Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCT 413 Fall 2022 Ch 1, 2, 4, 5 30. Alex is 63 years old and retired. This year Alex won $173,500 in the

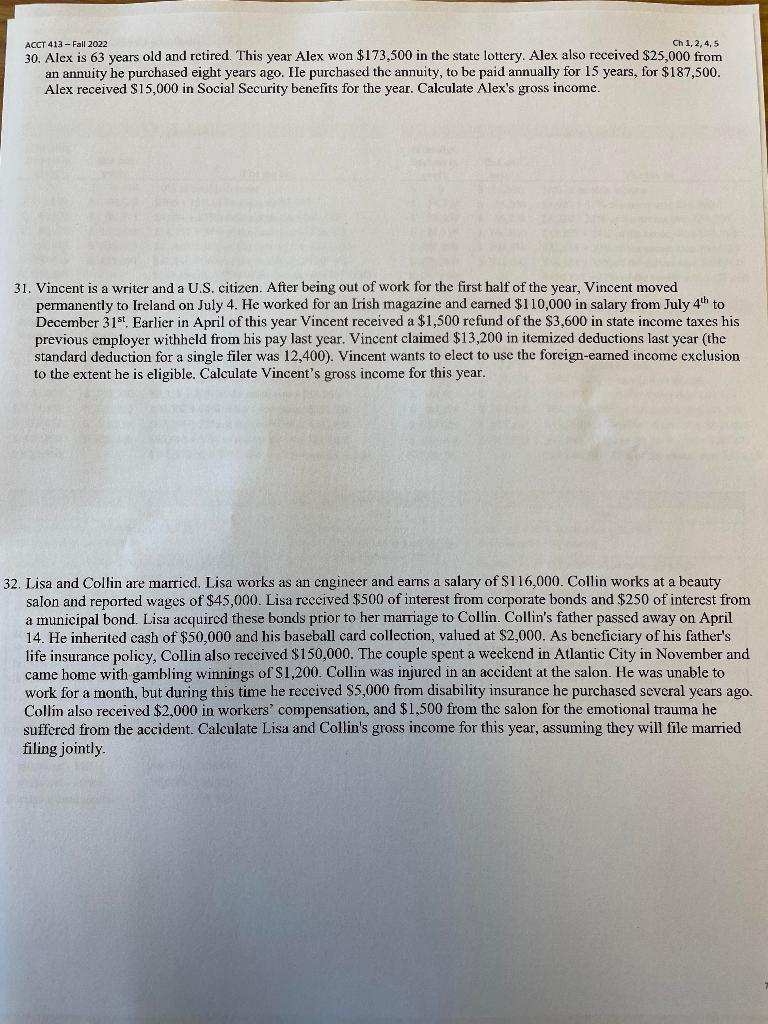

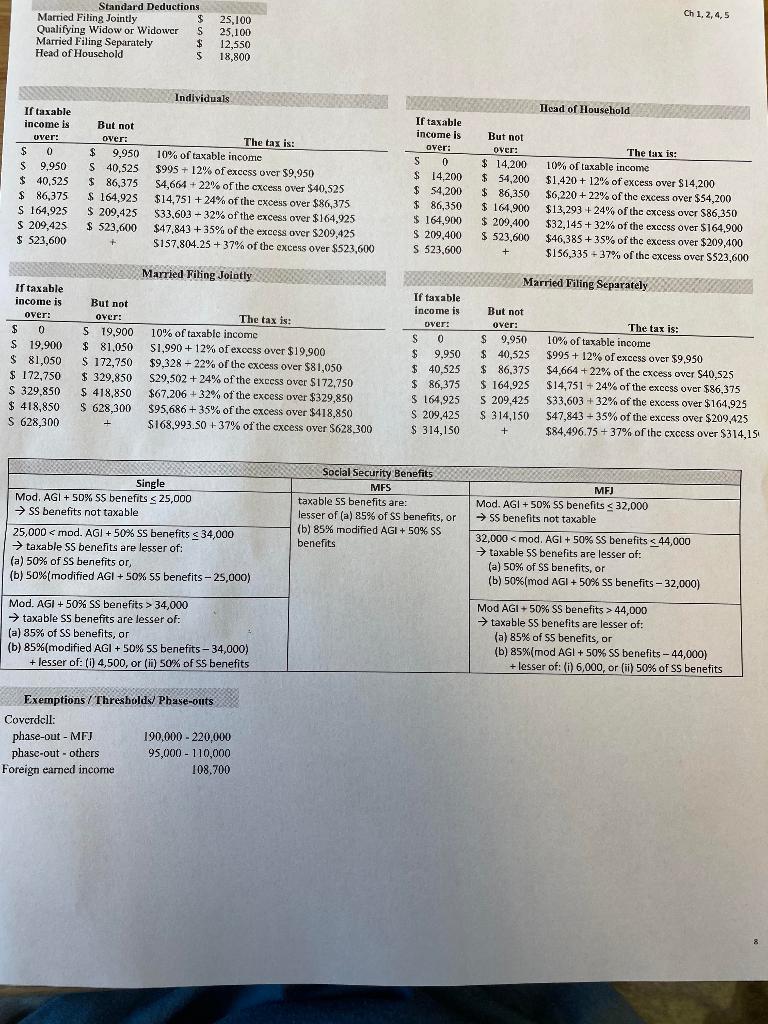

ACCT 413 Fall 2022 Ch 1, 2, 4, 5 30. Alex is 63 years old and retired. This year Alex won $173,500 in the state lottery. Alex also received $25,000 from an annuity he purchased eight years ago. He purchased the annuity, to be paid annually for 15 years, for $187,500. Alex received $15,000 in Social Security benefits for the year. Calculate Alex's gross income. 31. Vincent is a writer and a U.S. citizen. After being out of work for the first half of the year, Vincent moved permanently to Ireland on July 4. He worked for an Irish magazine and earned $110,000 in salary from July 4th to December 31st. Earlier in April of this year Vincent received a $1,500 refund of the $3,600 in state income taxes his previous employer withheld from his pay last year. Vincent claimed $13,200 in itemized deductions last year (the standard deduction for a single filer was 12,400). Vincent wants to elect to use the foreign-earned income exclusion to the extent he is eligible. Calculate Vincent's gross income for this year. 32. Lisa and Collin are married. Lisa works as an engineer and earns a salary of $116,000. Collin works at a beauty salon and reported wages of $45,000. Lisa received $500 of interest from corporate bonds and $250 of interest from a municipal bond. Lisa acquired these bonds prior to her marriage to Collin. Collin's father passed away on April 14. He inherited cash of $50,000 and his baseball card collection, valued at $2,000. As beneficiary of his father's life insurance policy, Collin also received $150,000. The couple spent a weekend in Atlantic City in November and came home with gambling winnings of $1,200. Collin was injured in an accident at the salon. He was unable to work for a month, but during this time he received $5,000 from disability insurance he purchased several years ago. Collin also received $2,000 in workers' compensation, and $1,500 from the salon for the emotional trauma he suffered from the accident. Calculate Lisa and Collin's gross income for this year, assuming they will file married filing jointly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started