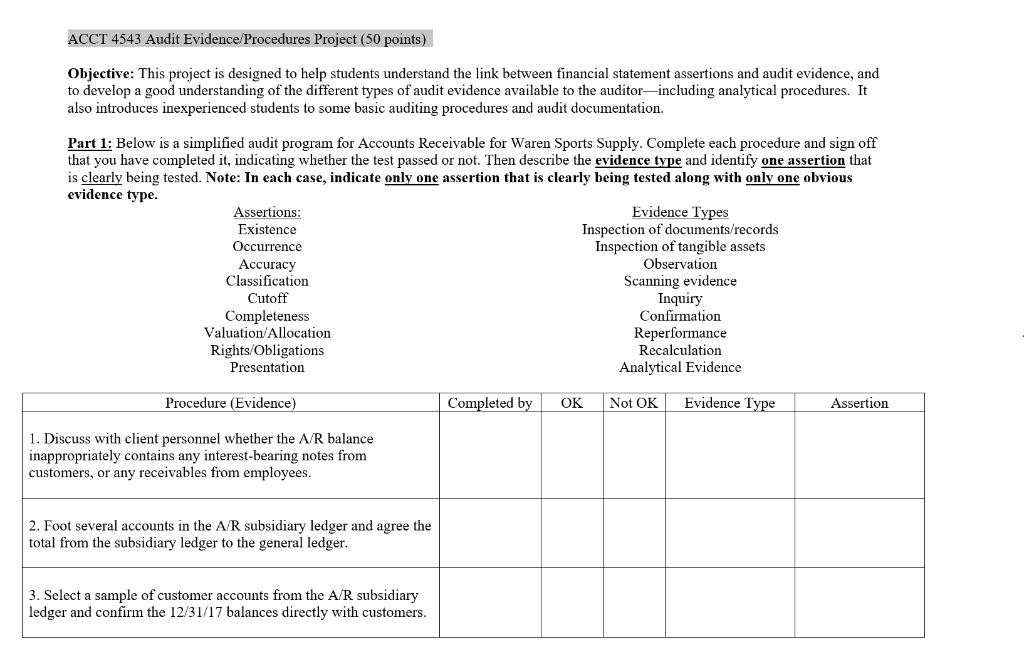

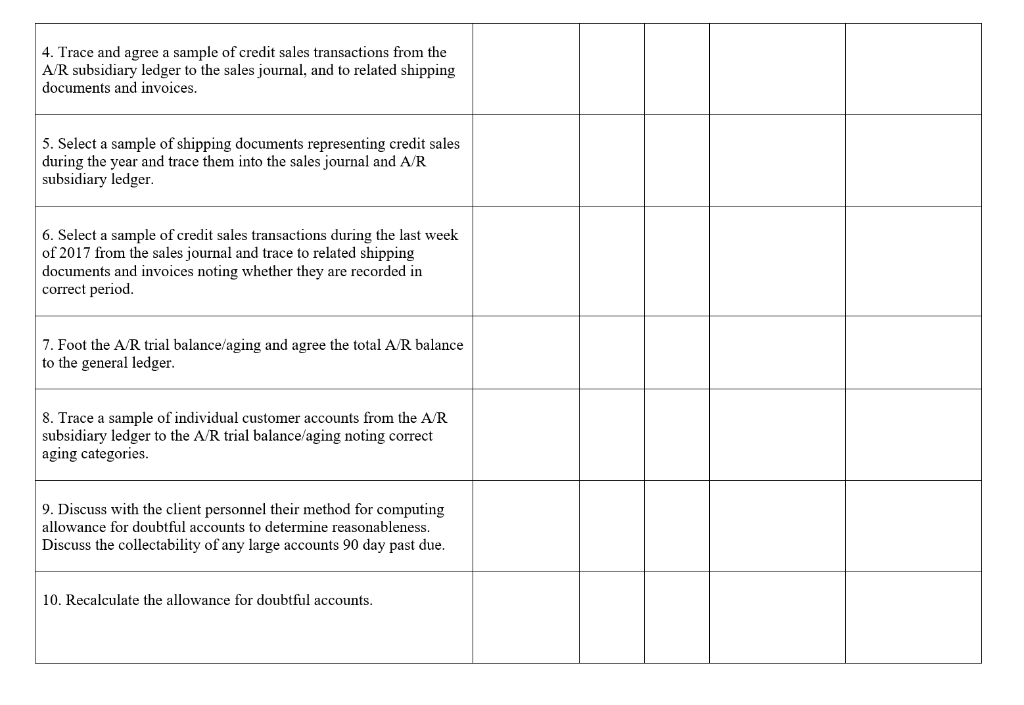

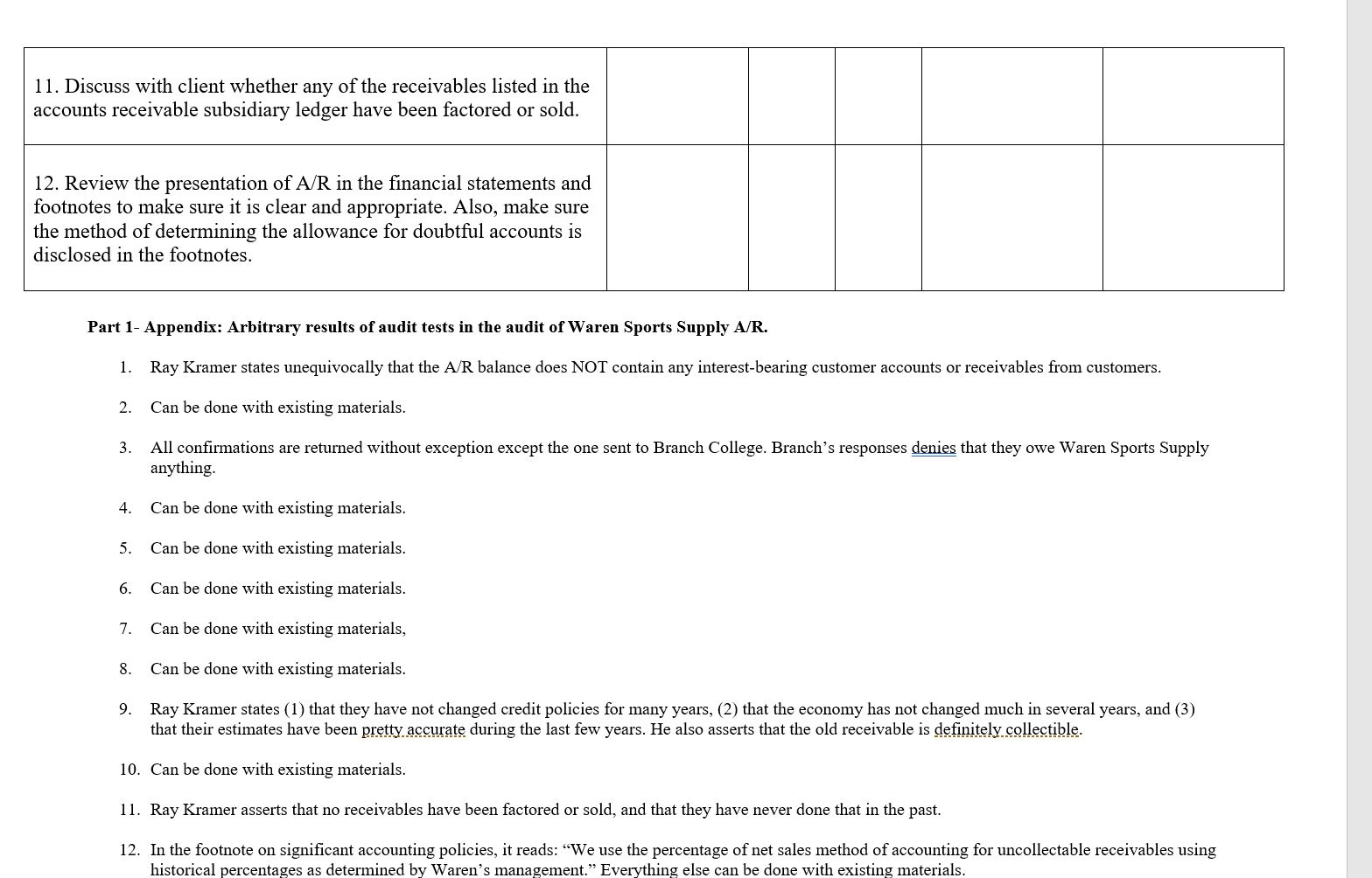

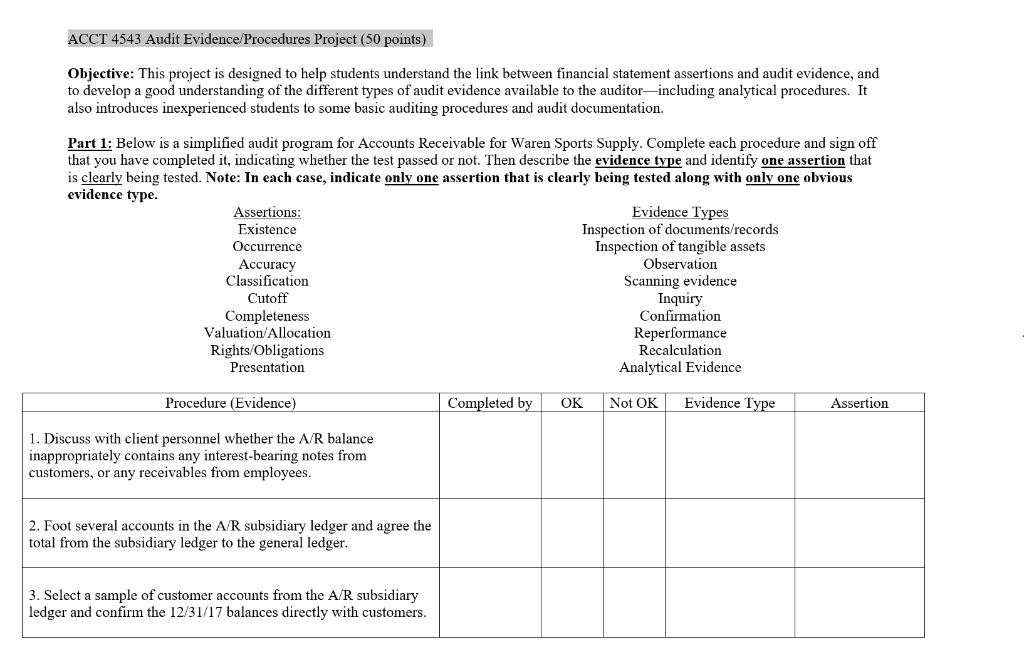

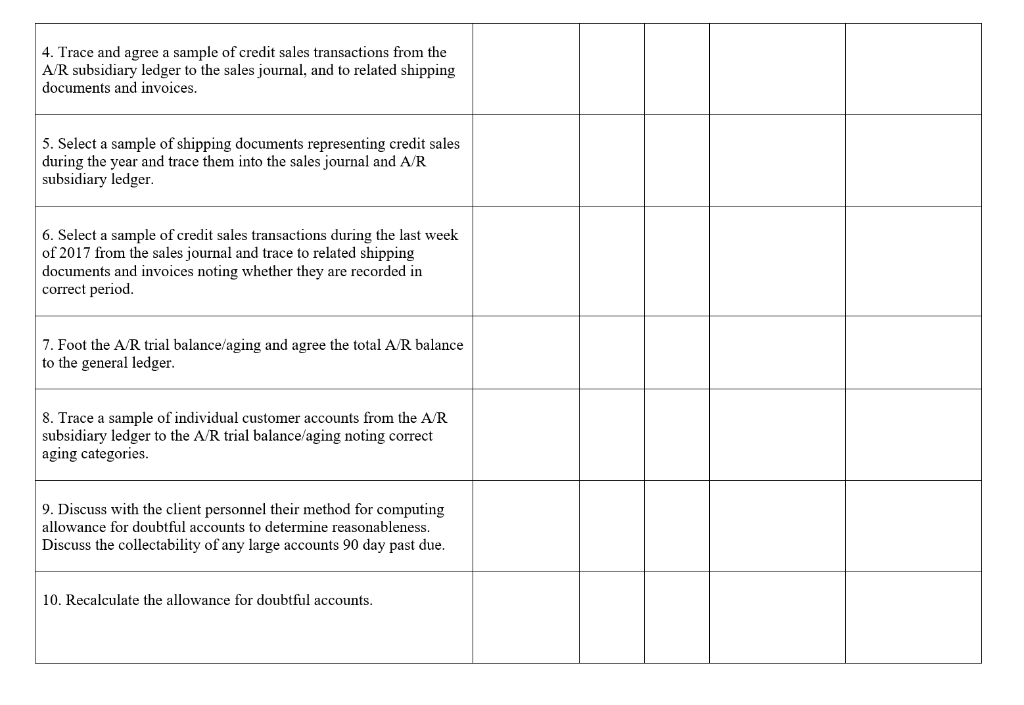

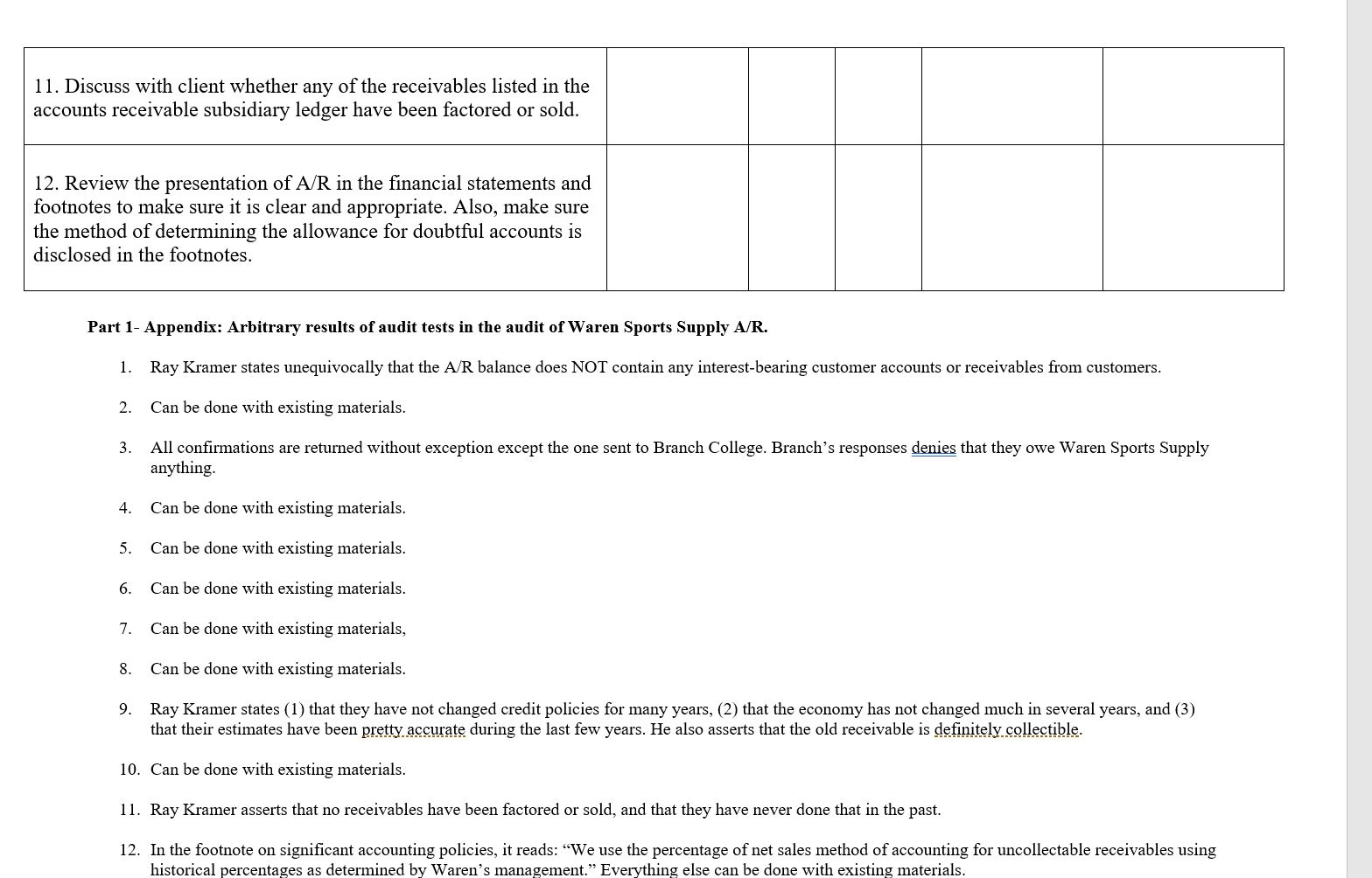

ACCT 4543 Audit Evidence/Procedures Project (50 points) Objective: This project is designed to help students understand the link between financial statement assertions and audit evidence, and to develop a good understanding of the different types of audit evidence available to the auditor-including analytical procedures. It also introduces inexperienced students to some basic auditing procedures and audit documentation. Part 1: Below is a simplified audit program for Accounts Receivable for Waren Sports Supply. Complete each procedure and sign off that you have completed it, indicating whether the test passed or not. Then describe the evidence type and identify one assertion that is clearly being tested. Note: In each case, indicate only one assertion that is clearly being tested along with only one obvious evidence type. Assertions: Evidence Types Existence Inspection of documents/records Occurrence Inspection of tangible assets Accuracy Observation Classification Scanning evidence Cutoff Inquiry Completeness Confirmation Valuation/ Allocation Reperformance Rights/Obligations Recalculation Presentation Analytical Evidence Procedure (Evidence) Completed by OK Not OK. Evidence Type Assertion 1. Discuss with client personnel whether the A/R balance inappropriately contains any interest-bearing notes from customers, or any receivables from employees. 2. Foot several accounts in the A/R subsidiary ledger and agree the total from the subsidiary ledger to the general ledger. 3. Select a sample of customer accounts from the A/R subsidiary ledger and confirm the 12/31/17 balances directly with customers. 4. Trace and agree a sample of credit sales transactions from the A/R subsidiary ledger to the sales journal, and to related shipping documents and invoices. 5. Select a sample of shipping documents representing credit sales during the year and trace them into the sales journal and A/R subsidiary ledger 6. Select a sample of credit sales transactions during the last week of 2017 from the sales journal and trace to related shipping documents and invoices noting whether they are recorded in correct period. 7. Foot the A/R trial balance/aging and agree the total A/R balance to the general ledger. 8. Trace a sample of individual customer accounts from the A/R subsidiary ledger to the A/R trial balance/aging noting correct aging categories. 9. Discuss with the client personnel their method for computing allowance for doubtful accounts to determine reasonableness. Discuss the collectability of any large accounts 90 day past due. 10. Recalculate the allowance for doubtful accounts. 11. Discuss with client whether any of the receivables listed in the accounts receivable subsidiary ledger have been factored or sold. 12. Review the presentation of AR in the financial statements and footnotes to make sure it is clear and appropriate. Also, make sure the method of determining the allowance for doubtful accounts is disclosed in the footnotes. Part 1- Appendix: Arbitrary results of audit tests in the audit of Waren Sports Supply A/R. 1. Ray Kramer states unequivocally that the A/R balance does NOT contain any interest-bearing customer accounts or receivables from customers. 2. Can be done with existing materials. 3. All confirmations are returned without exception except the one sent to Branch College. Branch's responses denies that they owe Waren Sports Supply anything. 4. Can be done with existing materials. 5. Can be done with existing materials. 6. Can be done with existing materials. 7. Can be done with existing materials, 8. Can be done with existing materials. 9. Ray Kramer states (1) that they have not changed credit policies for many years, (2) that the economy has not changed much in several years, and (3) that their estimates have been pretty accurate during the last few years. He also asserts that the old receivable is definitely collectible. 10. Can be done with existing materials. 11. Ray Kramer asserts that no receivables have been factored or sold, and that they have never done that in the past. 12. In the footnote on significant accounting policies, it reads: We use the percentage of net sales method of accounting for uncollectable receivables using historical percentages as determined by Waren's management." Everything else can be done with existing materials. ACCT 4543 Audit Evidence/Procedures Project (50 points) Objective: This project is designed to help students understand the link between financial statement assertions and audit evidence, and to develop a good understanding of the different types of audit evidence available to the auditor-including analytical procedures. It also introduces inexperienced students to some basic auditing procedures and audit documentation. Part 1: Below is a simplified audit program for Accounts Receivable for Waren Sports Supply. Complete each procedure and sign off that you have completed it, indicating whether the test passed or not. Then describe the evidence type and identify one assertion that is clearly being tested. Note: In each case, indicate only one assertion that is clearly being tested along with only one obvious evidence type. Assertions: Evidence Types Existence Inspection of documents/records Occurrence Inspection of tangible assets Accuracy Observation Classification Scanning evidence Cutoff Inquiry Completeness Confirmation Valuation/ Allocation Reperformance Rights/Obligations Recalculation Presentation Analytical Evidence Procedure (Evidence) Completed by OK Not OK. Evidence Type Assertion 1. Discuss with client personnel whether the A/R balance inappropriately contains any interest-bearing notes from customers, or any receivables from employees. 2. Foot several accounts in the A/R subsidiary ledger and agree the total from the subsidiary ledger to the general ledger. 3. Select a sample of customer accounts from the A/R subsidiary ledger and confirm the 12/31/17 balances directly with customers. 4. Trace and agree a sample of credit sales transactions from the A/R subsidiary ledger to the sales journal, and to related shipping documents and invoices. 5. Select a sample of shipping documents representing credit sales during the year and trace them into the sales journal and A/R subsidiary ledger 6. Select a sample of credit sales transactions during the last week of 2017 from the sales journal and trace to related shipping documents and invoices noting whether they are recorded in correct period. 7. Foot the A/R trial balance/aging and agree the total A/R balance to the general ledger. 8. Trace a sample of individual customer accounts from the A/R subsidiary ledger to the A/R trial balance/aging noting correct aging categories. 9. Discuss with the client personnel their method for computing allowance for doubtful accounts to determine reasonableness. Discuss the collectability of any large accounts 90 day past due. 10. Recalculate the allowance for doubtful accounts. 11. Discuss with client whether any of the receivables listed in the accounts receivable subsidiary ledger have been factored or sold. 12. Review the presentation of AR in the financial statements and footnotes to make sure it is clear and appropriate. Also, make sure the method of determining the allowance for doubtful accounts is disclosed in the footnotes. Part 1- Appendix: Arbitrary results of audit tests in the audit of Waren Sports Supply A/R. 1. Ray Kramer states unequivocally that the A/R balance does NOT contain any interest-bearing customer accounts or receivables from customers. 2. Can be done with existing materials. 3. All confirmations are returned without exception except the one sent to Branch College. Branch's responses denies that they owe Waren Sports Supply anything. 4. Can be done with existing materials. 5. Can be done with existing materials. 6. Can be done with existing materials. 7. Can be done with existing materials, 8. Can be done with existing materials. 9. Ray Kramer states (1) that they have not changed credit policies for many years, (2) that the economy has not changed much in several years, and (3) that their estimates have been pretty accurate during the last few years. He also asserts that the old receivable is definitely collectible. 10. Can be done with existing materials. 11. Ray Kramer asserts that no receivables have been factored or sold, and that they have never done that in the past. 12. In the footnote on significant accounting policies, it reads: We use the percentage of net sales method of accounting for uncollectable receivables using historical percentages as determined by Waren's management." Everything else can be done with existing materials