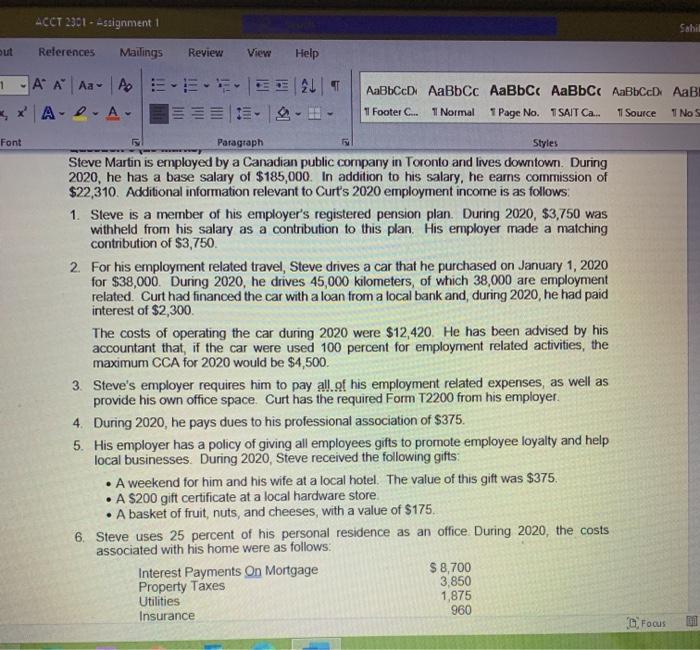

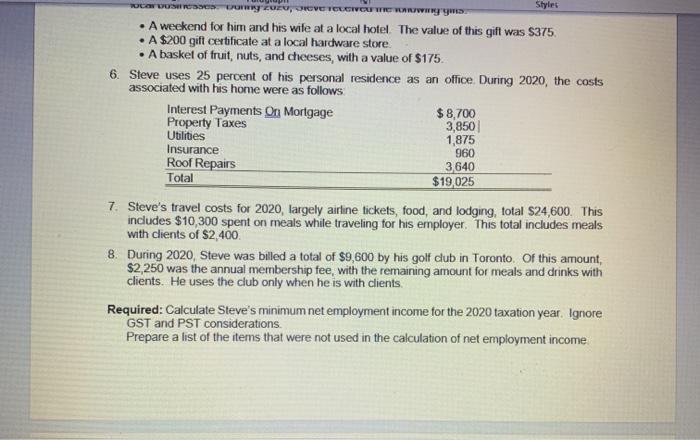

ACCT 2301 --ssignment 1 Sabil but References Mailings Review View Help 1 A A Aa AOE EEEE | 21 | T 3 X A o.A- cDAaBbcc . 1 Footer C... 1 Normal 1 Page No. TSAIT Ca... 11 Source 1 Nos Font Styles Paragraph Steve Martin is employed by a Canadian public company in Toronto and lives downtown. During 2020, he has a base salary of $185,000. In addition to his salary, he earns commission of $22,310. Additional information relevant to Curt's 2020 employment income is as follows: 1. Steve is a member of his employer's registered pension plan. During 2020, $3,750 was withheld from his salary as a contribution to this plan. His employer made a matching contribution of $3,750. 2. For his employment related travel, Steve drives a car that he purchased on January 1, 2020 for $38,000. During 2020, he drives 45,000 kilometers, of which 38,000 are employment related. Curt had financed the car with a loan from a local bank and during 2020, he had paid interest of $2,300 The costs of operating the car during 2020 were $12,420. He has been advised by his accountant that, if the car were used 100 percent for employment related activities, the maximum CCA for 2020 would be $4,500. 3. Steve's employer requires him to pay all of his employment related expenses, as well as provide his own office space. Curt has the required Form T2200 from his employer. 4. During 2020, he pays dues to his professional association of $375. 5. His employer has a policy of giving all employees gifts to promote employee loyalty and help local businesses. During 2020, Steve received the following gifts: A weekend for him and his wife at a local hotel. The value of this gift was $375, A $200 gift certificate at a local hardware store A basket of fruit, nuts, and cheeses, with a value of $175. 6. Steve uses 25 percent of his personal residence as an office. During 2020, the costs associated with his home were as follows: Interest Payments On Mortgage $ 8,700 Property Taxes 3,850 Utilities 1,875 Insurance 960 Focus GU Styles WASTED , DOVE TOUCIVER VAR A weekend for him and his wife at a local hotel. The value of this gift was $375. A $200 gift certificate at a local hardware store A basket of fruit, nuts, and cheeses, with a value of $175. 6. Steve uses 25 percent of his personal residence as an office. During 2020, the costs associated with his home were as follows Interest Payments On Mortgage $8,700 Property Taxes 3,850 Utilities 1,875 Insurance 960 Roof Repairs 3,640 Total $19,025 7. Steve's travel costs for 2020, largely airline tickets, food, and lodging, total $24,600. This includes $10,300 spent on meals while traveling for his employer. This total includes meals with clients of $2,400 8. During 2020, Steve was billed a total of $9,600 by his golf club in Toronto. Of this amount $2,250 was the annual membership fee, with the remaining amount for meals and drinks with clients. He uses the club only when he is with clients Required: Calculate Steve's minimum net employment income for the 2020 taxation year. Ignore GST and PST considerations Prepare a list of the items that were not used in the calculation of net employment income ACCT 2301 --ssignment 1 Sabil but References Mailings Review View Help 1 A A Aa AOE EEEE | 21 | T 3 X A o.A- cDAaBbcc . 1 Footer C... 1 Normal 1 Page No. TSAIT Ca... 11 Source 1 Nos Font Styles Paragraph Steve Martin is employed by a Canadian public company in Toronto and lives downtown. During 2020, he has a base salary of $185,000. In addition to his salary, he earns commission of $22,310. Additional information relevant to Curt's 2020 employment income is as follows: 1. Steve is a member of his employer's registered pension plan. During 2020, $3,750 was withheld from his salary as a contribution to this plan. His employer made a matching contribution of $3,750. 2. For his employment related travel, Steve drives a car that he purchased on January 1, 2020 for $38,000. During 2020, he drives 45,000 kilometers, of which 38,000 are employment related. Curt had financed the car with a loan from a local bank and during 2020, he had paid interest of $2,300 The costs of operating the car during 2020 were $12,420. He has been advised by his accountant that, if the car were used 100 percent for employment related activities, the maximum CCA for 2020 would be $4,500. 3. Steve's employer requires him to pay all of his employment related expenses, as well as provide his own office space. Curt has the required Form T2200 from his employer. 4. During 2020, he pays dues to his professional association of $375. 5. His employer has a policy of giving all employees gifts to promote employee loyalty and help local businesses. During 2020, Steve received the following gifts: A weekend for him and his wife at a local hotel. The value of this gift was $375, A $200 gift certificate at a local hardware store A basket of fruit, nuts, and cheeses, with a value of $175. 6. Steve uses 25 percent of his personal residence as an office. During 2020, the costs associated with his home were as follows: Interest Payments On Mortgage $ 8,700 Property Taxes 3,850 Utilities 1,875 Insurance 960 Focus GU Styles WASTED , DOVE TOUCIVER VAR A weekend for him and his wife at a local hotel. The value of this gift was $375. A $200 gift certificate at a local hardware store A basket of fruit, nuts, and cheeses, with a value of $175. 6. Steve uses 25 percent of his personal residence as an office. During 2020, the costs associated with his home were as follows Interest Payments On Mortgage $8,700 Property Taxes 3,850 Utilities 1,875 Insurance 960 Roof Repairs 3,640 Total $19,025 7. Steve's travel costs for 2020, largely airline tickets, food, and lodging, total $24,600. This includes $10,300 spent on meals while traveling for his employer. This total includes meals with clients of $2,400 8. During 2020, Steve was billed a total of $9,600 by his golf club in Toronto. Of this amount $2,250 was the annual membership fee, with the remaining amount for meals and drinks with clients. He uses the club only when he is with clients Required: Calculate Steve's minimum net employment income for the 2020 taxation year. Ignore GST and PST considerations Prepare a list of the items that were not used in the calculation of net employment income