Question

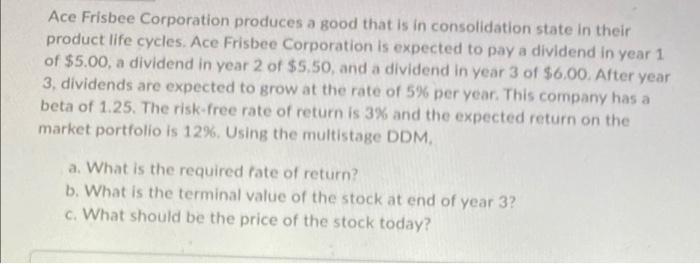

Ace Frisbee Corporation produces a good that is in consolidation state in their product life cycles. Ace Frisbee Corporation is expected to pay a

Ace Frisbee Corporation produces a good that is in consolidation state in their product life cycles. Ace Frisbee Corporation is expected to pay a dividend in year 1 of $5.00, a dividend in year 2 of $5.50, and a dividend in year 3 of $6.00. After year 3, dividends are expected to grow at the rate of 5% per year. This company has a beta of 1.25. The risk-free rate of return is 3% and the expected return on the market portfolio is 12%. Using the multistage DDM. a. What is the required fate of return? b. What is the terminal value of the stock at end of year 3? c. What should be the price of the stock today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Control Systems

Authors: Richard C. Dorf, Robert H. Bishop

12th edition

136024580, 978-0136024583

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App