Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acer Company disposed of a machine. The machine originally cost $75,000 and accumulated depreciation through the date of disposal was $55,000. Record the journal

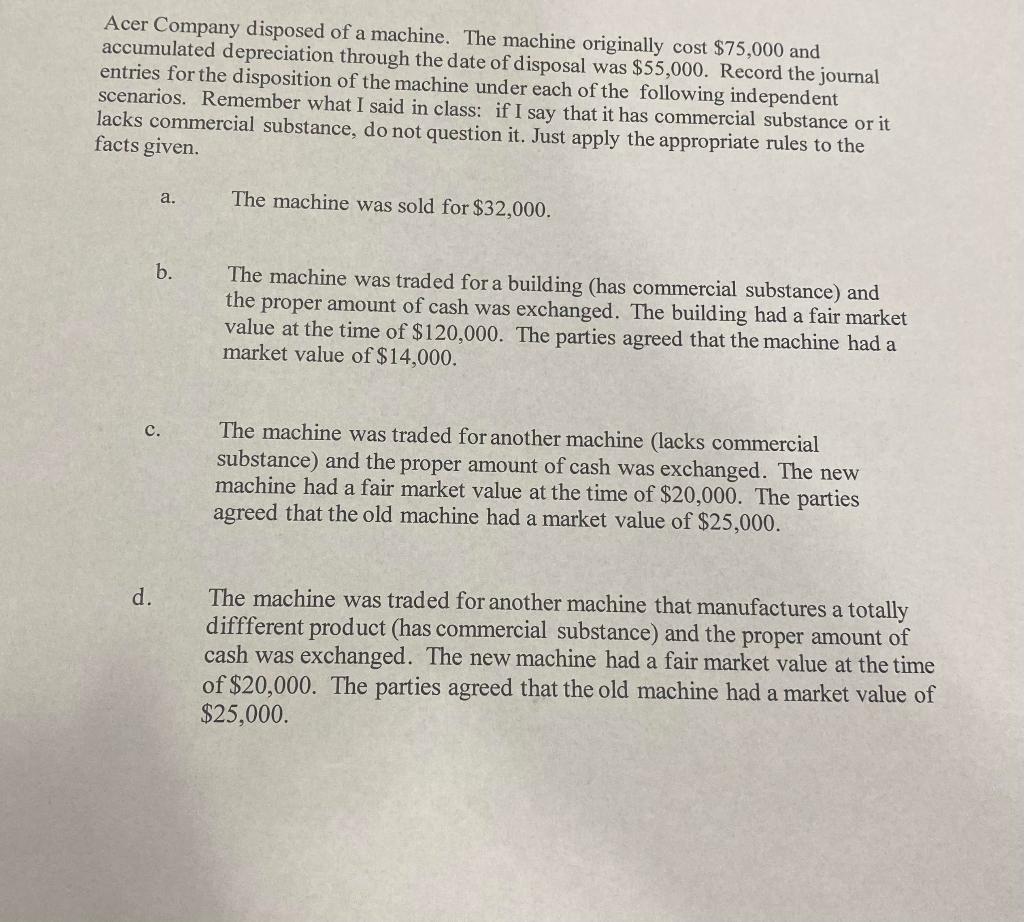

Acer Company disposed of a machine. The machine originally cost $75,000 and accumulated depreciation through the date of disposal was $55,000. Record the journal entries for the disposition of the machine under each of the following independent scenarios. Remember what I said in class: if I say that it has commercial substance or it lacks commercial substance, do not question it. Just apply the appropriate rules to the facts given. a. The machine was sold for $32,000. b. The machine was traded for a building (has commercial substance) and the proper amount of cash was exchanged. The building had a fair market value at the time of $120,000. The parties agreed that the machine had a market value of $14,000. The machine was traded for another machine (lacks commercial substance) and the proper amount of cash was exchanged. The new machine had a fair market value at the time of $20,000. The parties agreed that the old machine had a market value of $25,000. . The machine was traded for another machine that manufactures a totally diffferent product (has commercial substance) and the proper amount of cash was exchanged. The new machine had a fair market value at the time of $20,000. The parties agreed that the old machine had a market value of $25,000. d.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answers Answer Original cost 75000 Less Accumulated depreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started