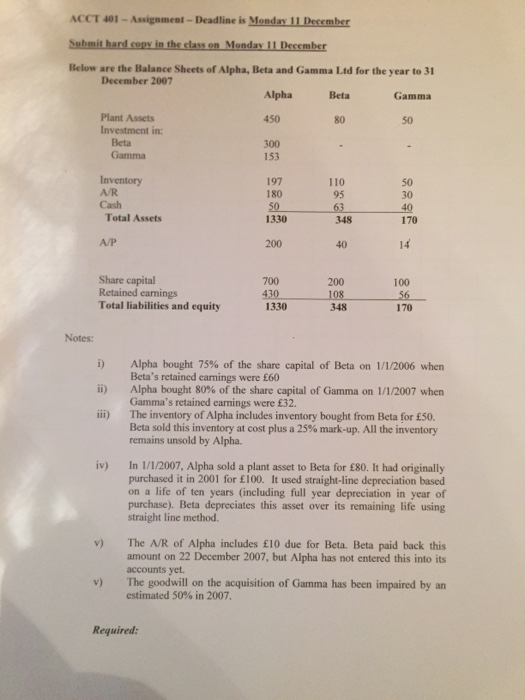

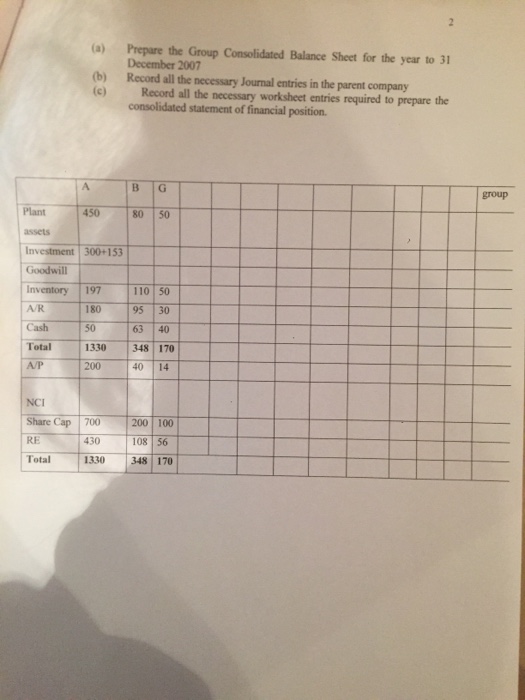

ACCT 401-Assignment-Deadline is Monday 11 December Submit hard copy in the class on Monday 11 December Below are the Balance Sheets of Alpha, Beta and Gamma Ltd for the year to 31 December 2007 Alpha Bet Gamma Plant Assets Investment in: 450 80 Beta 300 153 Inventory A/R Cash 197 110 50 180 1330 200 95 348 40 30 170 14 Total Assets A/P Share capital Retained earnings Total liabilities and equity 700 430 1330 200 100 170 Notes: Alpha bought 75% of the share capital of Beta on 1/1/2006 when Beta's retained earnings were 60 Alpha bought 80% of the share capital of Gamma on 1/1/2007 when Gamma's retained earnings were 32. i) ii) The inventory of Alpha includes inventory bought from Beta for 50. Beta sold this inventory at cost plus a 25% mark-up. All the inventory remains unsold by Alpha. iv) In 1/1/2007, Alpha sold a plant asset to Beta for 80. It had originally purchased it in 2001 for 100. It used straight-line depreciation based on a life of ten years (including full year depreciation in year of purchase). Beta depreciates this asset over its remaining life using straight line method. v) The A/R of Alpha includes 10 due for Beta. Beta paid back this amount on 22 December 2007, but Alpha has not entered this into its accounts yet. The goodwill on the acquisition of Gamma has been impaired by an estimated 50% in 2007. v) Required: ACCT 401-Assignment-Deadline is Monday 11 December Submit hard copy in the class on Monday 11 December Below are the Balance Sheets of Alpha, Beta and Gamma Ltd for the year to 31 December 2007 Alpha Bet Gamma Plant Assets Investment in: 450 80 Beta 300 153 Inventory A/R Cash 197 110 50 180 1330 200 95 348 40 30 170 14 Total Assets A/P Share capital Retained earnings Total liabilities and equity 700 430 1330 200 100 170 Notes: Alpha bought 75% of the share capital of Beta on 1/1/2006 when Beta's retained earnings were 60 Alpha bought 80% of the share capital of Gamma on 1/1/2007 when Gamma's retained earnings were 32. i) ii) The inventory of Alpha includes inventory bought from Beta for 50. Beta sold this inventory at cost plus a 25% mark-up. All the inventory remains unsold by Alpha. iv) In 1/1/2007, Alpha sold a plant asset to Beta for 80. It had originally purchased it in 2001 for 100. It used straight-line depreciation based on a life of ten years (including full year depreciation in year of purchase). Beta depreciates this asset over its remaining life using straight line method. v) The A/R of Alpha includes 10 due for Beta. Beta paid back this amount on 22 December 2007, but Alpha has not entered this into its accounts yet. The goodwill on the acquisition of Gamma has been impaired by an estimated 50% in 2007. v) Required