Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The written down value of the block of Machinery and Plant (Rate of depreciation: 15%) consisting of three plants A, B and C, on

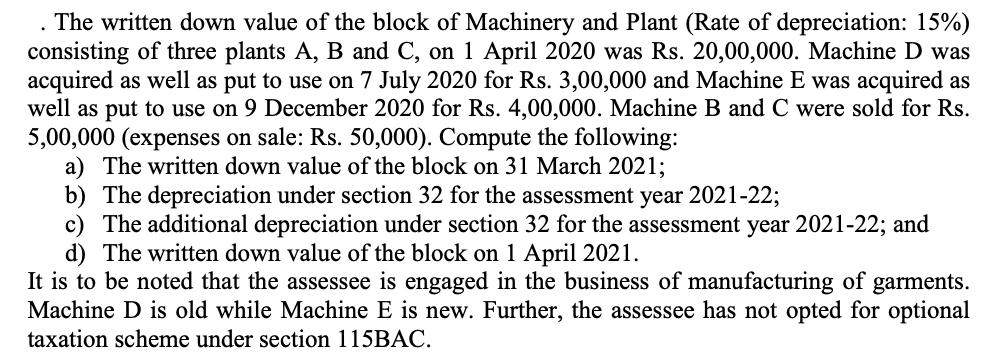

The written down value of the block of Machinery and Plant (Rate of depreciation: 15%) consisting of three plants A, B and C, on 1 April 2020 was Rs. 20,00,000. Machine D was acquired as well as put to use on 7 July 2020 for Rs. 3,00,000 and Machine E was acquired as well as put to use on 9 December 2020 for Rs. 4,00,000. Machine B and C were sold for Rs. 5,00,000 (expenses on sale: Rs. 50,000). Compute the following: a) The written down value of the block on 31 March 2021; b) The depreciation under section 32 for the assessment year 2021-22; c) The additional depreciation under section 32 for the assessment year 2021-22; and d) The written down value of the block on 1 April 2021. It is to be noted that the assessee is engaged in the business of manufacturing of garments. Machine D is old while Machine E is new. Further, the assessee has not opted for optional taxation scheme under section 115BAC.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started