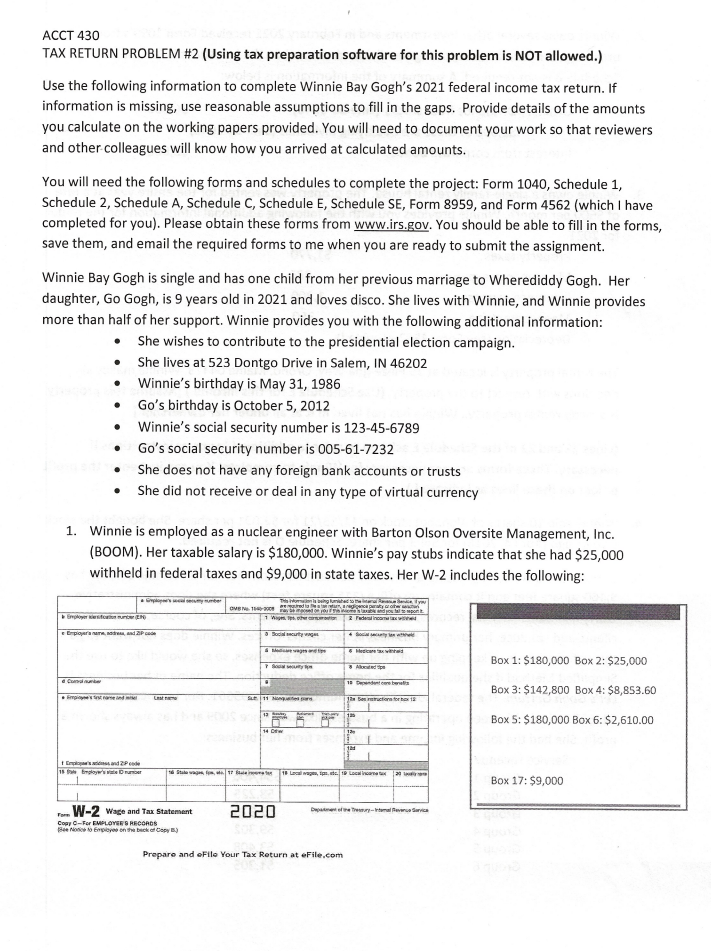

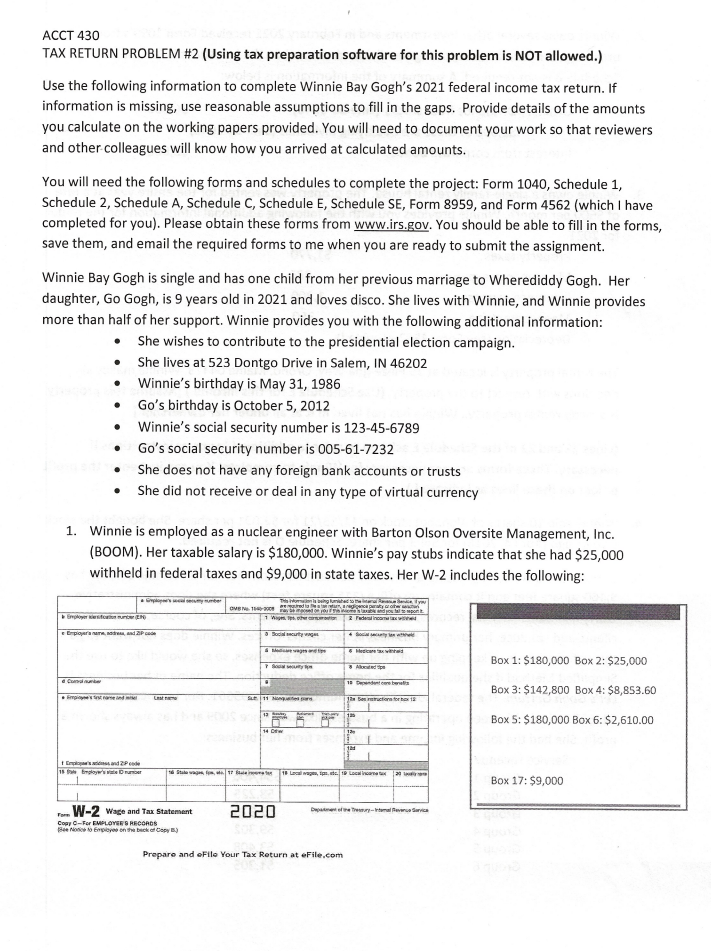

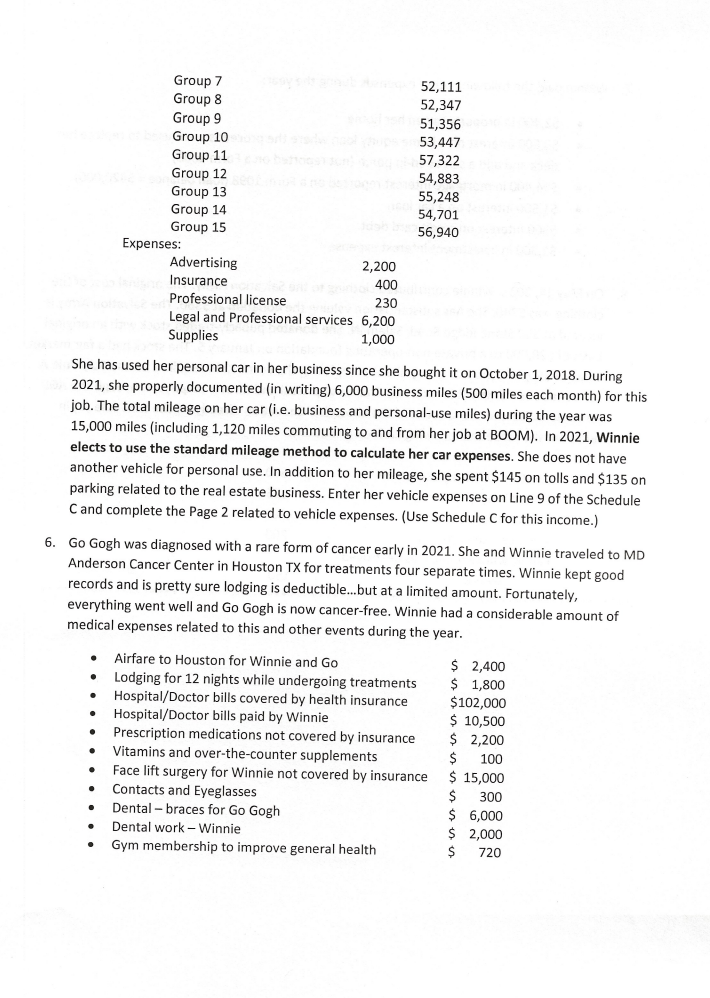

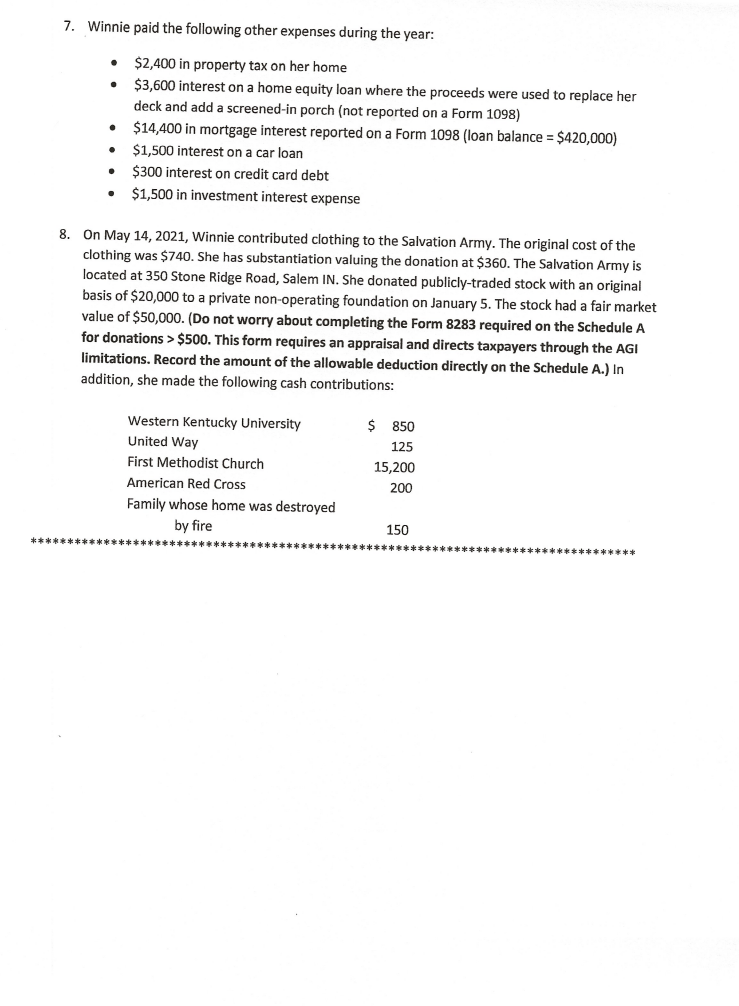

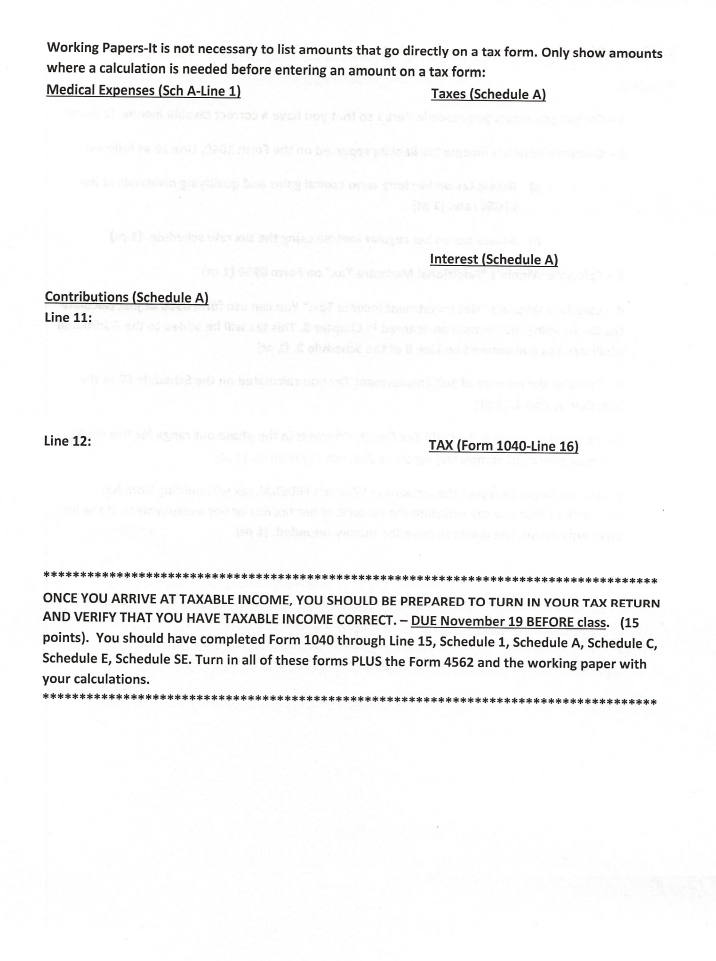

ACCT 430 TAX RETURN PROBLEM #2 (Using tax preparation software for this problem is NOT allowed.) Use the following information to complete Winnie Bay Gogh's 2021 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps. Provide details of the amounts you calculate on the working papers provided. You will need to document your work so that reviewers and other colleagues will know how you arrived at calculated amounts. You will need the following forms and schedules to complete the project: Form 1040, Schedule 1, Schedule 2, Schedule A, Schedule C, Schedule E, Schedule SE, Form 8959, and Form 4562 (which I have completed for you). Please obtain these forms from www.irs.gov. You should be able to fill in the forms, save them, and email the required forms to me when you are ready to submit the assignment. Winnie Bay Gogh is single and has one child from her previous marriage to Wherediddy Gogh. Her daughter, Go Gogh, is 9 years old in 2021 and loves disco. She lives with Winnie, and Winnie provides more than half of her support. Winnie provides you with the following additional information: She wishes to contribute to the presidential election campaign. She lives at 523 Dontgo Drive in Salem, IN 46202 Winnie's birthday is May 31, 1986 . Go's birthday is October 5, 2012 Winnie's social security number is 123-45-6789 Go's social security number is 005-61-7232 She does not have any foreign bank accounts or trusts She did not receive or deal in any type of virtual currency 1. Winnie is employed as a nuclear engineer with Barton Olson Oversite Management, Inc. (BOOM). Her taxable salary is $180,000. Winnie's pay stubs indicate that she had $25,000 withheld in federal taxes and $9,000 in state taxes. Her W-2 includes the following: ig lar GMENT Eestion Employer andre and 3 Songs 6 W Box 1: $180,000 Box 2: $25,000 Com 13 Depotreba Box 3: $142,800 Box 4: $8,853.60 Last 1 Bostruction for tex 18 13 138 Box 5: $180,000 Box 6: $2,610.00 14 w 13 1 Emploss and Pede 1 blowe Stale age 11 Lacalago, tip 1 Local context Box 17: $9,000 2020 Day-na Gorica W-2 Wage and Tax Statement Copy C-For EMPLOYEES RECORDS 184 Epices on the bike Copy) Prepare and File Your Tax Return at eFile.com 2. Winnie owns several other investments and in February 2021 received Form 1099's from her brokerage firm and bank reporting the dividends earned on the investments for 2021. A Schedule B is not required. A summary of the information is below: Ordinary Dividends from stocks (Line 3b-1040) $6,000 *$2,000 of these are qualifying dividends (Line 3a-1040) Interest from corporate bonds $3,000 3. Winnie owns a single-family rental house. The property was rented for the entire year at a rate of $600 per month. Winnie provides you with the following additional information for the rental for 2021. Property taxes $1,770 Maintenance expenses 285 Insurance expense 1,200 Management fee 350 Depreciation (see Form 4562-provided) The rental property is located at 35 Pleze-goa Way, Orono, Maine 04473. Winnie makes all decisions with respect to the property. (Use Schedule E for this income.) (Assume this property is strictly rental property... Winnie has not lived in it at all under her ownership.] (Lines 21 and 22 of the Schedule E ask you to refer to additional forms or instructions if necessary. These forms are not necessary for Winnie to complete. You can just enter the profit or loss on these lines as indicated.) 4. Winnie sold 10 shares of Alphabet stock on 11/15/21 for $2,091 per share. She bought the stock 5 years ago (April 4, 2016) for $693 per share. Schedule D is not required. 5. Winnie runs a consulting business. She runs her business from her home. Winnie's house has 3,160 square feet and it contains an office (215 square feet) where she does administrative work, maintains financial records, and schedules appointments. She, of course, meets with clients and conducts her primary business at her clients' offices. Winnie does not want to go through the hassle of keeping up with her home office expenses, so she would like to use the Simplified Method if she qualifies for the home office deduction. The name of her business is Let's Gogh Gettum. The federal identification number is 05-8799561. Her business code is 541618. Winnie has been operating in a business-like way since 2009 and has always shown a profit. She had the following income and expenses from her business: Service revenue Group 1 $54,406 Group 2 58,225 Group 3 52,973 Group 4 59,302 Group 5 53,408 Group 6 51,305 Group 7 Group 8 Group 9 Group 10 Group 11 Group 12 Group 13 Group 14 Group 15 Expenses: Advertising 2,200 Insurance 400 Professional license 230 Legal and Professional services 6,200 Supplies 1,000 52,111 52,347 51,356 53,447 57,322 54,883 55,248 54,701 56,940 She has used her personal car in her business since she bought it on October 1, 2018. During 2021, she properly documented in writing) 6,000 business miles (500 miles each month) for this job. The total mileage on her car (i.e. business and personal-use miles) during the year was 15,000 miles (including 1,120 miles commuting to and from her job at BOOM). In 2021, Winnie elects to use the standard mileage method to calculate her car expenses. She does not have another vehicle for personal use. In addition to her mileage, she spent $145 on tolls and $135 on parking related to the real estate business. Enter her vehicle expenses on Line 9 of the Schedule Cand complete the Page 2 related to vehicle expenses. (Use Schedule C for this income.) 6. Go Gogh was diagnosed with a rare form of cancer early in 2021. She and Winnie traveled to MD Anderson Cancer Center in Houston TX for treatments four separate times. Winnie kept good records and is pretty sure lodging is deductible...but at a limited amount. Fortunately, everything went well and Go Gogh is now cancer-free. Winnie had a considerable amount of medical expenses related to this and other events during the year. . . Airfare to Houston for Winnie and Go Lodging for 12 nights while undergoing treatments Hospital/Doctor bills covered by health insurance Hospital/Doctor bills paid by Winnie Prescription medications not covered by insurance Vitamins and over-the-counter supplements Face lift surgery for Winnie not covered by insurance Contacts and Eyeglasses Dental-braces for Go Gogh Dental work-Winnie Gym membership to improve general health $ 2,400 $ 1,800 $102,000 $ 10,500 $ 2,200 $ 100 $ 15,000 $ 300 $ 6,000 $ 2,000 $ . . 720 7. Winnie paid the following other expenses during the year: . . . $2,400 in property tax on her home $3,600 interest on a home equity loan where the proceeds were used to replace her deck and add a screened-in porch (not reported on a Form 1098) $14,400 in mortgage interest reported on a Form 1098 (loan balance = $420,000) $1,500 interest on a car loan $300 interest on credit card debt $1,500 in investment interest expense . . 8. On May 14, 2021, Winnie contributed clothing to the Salvation Army. The original cost of the clothing was $740. She has substantiation valuing the donation at $360. The Salvation Army is located at 350 Stone Ridge Road, Salem IN. She donated publicly-traded stock with an original basis of $20,000 to a private non-operating foundation on January 5. The stock had a fair market value of $50,000. (Do not worry about completing the Form 8283 required on the Schedule A for donations > $500. This form requires an appraisal and directs taxpayers through the AGI limitations. Record the amount of the allowable deduction directly on the Schedule A.) In addition, she made the following cash contributions: Western Kentucky University United Way First Methodist Church American Red Cross Family whose home was destroyed by fire $ 850 125 15,200 200 150 ***************** Working Papers-It is not necessary to list amounts that go directly on a tax form. Only show amounts where a calculation is needed before entering an amount on a tax form: Medical Expenses (Sch A-Line 1) Taxes (Schedule A) Interest (Schedule A) Contributions (Schedule A) Line 11: Line 12: TAX (Form 1040-Line 16) **************** ONCE YOU ARRIVE AT TAXABLE INCOME, YOU SHOULD BE PREPARED TO TURN IN YOUR TAX RETURN AND VERIFY THAT YOU HAVE TAXABLE INCOME CORRECT. - DUE November 19 BEFORE class. (15 points). You should have completed Form 1040 through Line 15, Schedule 1, Schedule A, Schedule C, Schedule E, Schedule SE. Turn in all of these forms PLUS the Form 4562 and the working paper with your calculations. Tax Return #2--Part 2: Required: 1 - Correct any errors you made in Part 1 so that you have a correct taxable income (1 point) 2 - Calculate Winnie's income tax liability reported on the Form 1040, Line 16 as follows: a) Assess tax on her long-term capital gains and qualifying dividends at her LTCGs rate. (1 pt) b) Assess tax on her regular income using the tax rate schedule. (1 pt) 3 - Calculate Winnie's "Additional Medicare Tax on Form 8959 (1 pt) 4 - Calculate Winnie's "Net Investment Income Tax." You can use form 8960 or just calculate the tax by using the formula we learned in Chapter 8. This tax will be added to the Additional Medicare Tax and entered on Line 8 of the Schedule 2. (1 pt) 5- Transfer the amount of Self Employment Tax you calculated on the Schedule SE to the Schedule 2, Line 4. (1 pt) 6-Be sure to calculate the Child Tax Credit. Winnie is in the phase out range for this credit and may phase out completely for some (but not all) returns. (1 pt) 7-Do not forget to report the amount of Winnie's FEDERAL tax withholding from her paycheck so that you can calculate the amount of her tax due or her overpayment. If she has an overpayment, she wants to have the money refunded. (1 pt) ACCT 430 TAX RETURN PROBLEM #2 (Using tax preparation software for this problem is NOT allowed.) Use the following information to complete Winnie Bay Gogh's 2021 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps. Provide details of the amounts you calculate on the working papers provided. You will need to document your work so that reviewers and other colleagues will know how you arrived at calculated amounts. You will need the following forms and schedules to complete the project: Form 1040, Schedule 1, Schedule 2, Schedule A, Schedule C, Schedule E, Schedule SE, Form 8959, and Form 4562 (which I have completed for you). Please obtain these forms from www.irs.gov. You should be able to fill in the forms, save them, and email the required forms to me when you are ready to submit the assignment. Winnie Bay Gogh is single and has one child from her previous marriage to Wherediddy Gogh. Her daughter, Go Gogh, is 9 years old in 2021 and loves disco. She lives with Winnie, and Winnie provides more than half of her support. Winnie provides you with the following additional information: She wishes to contribute to the presidential election campaign. She lives at 523 Dontgo Drive in Salem, IN 46202 Winnie's birthday is May 31, 1986 . Go's birthday is October 5, 2012 Winnie's social security number is 123-45-6789 Go's social security number is 005-61-7232 She does not have any foreign bank accounts or trusts She did not receive or deal in any type of virtual currency 1. Winnie is employed as a nuclear engineer with Barton Olson Oversite Management, Inc. (BOOM). Her taxable salary is $180,000. Winnie's pay stubs indicate that she had $25,000 withheld in federal taxes and $9,000 in state taxes. Her W-2 includes the following: ig lar GMENT Eestion Employer andre and 3 Songs 6 W Box 1: $180,000 Box 2: $25,000 Com 13 Depotreba Box 3: $142,800 Box 4: $8,853.60 Last 1 Bostruction for tex 18 13 138 Box 5: $180,000 Box 6: $2,610.00 14 w 13 1 Emploss and Pede 1 blowe Stale age 11 Lacalago, tip 1 Local context Box 17: $9,000 2020 Day-na Gorica W-2 Wage and Tax Statement Copy C-For EMPLOYEES RECORDS 184 Epices on the bike Copy) Prepare and File Your Tax Return at eFile.com 2. Winnie owns several other investments and in February 2021 received Form 1099's from her brokerage firm and bank reporting the dividends earned on the investments for 2021. A Schedule B is not required. A summary of the information is below: Ordinary Dividends from stocks (Line 3b-1040) $6,000 *$2,000 of these are qualifying dividends (Line 3a-1040) Interest from corporate bonds $3,000 3. Winnie owns a single-family rental house. The property was rented for the entire year at a rate of $600 per month. Winnie provides you with the following additional information for the rental for 2021. Property taxes $1,770 Maintenance expenses 285 Insurance expense 1,200 Management fee 350 Depreciation (see Form 4562-provided) The rental property is located at 35 Pleze-goa Way, Orono, Maine 04473. Winnie makes all decisions with respect to the property. (Use Schedule E for this income.) (Assume this property is strictly rental property... Winnie has not lived in it at all under her ownership.] (Lines 21 and 22 of the Schedule E ask you to refer to additional forms or instructions if necessary. These forms are not necessary for Winnie to complete. You can just enter the profit or loss on these lines as indicated.) 4. Winnie sold 10 shares of Alphabet stock on 11/15/21 for $2,091 per share. She bought the stock 5 years ago (April 4, 2016) for $693 per share. Schedule D is not required. 5. Winnie runs a consulting business. She runs her business from her home. Winnie's house has 3,160 square feet and it contains an office (215 square feet) where she does administrative work, maintains financial records, and schedules appointments. She, of course, meets with clients and conducts her primary business at her clients' offices. Winnie does not want to go through the hassle of keeping up with her home office expenses, so she would like to use the Simplified Method if she qualifies for the home office deduction. The name of her business is Let's Gogh Gettum. The federal identification number is 05-8799561. Her business code is 541618. Winnie has been operating in a business-like way since 2009 and has always shown a profit. She had the following income and expenses from her business: Service revenue Group 1 $54,406 Group 2 58,225 Group 3 52,973 Group 4 59,302 Group 5 53,408 Group 6 51,305 Group 7 Group 8 Group 9 Group 10 Group 11 Group 12 Group 13 Group 14 Group 15 Expenses: Advertising 2,200 Insurance 400 Professional license 230 Legal and Professional services 6,200 Supplies 1,000 52,111 52,347 51,356 53,447 57,322 54,883 55,248 54,701 56,940 She has used her personal car in her business since she bought it on October 1, 2018. During 2021, she properly documented in writing) 6,000 business miles (500 miles each month) for this job. The total mileage on her car (i.e. business and personal-use miles) during the year was 15,000 miles (including 1,120 miles commuting to and from her job at BOOM). In 2021, Winnie elects to use the standard mileage method to calculate her car expenses. She does not have another vehicle for personal use. In addition to her mileage, she spent $145 on tolls and $135 on parking related to the real estate business. Enter her vehicle expenses on Line 9 of the Schedule Cand complete the Page 2 related to vehicle expenses. (Use Schedule C for this income.) 6. Go Gogh was diagnosed with a rare form of cancer early in 2021. She and Winnie traveled to MD Anderson Cancer Center in Houston TX for treatments four separate times. Winnie kept good records and is pretty sure lodging is deductible...but at a limited amount. Fortunately, everything went well and Go Gogh is now cancer-free. Winnie had a considerable amount of medical expenses related to this and other events during the year. . . Airfare to Houston for Winnie and Go Lodging for 12 nights while undergoing treatments Hospital/Doctor bills covered by health insurance Hospital/Doctor bills paid by Winnie Prescription medications not covered by insurance Vitamins and over-the-counter supplements Face lift surgery for Winnie not covered by insurance Contacts and Eyeglasses Dental-braces for Go Gogh Dental work-Winnie Gym membership to improve general health $ 2,400 $ 1,800 $102,000 $ 10,500 $ 2,200 $ 100 $ 15,000 $ 300 $ 6,000 $ 2,000 $ . . 720 7. Winnie paid the following other expenses during the year: . . . $2,400 in property tax on her home $3,600 interest on a home equity loan where the proceeds were used to replace her deck and add a screened-in porch (not reported on a Form 1098) $14,400 in mortgage interest reported on a Form 1098 (loan balance = $420,000) $1,500 interest on a car loan $300 interest on credit card debt $1,500 in investment interest expense . . 8. On May 14, 2021, Winnie contributed clothing to the Salvation Army. The original cost of the clothing was $740. She has substantiation valuing the donation at $360. The Salvation Army is located at 350 Stone Ridge Road, Salem IN. She donated publicly-traded stock with an original basis of $20,000 to a private non-operating foundation on January 5. The stock had a fair market value of $50,000. (Do not worry about completing the Form 8283 required on the Schedule A for donations > $500. This form requires an appraisal and directs taxpayers through the AGI limitations. Record the amount of the allowable deduction directly on the Schedule A.) In addition, she made the following cash contributions: Western Kentucky University United Way First Methodist Church American Red Cross Family whose home was destroyed by fire $ 850 125 15,200 200 150 ***************** Working Papers-It is not necessary to list amounts that go directly on a tax form. Only show amounts where a calculation is needed before entering an amount on a tax form: Medical Expenses (Sch A-Line 1) Taxes (Schedule A) Interest (Schedule A) Contributions (Schedule A) Line 11: Line 12: TAX (Form 1040-Line 16) **************** ONCE YOU ARRIVE AT TAXABLE INCOME, YOU SHOULD BE PREPARED TO TURN IN YOUR TAX RETURN AND VERIFY THAT YOU HAVE TAXABLE INCOME CORRECT. - DUE November 19 BEFORE class. (15 points). You should have completed Form 1040 through Line 15, Schedule 1, Schedule A, Schedule C, Schedule E, Schedule SE. Turn in all of these forms PLUS the Form 4562 and the working paper with your calculations. Tax Return #2--Part 2: Required: 1 - Correct any errors you made in Part 1 so that you have a correct taxable income (1 point) 2 - Calculate Winnie's income tax liability reported on the Form 1040, Line 16 as follows: a) Assess tax on her long-term capital gains and qualifying dividends at her LTCGs rate. (1 pt) b) Assess tax on her regular income using the tax rate schedule. (1 pt) 3 - Calculate Winnie's "Additional Medicare Tax on Form 8959 (1 pt) 4 - Calculate Winnie's "Net Investment Income Tax." You can use form 8960 or just calculate the tax by using the formula we learned in Chapter 8. This tax will be added to the Additional Medicare Tax and entered on Line 8 of the Schedule 2. (1 pt) 5- Transfer the amount of Self Employment Tax you calculated on the Schedule SE to the Schedule 2, Line 4. (1 pt) 6-Be sure to calculate the Child Tax Credit. Winnie is in the phase out range for this credit and may phase out completely for some (but not all) returns. (1 pt) 7-Do not forget to report the amount of Winnie's FEDERAL tax withholding from her paycheck so that you can calculate the amount of her tax due or her overpayment. If she has an overpayment, she wants to have the money refunded. (1 pt)