Accurued revenues

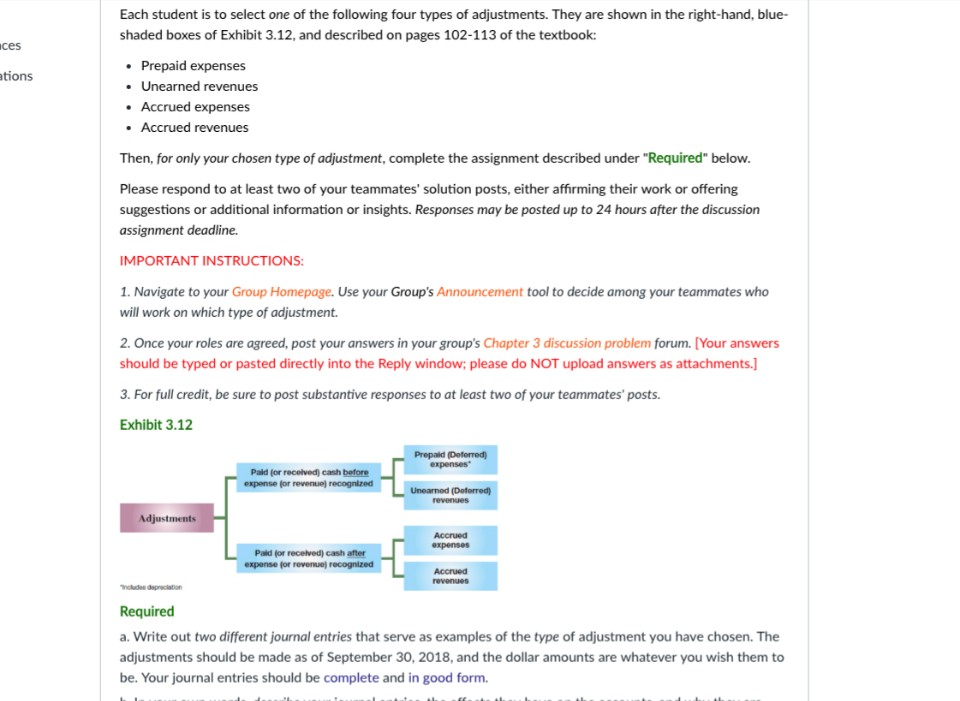

a. Write out two different journal entries that serve as examples of the type of adjustment you have chosen. The adjustments should be made as of September 30, 2018, and the dollar amounts are whatever you wish them to be. Your journal entries should be completeand in good form.

b. In your own words, describe your journal entries, the effects they have on the accounts, and why they are necessary.

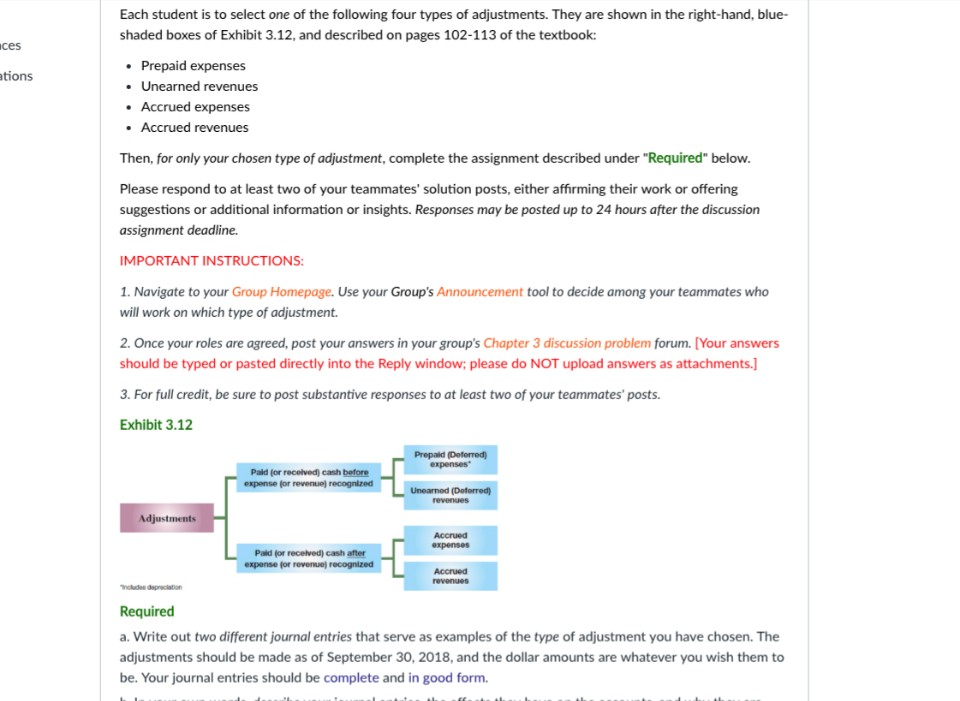

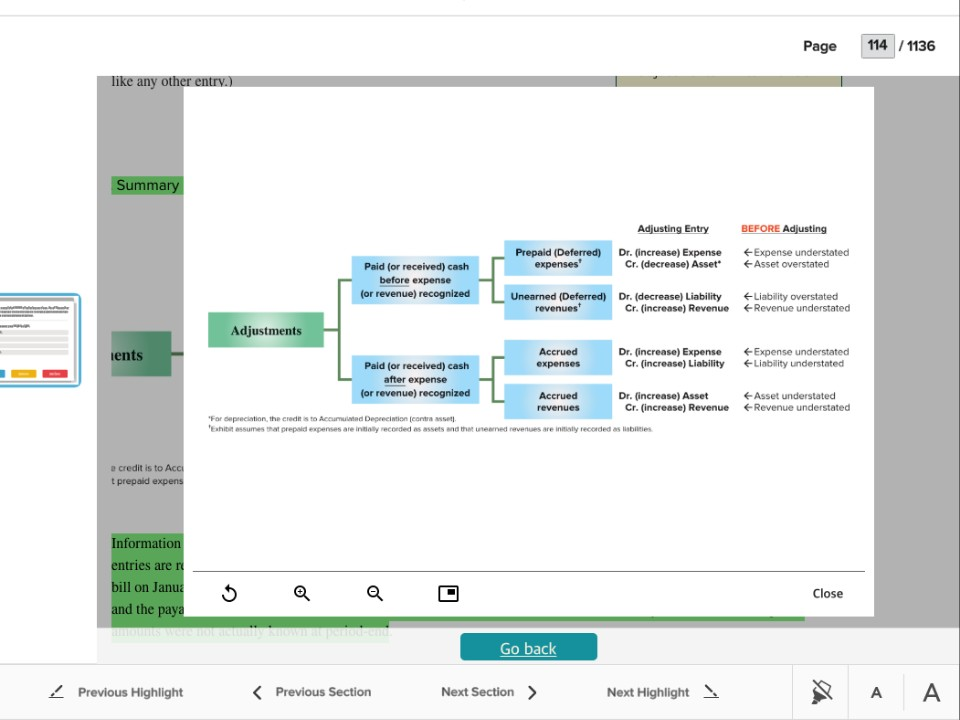

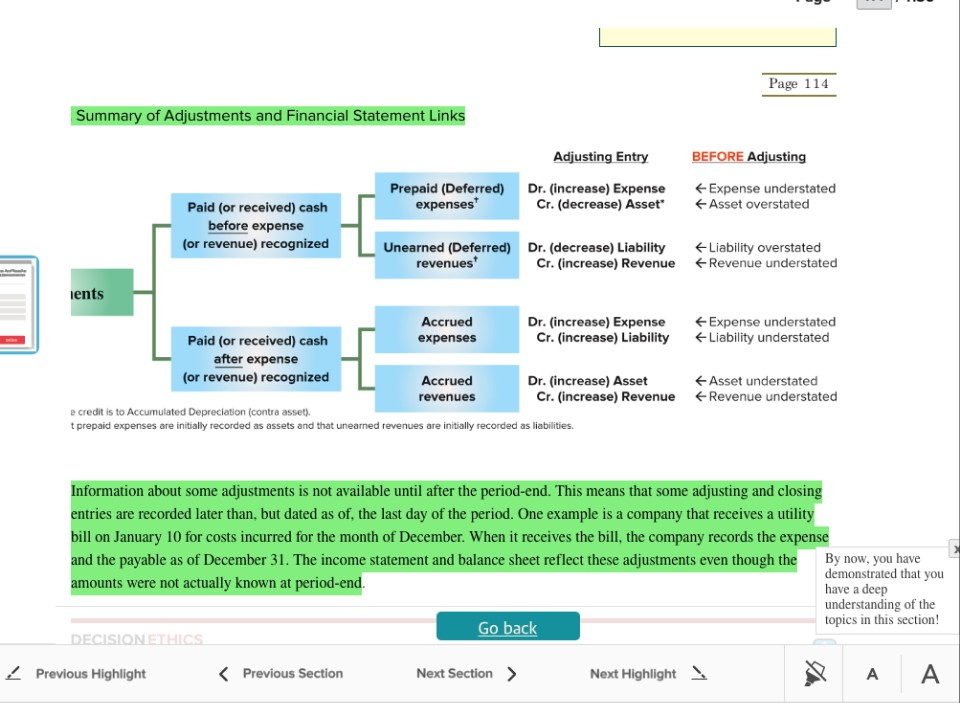

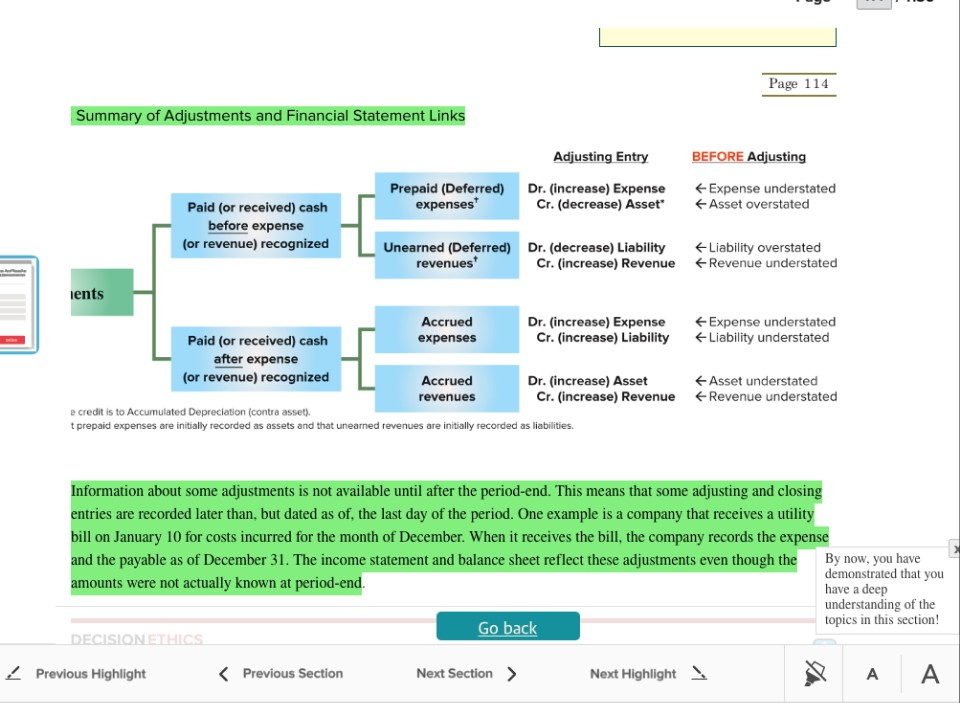

Each student is to select one of the following four types of adjustments. They are shown in the right-hand, blue- shaded boxes of Exhibit 3.12, and described on pages 102-113 of the textbook: ces .Prepaid expenses tions Unearned revenues Accrued expenses Accrued revenues Then, for only your chosen type of adjustment, complete the assignment described under "Required" below. Please respond to at least two of your teammates' solution posts, either affirming their work or offering suggestions or additional information or insights. Responses may be posted up to 24 hours after the discussion assignment deadline. IMPORTANT INSTRUCTIONS 1. Navigate to your Group Homepage. Use your Group's Announcement tool to decide among your teammates who will work on which type of adjustment. 2. Once your roles are agreed, post your answers in your group's Chapter 3 discussion problem forum. [Your answers should be typed or pasted directly into the Reply window; please do NOT upload answers as attachments.] 3. For full credit, be sure to post substantive responses to at least two of your teammates' posts. Exhibit 3.12 expenses" Pald (or recelved) cash before Adjustments Accrued Paid or recelvedj cash after Accrued revenues Required a. Write out two different journal entries that serve as examples of the type of adjustment you have chosen. The adjustments should be made as of September 30, 2018, and the dollar amounts are whatever you wish them to be. Your journal entries should be complete and in good form. Each student is to select one of the following four types of adjustments. They are shown in the right-hand, blue- shaded boxes of Exhibit 3.12, and described on pages 102-113 of the textbook: ces .Prepaid expenses tions Unearned revenues Accrued expenses Accrued revenues Then, for only your chosen type of adjustment, complete the assignment described under "Required" below. Please respond to at least two of your teammates' solution posts, either affirming their work or offering suggestions or additional information or insights. Responses may be posted up to 24 hours after the discussion assignment deadline. IMPORTANT INSTRUCTIONS 1. Navigate to your Group Homepage. Use your Group's Announcement tool to decide among your teammates who will work on which type of adjustment. 2. Once your roles are agreed, post your answers in your group's Chapter 3 discussion problem forum. [Your answers should be typed or pasted directly into the Reply window; please do NOT upload answers as attachments.] 3. For full credit, be sure to post substantive responses to at least two of your teammates' posts. Exhibit 3.12 expenses" Pald (or recelved) cash before Adjustments Accrued Paid or recelvedj cash after Accrued revenues Required a. Write out two different journal entries that serve as examples of the type of adjustment you have chosen. The adjustments should be made as of September 30, 2018, and the dollar amounts are whatever you wish them to be. Your journal entries should be complete and in good form