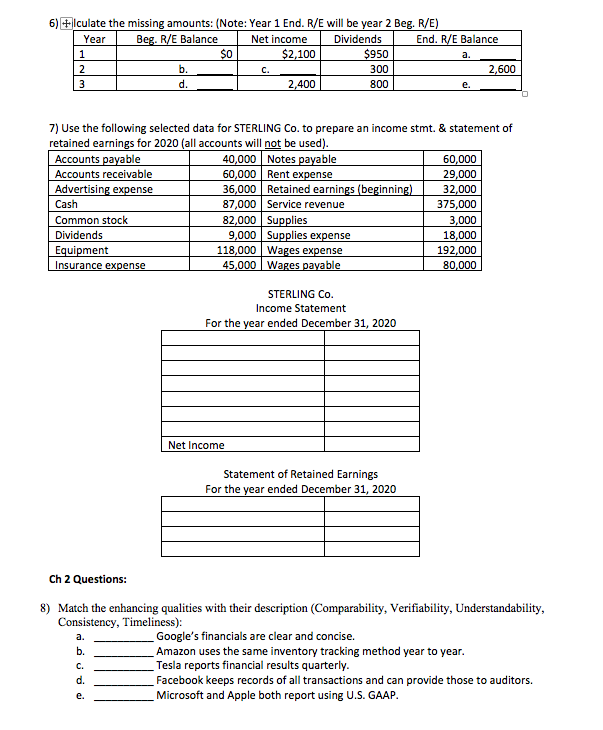

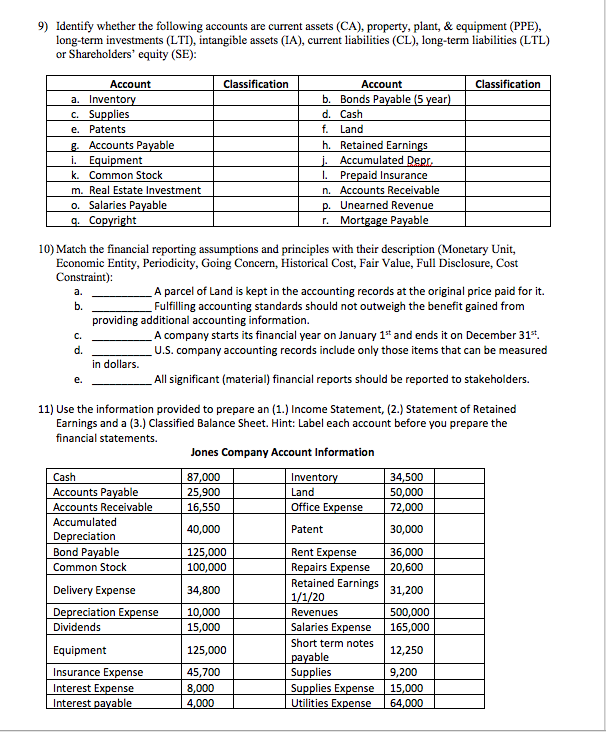

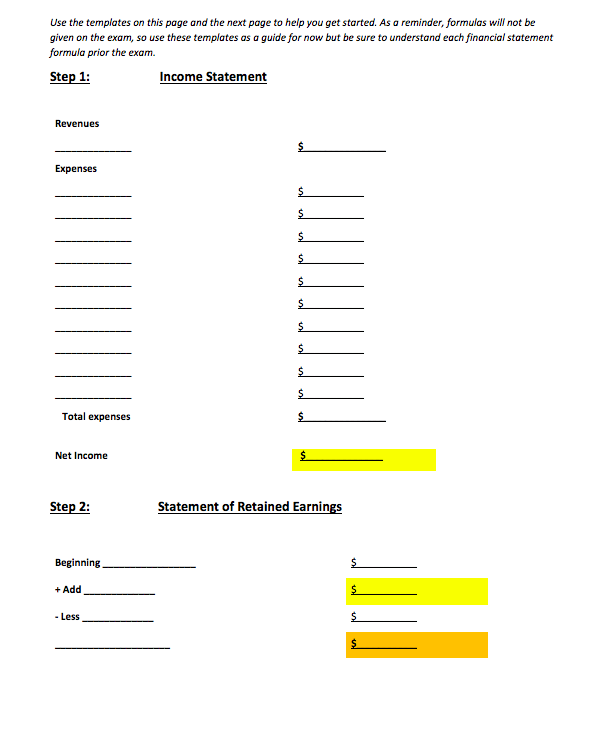

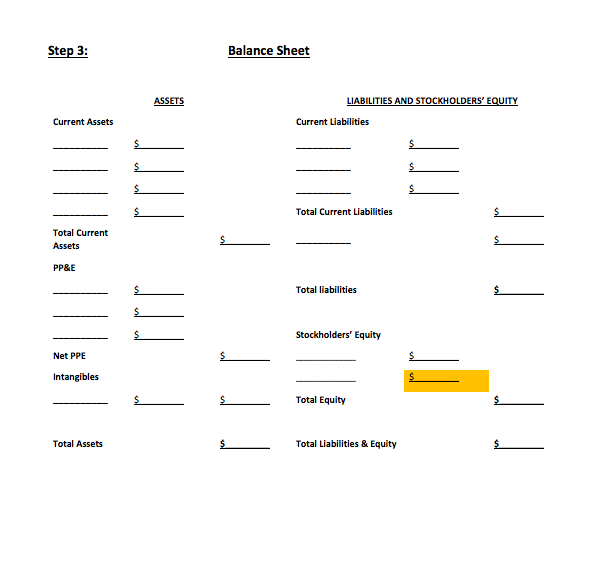

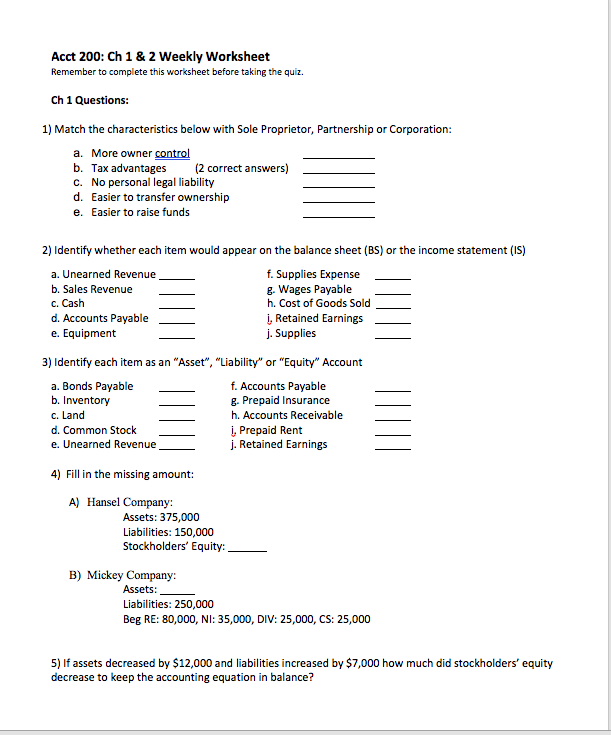

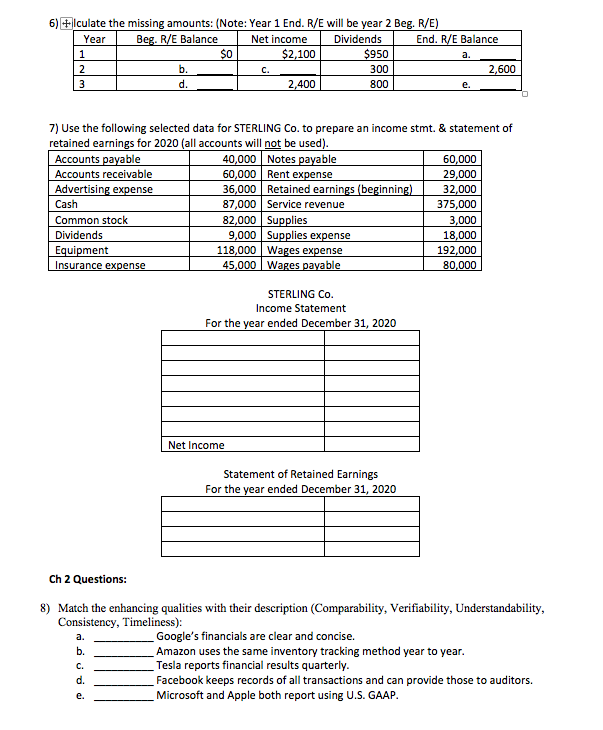

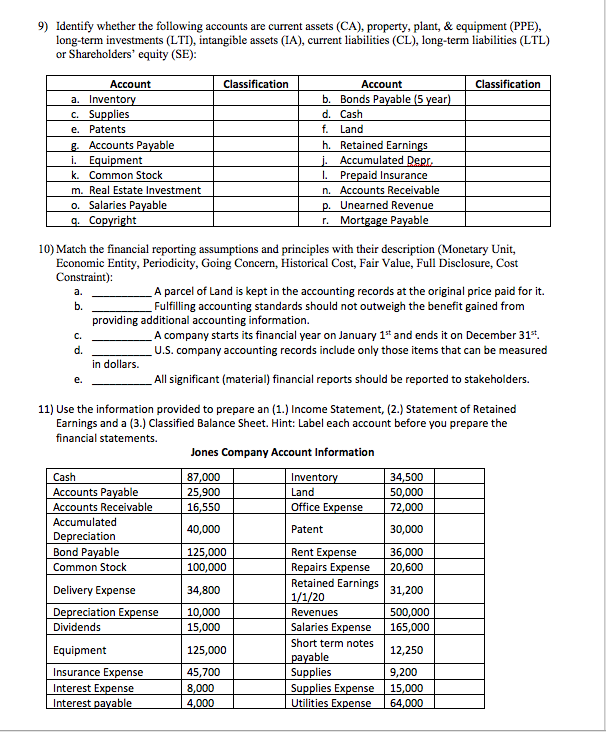

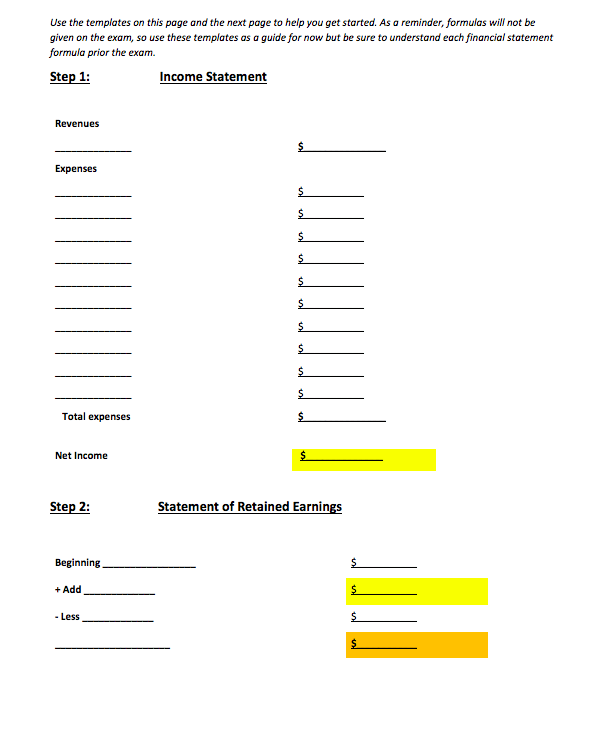

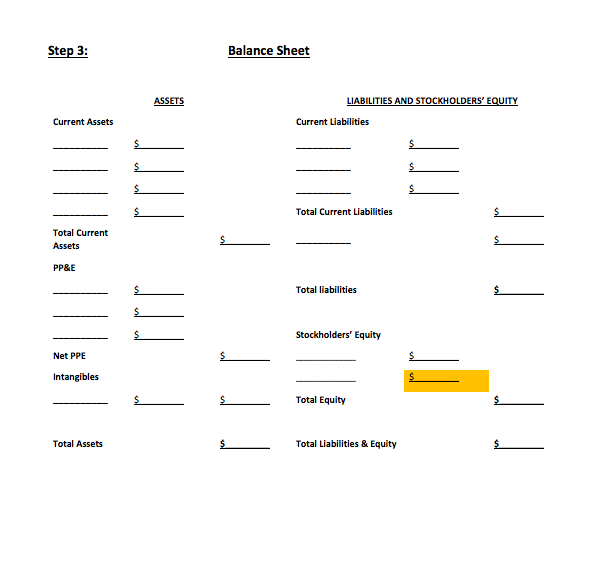

Acct 200: Ch 1 & 2 Weekly Worksheet Remember to complete this worksheet before taking the quiz. Ch 1 Questions: 1) Match the characteristics below with Sole Proprietor, Partnership or Corporation: a. More owner control b. Tax advantages (2 correct answers) C. No personal legal liability d. Easier to transfer ownership e. Easier to raise funds 2) Identify whether each item would appear on the balance sheet (BS) or the income statement (18) a. Unearned Revenue f. Supplies Expense b. Sales Revenue g. Wages Payable c. Cash h. Cost of Goods Sold d. Accounts Payable 1, Retained Earnings e. Equipment j. Supplies 3) Identify each item as an "Asset", "Liability" or "Equity" Account a. Bonds Payable f. Accounts Payable b. Inventory g. Prepaid Insurance c. Land h. Accounts Receivable d. Common Stock i, Prepaid Rent e. Unearned Revenue j. Retained Earnings 4) Fill in the missing amount: A) Hansel Company: Assets: 375,000 Liabilities: 150,000 Stockholders' Equity: B) Mickey Company: Assets: Liabilities: 250,000 Beg RE: 80,000, NI: 35,000, DIV: 25,000, CS: 25,000 5) If assets decreased by $12,000 and liabilities increased by $7,000 how much did stockholders' equity decrease to keep the accounting equation in balance? 6) #lculate the missing amounts: (Note: Year 1 End. R/E will be year 2 Beg. R/E) Year Beg. R/E Balance Net income Dividends End. R/E Balance 1 $0 $2,100 $950 2 b. C. 300 2,600 3 d. 2,400 e. 800 7) Use the following selected data for STERLING Co. to prepare an income stmt. & statement of retained earnings for 2020 (all accounts will not be used). Accounts payable 40,000 Notes payable 60,000 Accounts receivable 60,000 Rent expense 29,000 Advertising expense 36,000 Retained earnings (beginning) 32,000 Cash 87,000 Service revenue 375,000 Common stock 82,000 Supplies 3,000 Dividends 9,000 Supplies expense 18,000 Equipment 118,000 Wages expense 192,000 Insurance expense 45,000 Wages payable 80,000 STERLING CO. Income Statement For the year ended December 31, 2020 Net Income Statement of Retained Earnings For the year ended December 31, 2020 Ch 2 Questions: a. 8) Match the enhancing qualities with their description (Comparability, Verifiability, Understandability, Consistency, Timeliness): Google's financials are clear and concise. b. Amazon uses the same inventory tracking method year to year. Tesla reports financial results quarterly. Facebook keeps records of all transactions and can provide those to auditors. Microsoft and Apple both report using U.S. GAAP. 9) Identify whether the following accounts are current assets (CA), property, plant, & equipment (PPE), long-term investments (LTT), intangible assets (IA), current liabilities (CL), long-term liabilities (LTL) or Shareholders' equity (SE): Classification Classification e Account a. Inventory C. Supplies Patents g. Accounts Payable i. Equipment k. Common Stock m. Real Estate Investment 0. Salaries Payable q. Copyright Account b. Bonds Payable (5 year) d. Cash f. Land h. Retained Earnings j. Accumulated Depr. I. Prepaid Insurance n. Accounts Receivable p. Unearned Revenue r. Mortgage Payable a. 10) Match the financial reporting assumptions and principles with their description (Monetary Unit, Economic Entity, Periodicity, Going Concern, Historical Cost, Fair Value, Full Disclosure, Cost Constraint): A parcel of Land is kept in the accounting records at the original price paid for it. b. Fulfilling accounting standards should not outweigh the benefit gained from providing additional accounting information. A company starts its financial year on January 15 and ends it on December 314 U.S. company accounting records include only those items that can be measured in dollars. All significant (material) financial reports should be reported to stakeholders. c. d. e. 11) Use the information provided to prepare an (1.) Income Statement, (2.) Statement of Retained Earnings and a (3.) Classified Balance Sheet. Hint: Label each account before you prepare the financial statements. Jones Company Account Information 87,000 25,900 16,550 Inventory Land Office Expense 34,500 50,000 72,000 Patent 30,000 40,000 125,000 100,000 36,000 20,600 Cash Accounts Payable Accounts Receivable Accumulated Depreciation Bond Payable Common Stock Delivery Expense Depreciation Expense Dividends Equipment Insurance Expense Interest Expense Interest payable 34,800 10,000 15,000 Rent Expense Repairs Expense Retained Earnings 1/1/20 Revenues Salaries Expense Short term notes payable Supplies Supplies Expense Utilities Expense 31,200 500,000 165,000 12,250 125,000 45,700 8,000 4,000 9,200 15,000 64,000 Use the templates on this page and the next page to help you get started. As a reminder, formulas will not be given on the exam, so use these templates as a guide for now but be sure to understand each financial statement formula prior the exam Step 1: Income Statement Revenues $ Expenses $ $ $ $ $ $ $ $ $ $ Total expenses $ Net Income Step 2: Statement of Retained Earnings Beginning $ + Add $ - Less $ $ Step 3: Balance Sheet ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY Current Assets Current Liabilities $ $ $ $ $ Total Current Liabilities Total Current Assets $ PP&E Total liabilities Stockholders' Equity Net PPE Intangibles Total Equity $ Total Assets $ Total Liabilities & Equity $