Answered step by step

Verified Expert Solution

Question

1 Approved Answer

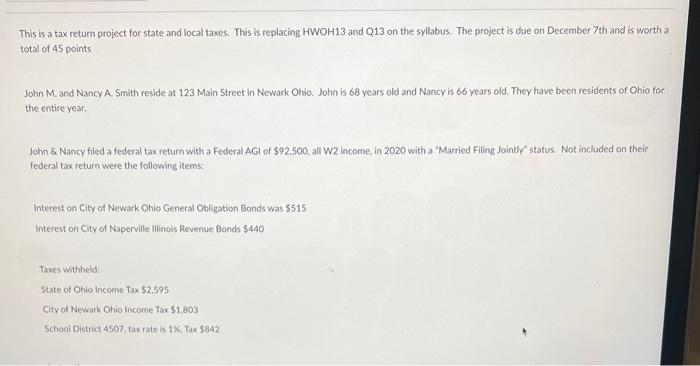

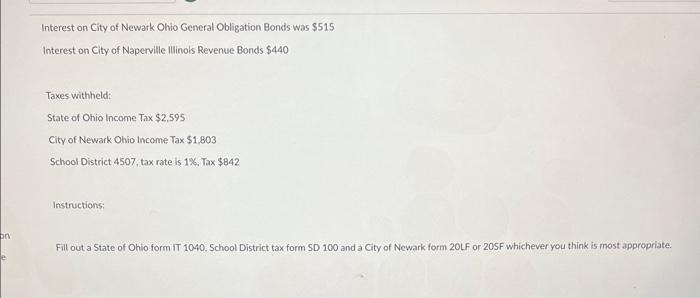

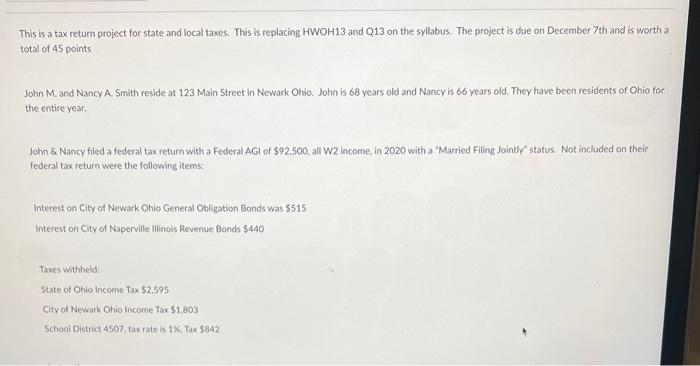

ACCT 224 This is a tax return project for state and local taxes. This is replacing HWOH13 and Q13 on the syllabus. The project is

ACCT 224

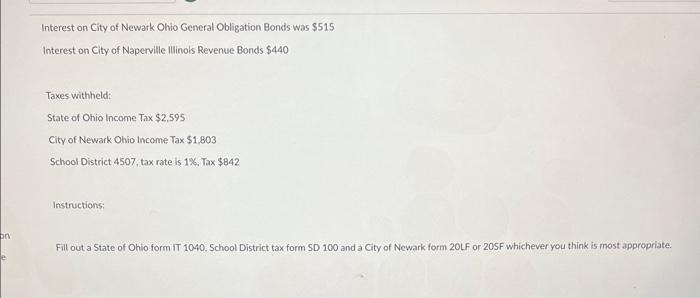

This is a tax return project for state and local taxes. This is replacing HWOH13 and Q13 on the syllabus. The project is due on December 7 th and is worth a total of 45 points John M. Mand Nancy A Smith reside at 123 Main Street in Newark Ohio. John is 68 years old and Nancy is 66 years old. They have been residents of Ohio tor the entire year. John \& Nancy filed a federal tax return with a Federal AGI of $92,500, all W2 income, in 2020 with a "Married Filing Jointly" status. Not included on their federal tax return were the following items: Interest on City of Newark Ohio General Obligation Bonds was $515 Interest on City of Naperville llilinois Revenue Bonds $440 Taxes withbeld: State of Ohio income Tax $2.595 City of Newark Ohio Income Tax $1.803 School District 4507, tax rate is 1, Tax $342 Interest on City of Newark Ohio General Obligation Bonds was $515 Interest on City of Naperville Illinois Revenue Bonds $440 Taxes withheld: State of Ohio Income Tax $2,595 City of Newark Ohio Income Tax \$1,803 School District 4507 , tax rate is 1%. Tax $842 Instructions: Fill out a State of Ohio form IT 1040. School District tax form SD 100 and a City of Newark form 20LF or 20 SF whichever you think is most appropriate. This is a tax return project for state and local taxes. This is replacing HWOH13 and Q13 on the syllabus. The project is due on December 7 th and is worth a total of 45 points John M. Mand Nancy A Smith reside at 123 Main Street in Newark Ohio. John is 68 years old and Nancy is 66 years old. They have been residents of Ohio tor the entire year. John \& Nancy filed a federal tax return with a Federal AGI of $92,500, all W2 income, in 2020 with a "Married Filing Jointly" status. Not included on their federal tax return were the following items: Interest on City of Newark Ohio General Obligation Bonds was $515 Interest on City of Naperville llilinois Revenue Bonds $440 Taxes withbeld: State of Ohio income Tax $2.595 City of Newark Ohio Income Tax $1.803 School District 4507, tax rate is 1, Tax $342 Interest on City of Newark Ohio General Obligation Bonds was $515 Interest on City of Naperville Illinois Revenue Bonds $440 Taxes withheld: State of Ohio Income Tax $2,595 City of Newark Ohio Income Tax \$1,803 School District 4507 , tax rate is 1%. Tax $842 Instructions: Fill out a State of Ohio form IT 1040. School District tax form SD 100 and a City of Newark form 20LF or 20 SF whichever you think is most appropriate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started