Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acct225 Integrative Case #1 Operational information Part 5 - Make or Buy Analysis Following your analysis of the Boots product line for the Alberta and

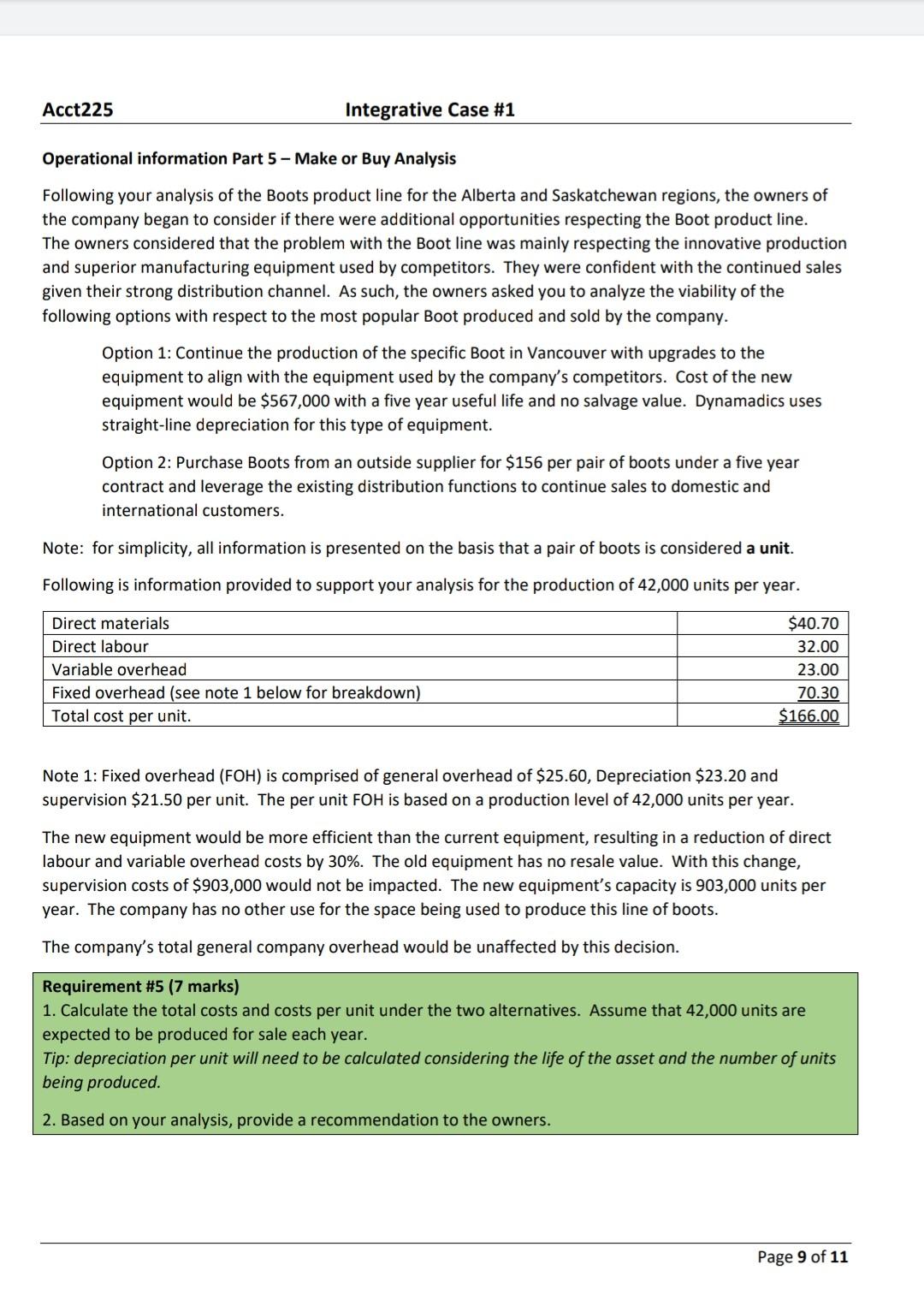

Acct225 Integrative Case #1 Operational information Part 5 - Make or Buy Analysis Following your analysis of the Boots product line for the Alberta and Saskatchewan regions, the owners of the company began to consider if there were additional opportunities respecting the Boot product line. The owners considered that the problem with the Boot line was mainly respecting the innovative production and superior manufacturing equipment used by competitors. They were confident with the continued sales given their strong distribution channel. As such, the owners asked you to analyze the viability of the following options with respect to the most popular Boot produced and sold by the company. Option 1: Continue the production of the specific Boot in Vancouver with upgrades to the equipment to align with the equipment used by the company's competitors. Cost of the new equipment would be $567,000 with a five year useful life and no salvage value. Dynamadics uses straight-line depreciation for this type of equipment. Option 2: Purchase Boots from an outside supplier for $156 per pair of boots under a five year contract and leverage the existing distribution functions to continue sales to domestic and international customers. Note: for simplicity, all information is presented on the basis that a pair of boots is considered a unit. Following is information provided to support your analysis for the production of 42,000 units per year. Direct materials Direct labour Variable overhead Fixed overhead (see note 1 below for breakdown) Total cost per unit. $40.70 32.00 23.00 70.30 $166.00 Note 1: Fixed overhead (FOH) is comprised of general overhead of $25.60, Depreciation $23.20 and supervision $21.50 per unit. The per unit FOH is based on a production level of 42,000 units per year. The new equipment would be more efficient than the current equipment, resulting in a reduction of direct labour and variable overhead costs by 30%. The old equipment has no resale value. With this change, supervision costs of $903,000 would not be impacted. The new equipment's capacity is 903,000 units per year. The company has no other use for the space being used to produce this line of boots. The company's total general company overhead would be unaffected by this decision. Requirement #5 (7 marks) 1. Calculate the total costs and costs per unit under the two alternatives. Assume that 42,000 units are expected to be produced for sale each year. Tip: depreciation per unit will need to be calculated considering the life of the asset and the number of units being produced 2. Based on your analysis, provide a recommendation to the owners. Page 9 of 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started