Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCT 30163: COST ANALYSIS AND CONTROL Spring 2021 Assignment #1: Cash budget and budgeted income statement. George Georgiou owns a factory that specializes in

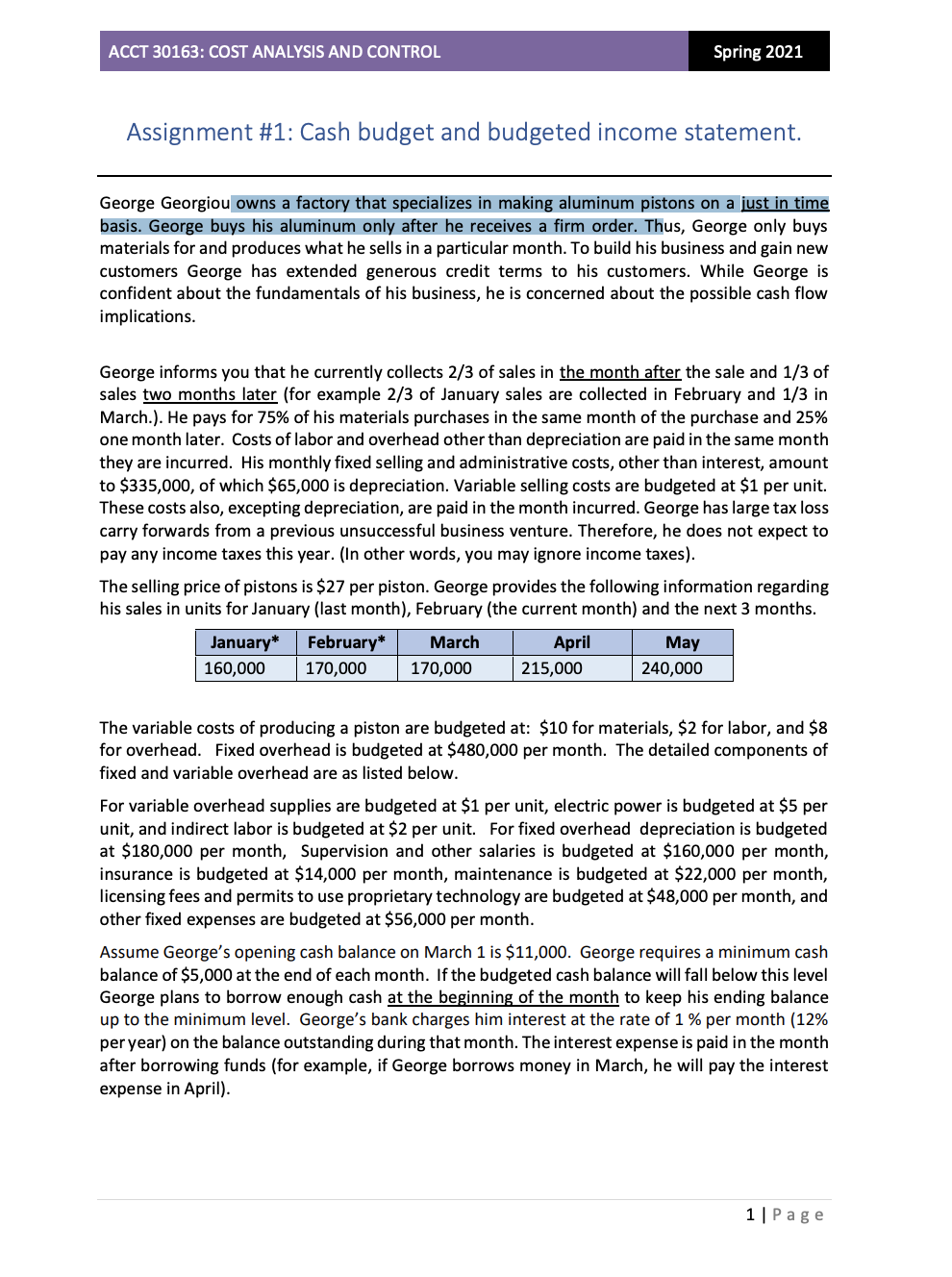

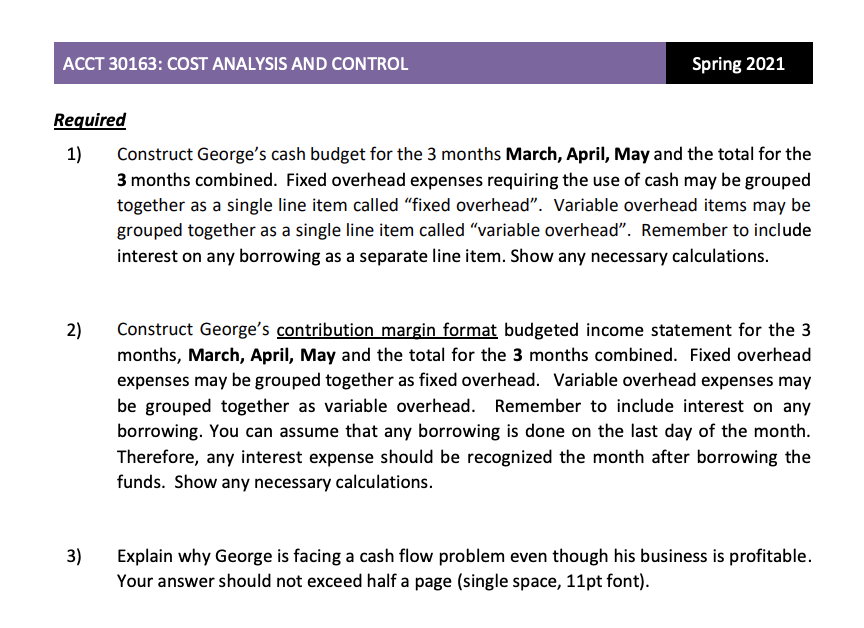

ACCT 30163: COST ANALYSIS AND CONTROL Spring 2021 Assignment #1: Cash budget and budgeted income statement. George Georgiou owns a factory that specializes in making aluminum pistons on a just in time basis. George buys his aluminum only after he receives a firm order. Thus, George only buys materials for and produces what he sells in a particular month. To build his business and gain new customers George has extended generous credit terms to his customers. While George is confident about the fundamentals of his business, he is concerned about the possible cash flow implications. George informs you that he currently collects 2/3 of sales in the month after the sale and 1/3 of sales two months later (for example 2/3 of January sales are collected in February and 1/3 in March.). He pays for 75% of his materials purchases in the same month of the purchase and 25% one month later. Costs of labor and overhead other than depreciation are paid in the same month they are incurred. His monthly fixed selling and administrative costs, other than interest, amount to $335,000, of which $65,000 is depreciation. Variable selling costs are budgeted at $1 per unit. These costs also, excepting depreciation, are paid in the month incurred. George has large tax loss carry forwards from a previous unsuccessful business venture. Therefore, he does not expect to pay any income taxes this year. (In other words, you may ignore income taxes). The selling price of pistons is $27 per piston. George provides the following information regarding his sales in units for January (last month), February (the current month) and the next 3 months. January* 160,000 February* 170,000 March 170,000 April 215,000 May 240,000 The variable costs of producing a piston are budgeted at: $10 for materials, $2 for labor, and $8 for overhead. Fixed overhead is budgeted at $480,000 per month. The detailed components of fixed and variable overhead are as listed below. For variable overhead supplies are budgeted at $1 per unit, electric power is budgeted at $5 per unit, and indirect labor is budgeted at $2 per unit. For fixed overhead depreciation is budgeted at $180,000 per month, Supervision and other salaries is budgeted at $160,000 per month, insurance is budgeted at $14,000 per month, maintenance is budgeted at $22,000 per month, licensing fees and permits to use proprietary technology are budgeted at $48,000 per month, and other fixed expenses are budgeted at $56,000 per month. Assume George's opening cash balance on March 1 is $11,000. George requires a minimum cash balance of $5,000 at the end of each month. If the budgeted cash balance will fall below this level George plans to borrow enough cash at the beginning of the month to keep his ending balance up to the minimum level. George's bank charges him interest at the rate of 1% per month (12% per year) on the balance outstanding during that month. The interest expense is paid in the month after borrowing funds (for example, if George borrows money in March, he will pay the interest expense in April). 1 Page ACCT 30163: COST ANALYSIS AND CONTROL Required 1) Spring 2021 Construct George's cash budget for the 3 months March, April, May and the total for the 3 months combined. Fixed overhead expenses requiring the use of cash may be grouped together as a single line item called "fixed overhead". Variable overhead items may be grouped together as a single line item called "variable overhead". Remember to include interest on any borrowing as a separate line item. Show any necessary calculations. 2) Construct George's contribution margin format budgeted income statement for the 3 months, March, April, May and the total for the 3 months combined. Fixed overhead expenses may be grouped together as fixed overhead. Variable overhead expenses may be grouped together as variable overhead. Remember to include interest on any borrowing. You can assume that any borrowing is done on the last day of the month. Therefore, any interest expense should be recognized the month after borrowing the funds. Show any necessary calculations. 3) Explain why George is facing a cash flow problem even though his business is profitable. Your answer should not exceed half a page (single space, 11pt font).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started