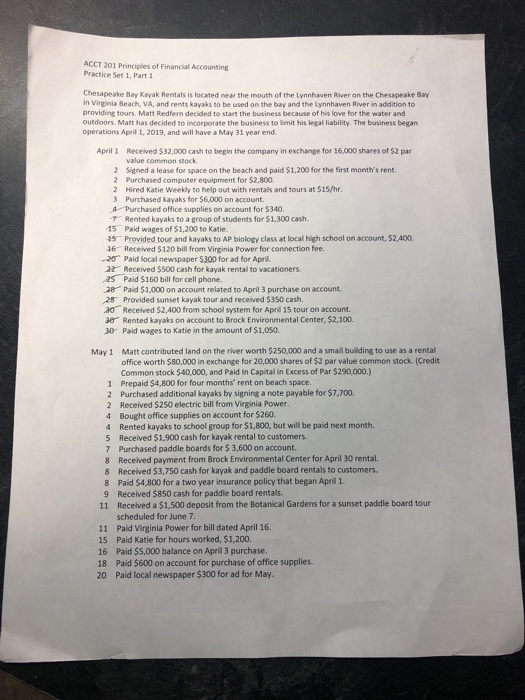

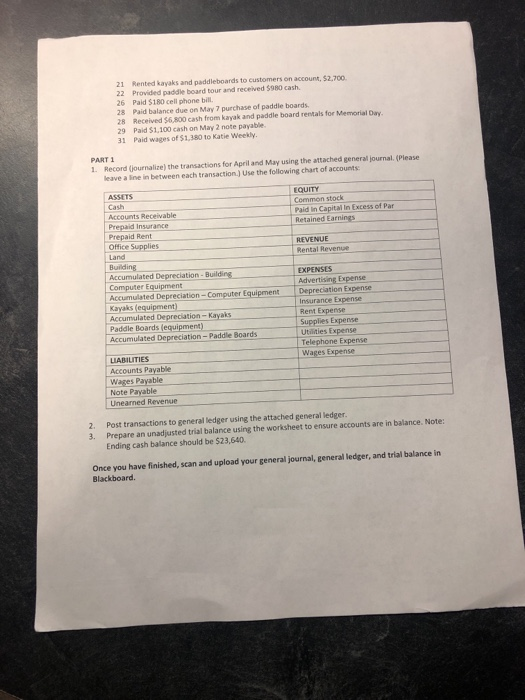

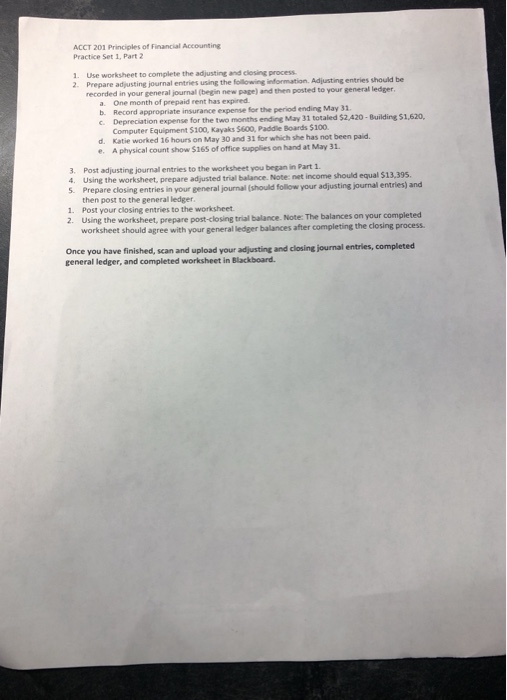

ACCT 201 Principles of Financial Accounting Practice Set 1 Part 1 Chesapeake Bay Kayak Rentals is located near the mouth of the Lynnhaven River on the Chesapeake Bay in Virginia Beach, VA, and rents kayaks to be used on the bay and the Lynnhaven River in addition to providing tours. Matt Redfern decided to start the business because of his love for the water and outdoors. Matt has decided to incorporate the business to limit his legal liability. The business began operations April 1, 2019, and will have a May 31 year end. April 1 Received $32,000 cash to begin the company in exchange for 16,000 shares of $2 par value common stock 2 Signed a lease for space on the beach and paid $1,200 for the first month's rent 2 Purchased computer equipment for $2,800. 2 Hired Katie Weekly to help out with rentals and tours at $15/hr. 3 Purchased kayaks for $6.000 on account. 4- Purchased office supplies on account for $340. 7 Rented kayaks to a group of students for $1,300 cash 15 Paid wages of $1,200 to Katie 35 Provided tour and kayaks to AP biology class at local high school on account, $2,400. 16 Received $120 bill from Virginia Power for connection fee. 20 Paid local newspaper $300 for ad for April 22 Received $500 cash for kayak rentalto vacationers 25 Paid $160 bill for cell phone. 28 Paid $1,000 on account related to April 3 purchase on account 28 Provided sunset kayak tour and received $350 cash 20 Received $2,400 from school system for April 15 tour on account. e Rented kayaks on account to Brock Environmental Center, $2,100. 30 Paid wages to Katie in the amount of $1,050. May 1 Matt contributed land on the river worth $250,000 and a small building to use as a rental office worth $80,000 in exchange for 20,000 shares of $2 par value common stock. (Credit Common stock $40,000, and Paid In Capital in Excess of Par $290,000.) 1 Prepaid $4,800 for four months' rent on beach space. 2 Purchased additional kayaks by signing a note payable for $7,700. Received $250 electric bill from Virginia Power. 4 Bought office supplies on account for $260. 4 Rented kayaks to school group for $1,800, but will be paid next month. 5 Received $1,900 cash for kayak rental to customers. 7 Purchased paddle boards for $3,600 on account. 8 Received payment from Brock Environmental Center for April 30 rental. 8 Received $3,750 cash for kayak and paddle board rentals to customers. 8 Paid $4,800 for a two year insurance policy that began April 1. 9 Received $850 cash for paddle board rentals. 11 Received a $1.500 deposit from the Botanical Gardens for a sunset paddle board tour scheduled for June 7. 11 Paid Virginia Power for bill dated April 16. 15 Paid Katie for hours worked, $1,200. 16 Paid $5,000 balance on April 3 purchase. 18 Paid $600 on account for purchase of office supplies. 20 Paid local newspaper $300 for ad for May. 21 Rented kayaks and paddleboards to customers on account, $2,700 22 Provided paddle board tour and received cash 26 Paid $10 cell phone bill 28 Paid balance due on May 7 purchase of paddle boards 28 Received 56.800 cash from Kayak and paddle board rentals for Memorial 29 Paid $1,100 cash on May 2 note payable 31 Paid was of 51.0 to Kate Weekly PART 1. Record journalize the transactions for April and Maying the attached general journal leave a line in between each transaction. Use the following chart of accounts: ASSETS Common stock Paid in Capital In Excess of Par Retained Earnings REVENUE Accounts Receivable Prepaid insurance Prepaid Rent Orice Supplies Land Building Accumulated Depreciation Build Computer Equipment Accumulated Depreciation - Computer Equipme Kayaks (equipment) Accumulated Depreciation-Kayaks Paddle Boards (equipment) Accumulated Depreciation - Paddle Boards EXPENSES Advertising Expense Depreciation Expense Insurance Expense Rent Expense Supplies Expense Utiles Expense Telephone Expense Wages Expense LIABILITIES Accounts Payable Wages Payable Note Payable Uneared Revenue 2. 3. Post transactions to general ledger using the attached general ledger Prepare an unadjusted trial balance using the worksheet to ensure accounts are in balance Note: Ending cash balance should be $23,640 Once you have finished, scan and upload your general journal, general ledger, and trial balance in Blackboard ACCT 201 Principles of Financial Accounting Practice Set 1 Part 2 1. Use worksheet to complete the adjusting and closing process 2. Prepare adjusting journal entries using the following information. Adjusting entries should be recorded in your general journal (begin new page) and then posted to your general ledger, a. One month of prepaid rent has expired. b. Record appropriate insurance expense for the period ending May 31 Depreciation expense for the two months ending May 31 totaled $2.420 - Building $1,620, Computer Equipment $100, Kayaks $600, Paddle Boards $100 d. Katie worked 16 hours on May 30 and 31 for which she has not been paid. e. A physical count show $165 of office supplies on hand at May 31 3. Post adjusting journal entries to the worksheet you began in Part 1 4. Using the worksheet, prepare adjusted trial balance. Note: net income should equal $13,395. 5. Prepare closing entries in your general journal (should follow your adjusting journal entries) and then post to the general ledger. 1. Post your closing entries to the worksheet. 2. Using the worksheet, prepare post-closing trial balance. Note: The balances on your completed worksheet should agree with your general ledger balances after completing the closing process Once you have finished, scan and upload your adjusting and closing journal entries, completed general ledger, and completed worksheet in Blackboard. ACCT 201 Principles of Financial Accounting Practice Set 1 Part 1 Chesapeake Bay Kayak Rentals is located near the mouth of the Lynnhaven River on the Chesapeake Bay in Virginia Beach, VA, and rents kayaks to be used on the bay and the Lynnhaven River in addition to providing tours. Matt Redfern decided to start the business because of his love for the water and outdoors. Matt has decided to incorporate the business to limit his legal liability. The business began operations April 1, 2019, and will have a May 31 year end. April 1 Received $32,000 cash to begin the company in exchange for 16,000 shares of $2 par value common stock 2 Signed a lease for space on the beach and paid $1,200 for the first month's rent 2 Purchased computer equipment for $2,800. 2 Hired Katie Weekly to help out with rentals and tours at $15/hr. 3 Purchased kayaks for $6.000 on account. 4- Purchased office supplies on account for $340. 7 Rented kayaks to a group of students for $1,300 cash 15 Paid wages of $1,200 to Katie 35 Provided tour and kayaks to AP biology class at local high school on account, $2,400. 16 Received $120 bill from Virginia Power for connection fee. 20 Paid local newspaper $300 for ad for April 22 Received $500 cash for kayak rentalto vacationers 25 Paid $160 bill for cell phone. 28 Paid $1,000 on account related to April 3 purchase on account 28 Provided sunset kayak tour and received $350 cash 20 Received $2,400 from school system for April 15 tour on account. e Rented kayaks on account to Brock Environmental Center, $2,100. 30 Paid wages to Katie in the amount of $1,050. May 1 Matt contributed land on the river worth $250,000 and a small building to use as a rental office worth $80,000 in exchange for 20,000 shares of $2 par value common stock. (Credit Common stock $40,000, and Paid In Capital in Excess of Par $290,000.) 1 Prepaid $4,800 for four months' rent on beach space. 2 Purchased additional kayaks by signing a note payable for $7,700. Received $250 electric bill from Virginia Power. 4 Bought office supplies on account for $260. 4 Rented kayaks to school group for $1,800, but will be paid next month. 5 Received $1,900 cash for kayak rental to customers. 7 Purchased paddle boards for $3,600 on account. 8 Received payment from Brock Environmental Center for April 30 rental. 8 Received $3,750 cash for kayak and paddle board rentals to customers. 8 Paid $4,800 for a two year insurance policy that began April 1. 9 Received $850 cash for paddle board rentals. 11 Received a $1.500 deposit from the Botanical Gardens for a sunset paddle board tour scheduled for June 7. 11 Paid Virginia Power for bill dated April 16. 15 Paid Katie for hours worked, $1,200. 16 Paid $5,000 balance on April 3 purchase. 18 Paid $600 on account for purchase of office supplies. 20 Paid local newspaper $300 for ad for May. 21 Rented kayaks and paddleboards to customers on account, $2,700 22 Provided paddle board tour and received cash 26 Paid $10 cell phone bill 28 Paid balance due on May 7 purchase of paddle boards 28 Received 56.800 cash from Kayak and paddle board rentals for Memorial 29 Paid $1,100 cash on May 2 note payable 31 Paid was of 51.0 to Kate Weekly PART 1. Record journalize the transactions for April and Maying the attached general journal leave a line in between each transaction. Use the following chart of accounts: ASSETS Common stock Paid in Capital In Excess of Par Retained Earnings REVENUE Accounts Receivable Prepaid insurance Prepaid Rent Orice Supplies Land Building Accumulated Depreciation Build Computer Equipment Accumulated Depreciation - Computer Equipme Kayaks (equipment) Accumulated Depreciation-Kayaks Paddle Boards (equipment) Accumulated Depreciation - Paddle Boards EXPENSES Advertising Expense Depreciation Expense Insurance Expense Rent Expense Supplies Expense Utiles Expense Telephone Expense Wages Expense LIABILITIES Accounts Payable Wages Payable Note Payable Uneared Revenue 2. 3. Post transactions to general ledger using the attached general ledger Prepare an unadjusted trial balance using the worksheet to ensure accounts are in balance Note: Ending cash balance should be $23,640 Once you have finished, scan and upload your general journal, general ledger, and trial balance in Blackboard ACCT 201 Principles of Financial Accounting Practice Set 1 Part 2 1. Use worksheet to complete the adjusting and closing process 2. Prepare adjusting journal entries using the following information. Adjusting entries should be recorded in your general journal (begin new page) and then posted to your general ledger, a. One month of prepaid rent has expired. b. Record appropriate insurance expense for the period ending May 31 Depreciation expense for the two months ending May 31 totaled $2.420 - Building $1,620, Computer Equipment $100, Kayaks $600, Paddle Boards $100 d. Katie worked 16 hours on May 30 and 31 for which she has not been paid. e. A physical count show $165 of office supplies on hand at May 31 3. Post adjusting journal entries to the worksheet you began in Part 1 4. Using the worksheet, prepare adjusted trial balance. Note: net income should equal $13,395. 5. Prepare closing entries in your general journal (should follow your adjusting journal entries) and then post to the general ledger. 1. Post your closing entries to the worksheet. 2. Using the worksheet, prepare post-closing trial balance. Note: The balances on your completed worksheet should agree with your general ledger balances after completing the closing process Once you have finished, scan and upload your adjusting and closing journal entries, completed general ledger, and completed worksheet in Blackboard