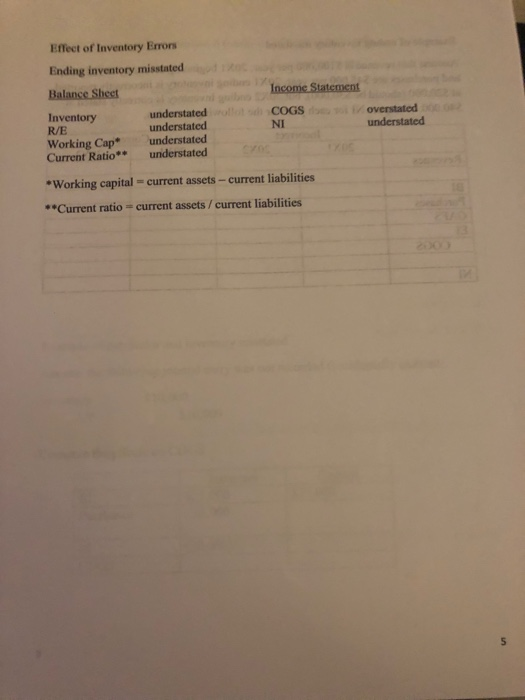

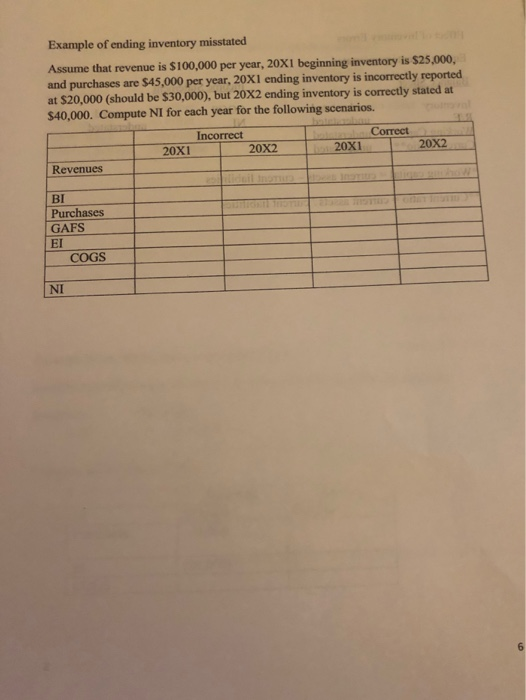

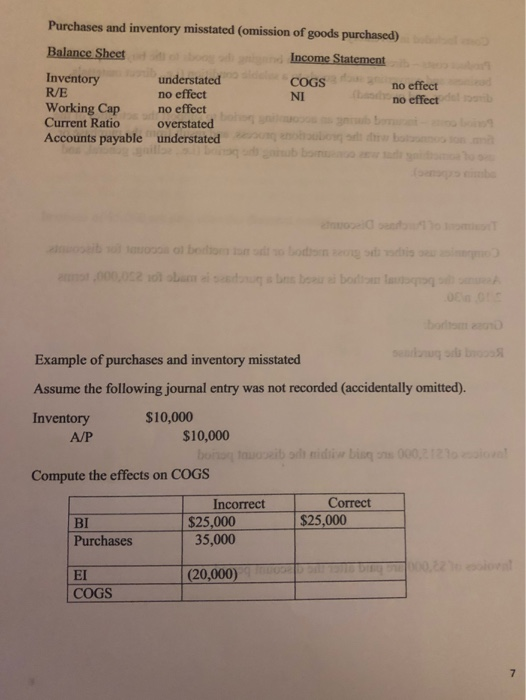

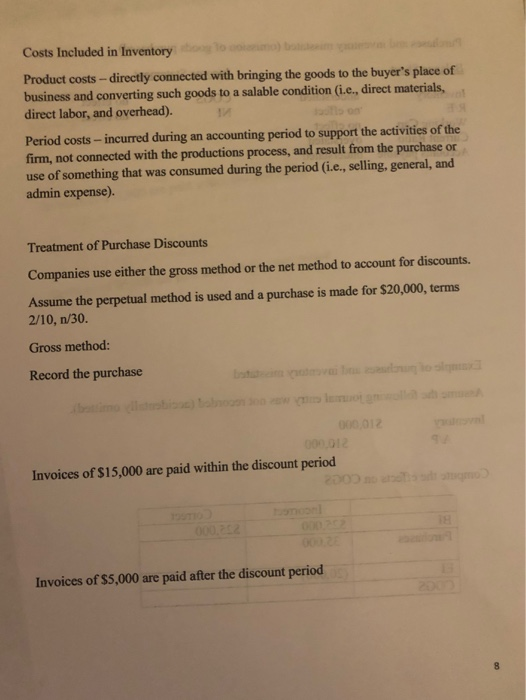

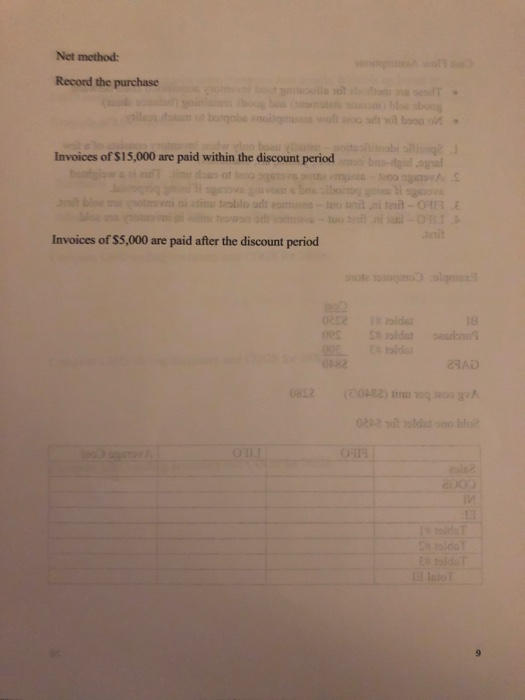

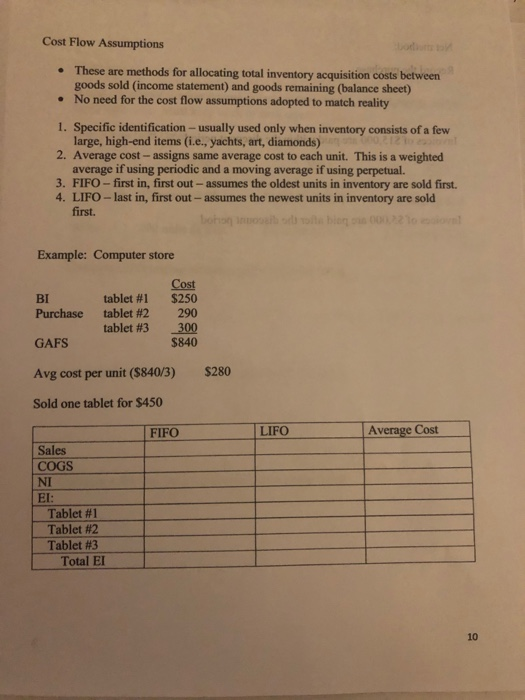

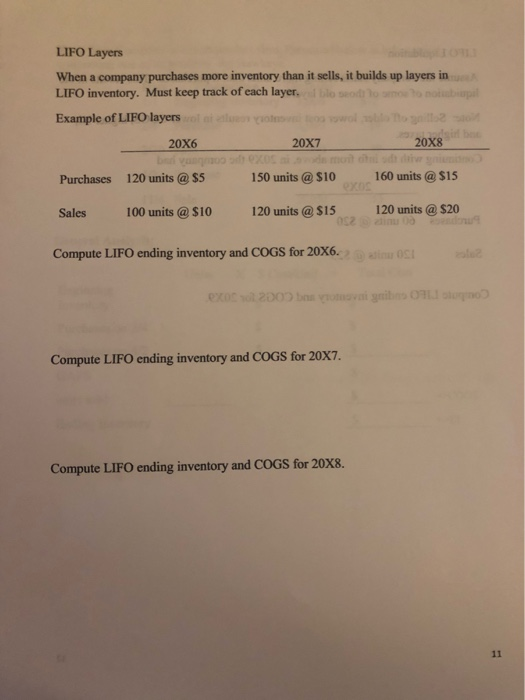

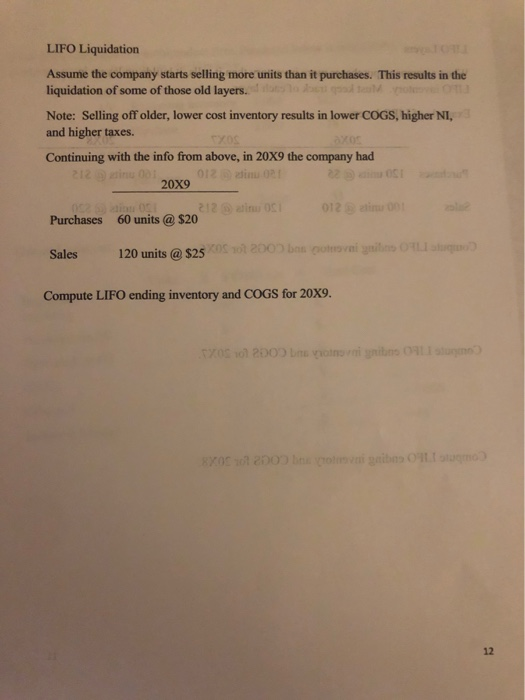

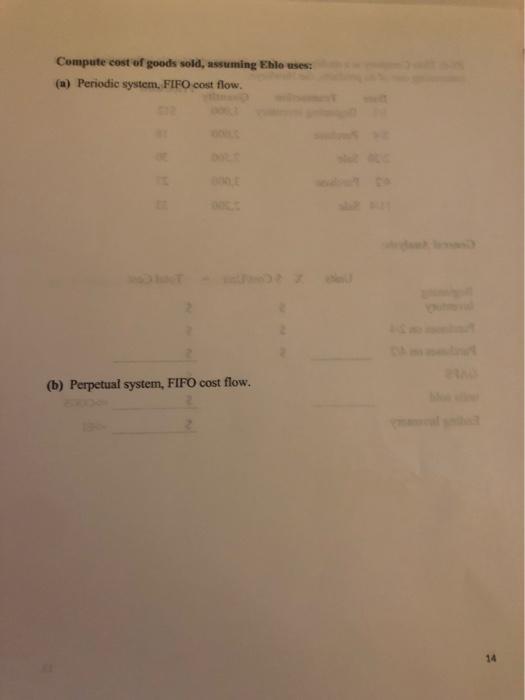

ACCT 3121 n ebo Chapter 8 Lecture Notes boom be De A Valuation of Inventories: A Cost-Basis Approach Inventory Issues Classification - two types Items held for resale (merchandiser) Goods to be used in the production of goods to be sold (manufacturer) A merchandiser has one inventory account - merchandise inventory. 2 A manufacturer has three accounts - raw materials, work in process, and finished goods. drugo There are two systems for maintaining inventory records: Perpetual system - Continuously tracks changes in inventory account. Purchases are debited to the inventory account. ises are debited to the inventory account. O b Freight-in is debited to inventory. Purchase returns and allowances and purchase discounts are credited to inventory. COGS is recorded at the time of each sale. Subsidiary ledger of inventory records is maintained for different types of inventories. The perpetual system provides a continuous record of inventory on hand an asset on balance sheet) and COGS (an expense on the income statement). Periodic system - the quantity of inventory on hand is determined periodically. Acquisitions of inventory are debited to the Purchases account. Purchases for the period are added to the beginning balance to arrive at the total goods available for sale. Ending inventory is subtracted from total available for sale to arrive at COGS for the period. Perpetual vs. Periodic (einem blommal Info Beginning Inventory do 100 units at $6 bo= $600 bol o ooo Purchases 900 units at S6 = $5,400 Sales br 600 units at $12 $7.2000 Ending Inventory 400 units at $6 = $2,400 Record the purchase of inventory. Perpetual Periodic videos baldab omu't Record the sale of inventory Colonios ballbun o ribbon Bolo to bolo this boni 1000 Vivni to obslubide to End of period adjusting entry 10901 Torneo bio 2003 l og no Valuation of Inventories requires determining The physical goods to include in inventory (who owns goods in transit?) The costs to include in inventory (product vs. period costs) The cost flow assumption to adopt (LIFO, FIFO, etc.) Physical Goods - a company should record inventory purchases when it obtains legal title to the goods. General rule is that inventory is the buyer's when received. Exceptions: FOB shipping point - buyers' at the time of delivery to common carrier Consignment goods - consignor's (owner), not consignee's (holder) 10 ml bril on s ooibre is basd no aww 000.011210 1200 diw se basa bowola X08.1E d oo Goods in Transit W moi sillotsd to do to bed 00012 FOB Shipping point 05 Do on yliol d barzinoid DEE.S0210 si 1 Title passes to buyer when goods are not Goods in transit are inventory of the wider E1202 yil b oots Tamo o 0.12 Toms no Tomo o Seller records the sale when goods are_OXO to the giggida d.o) on vd baqgida ww didw002.129 ME o bolbore 2 012 TXOLS odnosno o FOB Destination Title passes to buyer when goods are also Goods in transit are inventory of the of the EXOS E radiostat oldalom Seller records the sale when goods are by the Example: After a physical count of inventory on December 31, 20X1. Fair Grounds Coffee Co, determined that ending inventory was $200,000. They had two shipments in transit, not included in the physical count. The first was $15,000 of goods that Fair Grounds purchased FOB shipping and $22,000 (cost) of goods that Fair Grounds sold FOB destination. What is the correct amount of ending inventory that Fair Grounds should report at December 31" bor vi bon 78 honom o vavilob to sam od o noga Example: As an auditor of Bentley Inc. you find that a physical inventory on December 31, 20X8, showed merchandise with a cost of $440,600 was on hand at that date. You also discover the following items were all excluded from the $440,600. 12 1. Merchandise of $62,330 which is held by Bentley Inc. on consignment. The consignor is the Max Suzuki Company." 2. Merchandise costing $38,130 which was shipped by Bentley f.o.b. destination to a customer on December 31, 20X8. The customer was expected to receive the merchandise on January 6, 20X9.9 bog o n o 3. Merchandise costing $47,500 which was shipped by Bentley f.o.b. shipping point to a customer on December 29, 20X8. The customer was scheduled to receive the merchandise on January 2, 20X9. on 80 Based on the above information, calculate the amount that should appear on Bentley's balance sheet at December 31, 20X8, for inventory. be bonsaibo Effect of Inventory Errors Ending inventory misstated Balance Sheet Inventory understated R/E understated Working Cap* understated Current Ratio** understated Income Statement COGS overstated NI understated *Working capital = current assets - current liabilities **Current ratio current assets/ current liabilities Purchases and inventory misstated (omission of goods purchased) Balance Sheet Income Statement Inventory understated C OGS R/E no effect NI no effect Working Cap no effect Current Ratio overstated Accounts payable understated boobs and bo o m boris no Example of purchases and inventory misstated Assume the following journal entry was not recorded (accidentally omitted). Inventory $10,000 A/P $10,000 ibodi midiw bis 00021 Compute the effects on COGS Incorrect $25,000 35,000 Correct $25,000 BI Purchases EI (20,000) COGS Net method: Record the purchase Invoices of $15,000 are paid within the discount periode Invoices of $5,000 are paid after the discount period en als 02 olds 2AAD 0852 0182) DV Cost Flow Assumptions These are methods for allocating total inventory acquisition costs between goods sold (income statement) and goods remaining (balance sheet) No need for the cost flow assumptions adopted to match reality 1. Specific identification - usually used only when inventory consists of a few large, high-end items (i.e., yachts, art, diamonds) 2. Average cost-assigns same average cost to each unit. This is a weighted average if using periodic and a moving average if using perpetual. 3. FIFO - first in, first out - assumes the oldest units in inventory are sold first. 4. LIFO-last in, first out - assumes the newest units in inventory are sold first. boho bodo bien 002210 coral Example: Computer store BI Purchase tablet #1 tablet #2 tablet #3 Cost $250 290 300 $840 GAFS Avg cost per unit ($840/3) $280 Sold one tablet for $450 FIFO LIFO Average Cost Sales COGS NI EI: Tablet #1 Tablet #2 Tablet #3 Total EI ACCT 3121 n ebo Chapter 8 Lecture Notes boom be De A Valuation of Inventories: A Cost-Basis Approach Inventory Issues Classification - two types Items held for resale (merchandiser) Goods to be used in the production of goods to be sold (manufacturer) A merchandiser has one inventory account - merchandise inventory. 2 A manufacturer has three accounts - raw materials, work in process, and finished goods. drugo There are two systems for maintaining inventory records: Perpetual system - Continuously tracks changes in inventory account. Purchases are debited to the inventory account. ises are debited to the inventory account. O b Freight-in is debited to inventory. Purchase returns and allowances and purchase discounts are credited to inventory. COGS is recorded at the time of each sale. Subsidiary ledger of inventory records is maintained for different types of inventories. The perpetual system provides a continuous record of inventory on hand an asset on balance sheet) and COGS (an expense on the income statement). Periodic system - the quantity of inventory on hand is determined periodically. Acquisitions of inventory are debited to the Purchases account. Purchases for the period are added to the beginning balance to arrive at the total goods available for sale. Ending inventory is subtracted from total available for sale to arrive at COGS for the period. Perpetual vs. Periodic (einem blommal Info Beginning Inventory do 100 units at $6 bo= $600 bol o ooo Purchases 900 units at S6 = $5,400 Sales br 600 units at $12 $7.2000 Ending Inventory 400 units at $6 = $2,400 Record the purchase of inventory. Perpetual Periodic videos baldab omu't Record the sale of inventory Colonios ballbun o ribbon Bolo to bolo this boni 1000 Vivni to obslubide to End of period adjusting entry 10901 Torneo bio 2003 l og no Valuation of Inventories requires determining The physical goods to include in inventory (who owns goods in transit?) The costs to include in inventory (product vs. period costs) The cost flow assumption to adopt (LIFO, FIFO, etc.) Physical Goods - a company should record inventory purchases when it obtains legal title to the goods. General rule is that inventory is the buyer's when received. Exceptions: FOB shipping point - buyers' at the time of delivery to common carrier Consignment goods - consignor's (owner), not consignee's (holder) 10 ml bril on s ooibre is basd no aww 000.011210 1200 diw se basa bowola X08.1E d oo Goods in Transit W moi sillotsd to do to bed 00012 FOB Shipping point 05 Do on yliol d barzinoid DEE.S0210 si 1 Title passes to buyer when goods are not Goods in transit are inventory of the wider E1202 yil b oots Tamo o 0.12 Toms no Tomo o Seller records the sale when goods are_OXO to the giggida d.o) on vd baqgida ww didw002.129 ME o bolbore 2 012 TXOLS odnosno o FOB Destination Title passes to buyer when goods are also Goods in transit are inventory of the of the EXOS E radiostat oldalom Seller records the sale when goods are by the Example: After a physical count of inventory on December 31, 20X1. Fair Grounds Coffee Co, determined that ending inventory was $200,000. They had two shipments in transit, not included in the physical count. The first was $15,000 of goods that Fair Grounds purchased FOB shipping and $22,000 (cost) of goods that Fair Grounds sold FOB destination. What is the correct amount of ending inventory that Fair Grounds should report at December 31" bor vi bon 78 honom o vavilob to sam od o noga Example: As an auditor of Bentley Inc. you find that a physical inventory on December 31, 20X8, showed merchandise with a cost of $440,600 was on hand at that date. You also discover the following items were all excluded from the $440,600. 12 1. Merchandise of $62,330 which is held by Bentley Inc. on consignment. The consignor is the Max Suzuki Company." 2. Merchandise costing $38,130 which was shipped by Bentley f.o.b. destination to a customer on December 31, 20X8. The customer was expected to receive the merchandise on January 6, 20X9.9 bog o n o 3. Merchandise costing $47,500 which was shipped by Bentley f.o.b. shipping point to a customer on December 29, 20X8. The customer was scheduled to receive the merchandise on January 2, 20X9. on 80 Based on the above information, calculate the amount that should appear on Bentley's balance sheet at December 31, 20X8, for inventory. be bonsaibo Effect of Inventory Errors Ending inventory misstated Balance Sheet Inventory understated R/E understated Working Cap* understated Current Ratio** understated Income Statement COGS overstated NI understated *Working capital = current assets - current liabilities **Current ratio current assets/ current liabilities Purchases and inventory misstated (omission of goods purchased) Balance Sheet Income Statement Inventory understated C OGS R/E no effect NI no effect Working Cap no effect Current Ratio overstated Accounts payable understated boobs and bo o m boris no Example of purchases and inventory misstated Assume the following journal entry was not recorded (accidentally omitted). Inventory $10,000 A/P $10,000 ibodi midiw bis 00021 Compute the effects on COGS Incorrect $25,000 35,000 Correct $25,000 BI Purchases EI (20,000) COGS Net method: Record the purchase Invoices of $15,000 are paid within the discount periode Invoices of $5,000 are paid after the discount period en als 02 olds 2AAD 0852 0182) DV Cost Flow Assumptions These are methods for allocating total inventory acquisition costs between goods sold (income statement) and goods remaining (balance sheet) No need for the cost flow assumptions adopted to match reality 1. Specific identification - usually used only when inventory consists of a few large, high-end items (i.e., yachts, art, diamonds) 2. Average cost-assigns same average cost to each unit. This is a weighted average if using periodic and a moving average if using perpetual. 3. FIFO - first in, first out - assumes the oldest units in inventory are sold first. 4. LIFO-last in, first out - assumes the newest units in inventory are sold first. boho bodo bien 002210 coral Example: Computer store BI Purchase tablet #1 tablet #2 tablet #3 Cost $250 290 300 $840 GAFS Avg cost per unit ($840/3) $280 Sold one tablet for $450 FIFO LIFO Average Cost Sales COGS NI EI: Tablet #1 Tablet #2 Tablet #3 Total EI