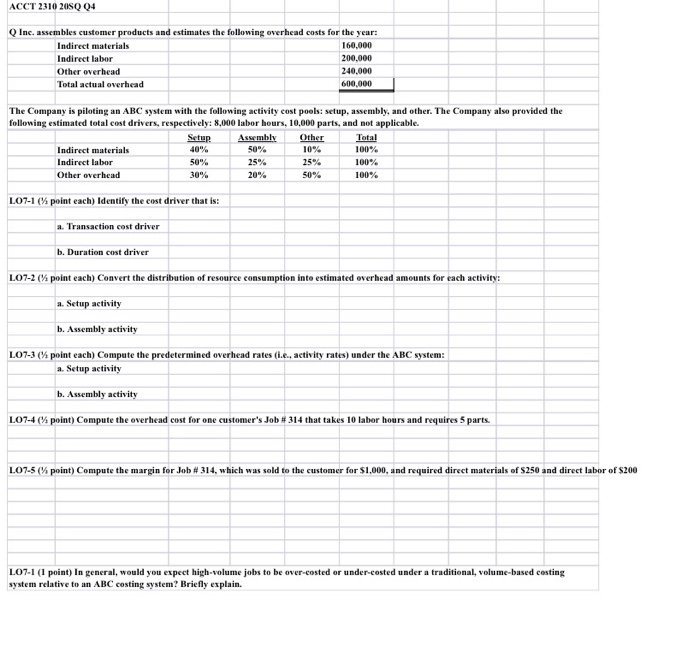

ACCT 2310 20SQ Q4 Q Inc. assembles customer products and estimates the following overhead costs for the year: Indirect materials 160,000 Indirect labor 200.000 Other overhead 240.000 Total actual overhead 600,000 The Company is piloting an ABC system with the following activity cost pools: setup, assembly, and other. The Company also provided the following estimated total cost drivers, respectively: 8,000 labor hours, 10.000 parts, and not applicable. Setur Assembly Other Indirect materials 40% 50% 10% 100% Indirect labor 50% 25% 25% 100% Other over head 30% 20% 50% 100% LO7-1 (% point each) Identify the cost driver that is: a. Transaction cost driver b. Duration cost driver LO7-2 (6 point each) Convert the distribution of resource consumption into estimated overhead amounts for each activity: a. Setup activity b. Assembly activity LO7-3 (% point each) Compute the predetermined overhead rates (i.e., activity rates) under the ABC system: a. Setup activity b. Assembly activity LO7-4 (% point) Compute the overhead cost for one customer's Job #314 that takes 10 labor hours and requires 5 parts. L07-5 ( point) Compute the margin for Job #314, which was sold to the customer for $1,000, and required direct materials of S250 and direct labor of $200 LO7-1 (1 point) In general, would you expect high-volume jobs to be over-costed or under-costed under a traditional, volume-based costing system relative to an ABC costing system? Briefly explain. ACCT 2310 20SQ Q4 Q Inc. assembles customer products and estimates the following overhead costs for the year: Indirect materials 160,000 Indirect labor 200.000 Other overhead 240.000 Total actual overhead 600,000 The Company is piloting an ABC system with the following activity cost pools: setup, assembly, and other. The Company also provided the following estimated total cost drivers, respectively: 8,000 labor hours, 10.000 parts, and not applicable. Setur Assembly Other Indirect materials 40% 50% 10% 100% Indirect labor 50% 25% 25% 100% Other over head 30% 20% 50% 100% LO7-1 (% point each) Identify the cost driver that is: a. Transaction cost driver b. Duration cost driver LO7-2 (6 point each) Convert the distribution of resource consumption into estimated overhead amounts for each activity: a. Setup activity b. Assembly activity LO7-3 (% point each) Compute the predetermined overhead rates (i.e., activity rates) under the ABC system: a. Setup activity b. Assembly activity LO7-4 (% point) Compute the overhead cost for one customer's Job #314 that takes 10 labor hours and requires 5 parts. L07-5 ( point) Compute the margin for Job #314, which was sold to the customer for $1,000, and required direct materials of S250 and direct labor of $200 LO7-1 (1 point) In general, would you expect high-volume jobs to be over-costed or under-costed under a traditional, volume-based costing system relative to an ABC costing system? Briefly explain