Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bill and Mary Clients are married and wish to file jointly. Bill has been promoted to Vice President for Com-Pac, a local packagng manufacturer.

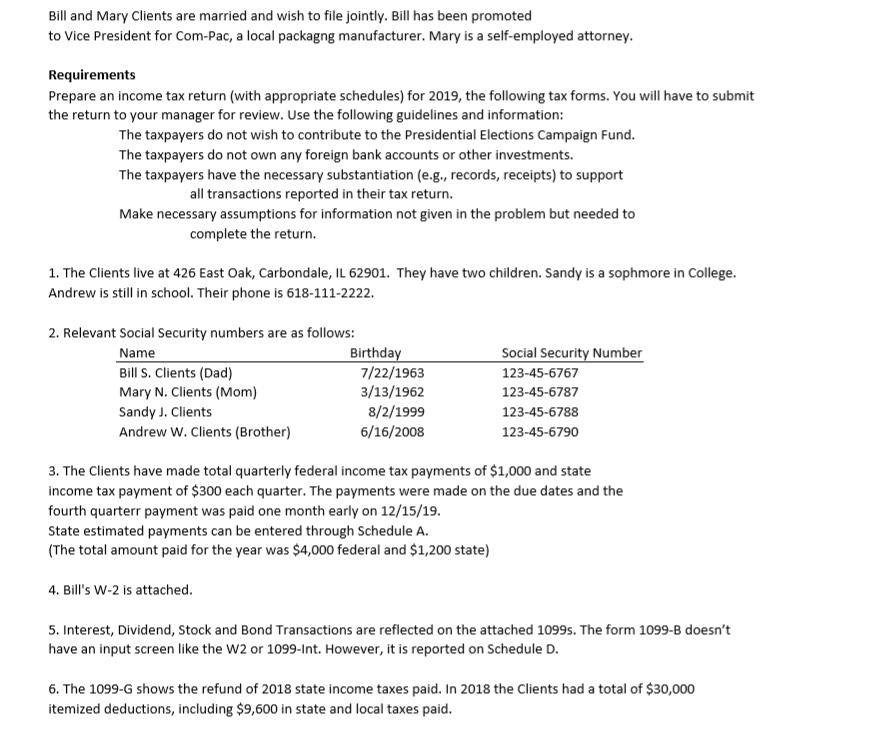

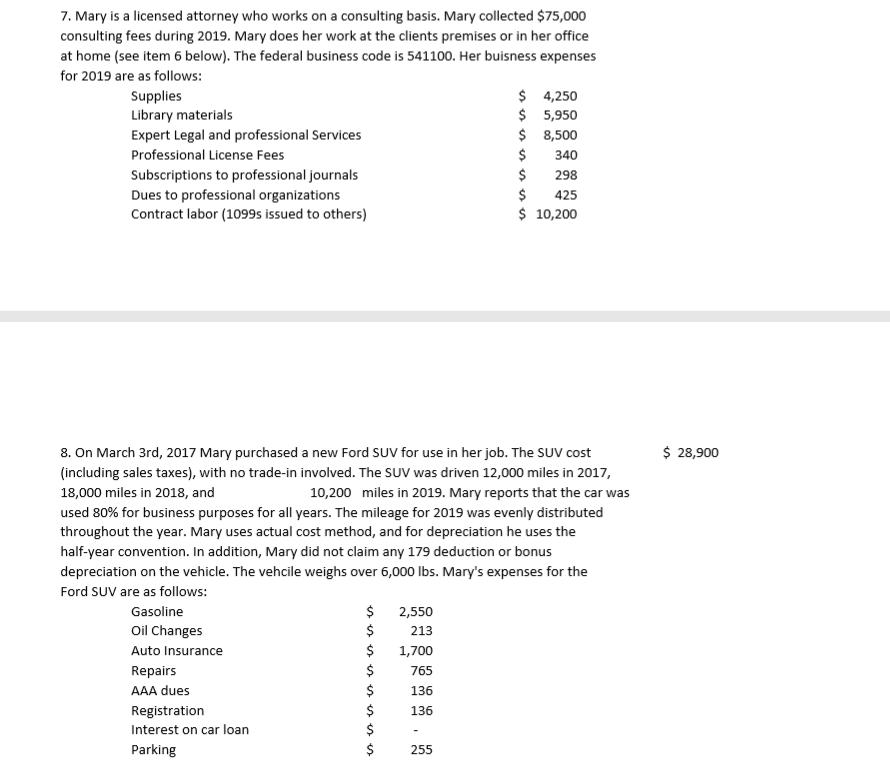

Bill and Mary Clients are married and wish to file jointly. Bill has been promoted to Vice President for Com-Pac, a local packagng manufacturer. Mary is a self-employed attorney. Requirements Prepare an income tax return (with appropriate schedules) for 2019, the following tax forms. You will have to submit the return to your manager for review. Use the following guidelines and information: The taxpayers do not wish to contribute to the Presidential Elections Campaign Fund. The taxpayers do not own any foreign bank accounts or other investments. The taxpayers have the necessary substantiation (e.g., records, receipts) to support all transactions reported in their tax return. Make necessary assumptions for information not given in the problem but needed to complete the return. 1. The Clients live at 426 East Oak, Carbondale, IL 62901. They have two children. Sandy is a sophmore in College. Andrew is still in school. Their phone is 618-111-2222. 2. Relevant Social Security numbers are as follows: Name Bill S. Clients (Dad) Mary N. Clients (Mom) Sandy J. Clients Andrew W. Clients (Brother) Birthday 7/22/1963 3/13/1962 8/2/1999 6/16/2008 Social Security Number 123-45-6767 123-45-6787 123-45-6788 123-45-6790 3. The Clients have made total quarterly federal income tax payments of $1,000 and state income tax payment of $300 each quarter. The payments were made on the due dates and the fourth quarterr payment was paid one month early on 12/15/19. State estimated payments can be entered through Schedule A. (The total amount paid for the year was $4,000 federal and $1,200 state) 4. Bill's W-2 is attached. 5. Interest, Dividend, Stock and Bond Transactions are reflected on the attached 1099s. The form 1099-B doesn't have an input screen like the W2 or 1099-Int. However, it is reported on Schedule D. 6. The 1099-G shows the refund of 2018 state income taxes paid. In 2018 the Clients had a total of $30,000 itemized deductions, including $9,600 in state and local taxes paid. 7. Mary is a licensed attorney who works on a consulting basis. Mary collected $75,000 consulting fees during 2019. Mary does her work at the clients premises or in her office at home (see item 6 below). The federal business code is 541100. Her buisness expenses for 2019 are as follows: Supplies Library materials Expert Legal and professional Services Professional License Fees Subscriptions to professional journals Dues to professional organizations Contract labor (1099s issued to others) Repairs AAA dues Registration Interest on car loan Parking $ $ 8. On March 3rd, 2017 Mary purchased a new Ford SUV for use in her job. The SUV cost (including sales taxes), with no trade-in involved. The SUV was driven 12,000 miles in 2017, 18,000 miles in 2018, and 10,200 miles in 2019. Mary reports that the car was used 80% for business purposes for all years. The mileage for 2019 was evenly distributed throughout the year. Mary uses actual cost method, and for depreciation he uses the half-year convention. In addition, Mary did not claim any 179 deduction or bonus depreciation on the vehicle. The vehcile weighs over 6,000 lbs. Mary's expenses for the Ford SUV are as follows: Gasoline Oil Changes Auto Insurance ssssss es es es es $ 1,700 $ 765 136 136 $ 2,550 213 $ $ $ $ 4,250 5,950 8,500 340 $ 298 $ 425 $ 10,200 255 $ $ $ 28,900

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To prepare a tax return for Bill and Mary Clients you would need to gather all the necessary forms and schedules required for a married filing jointly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started