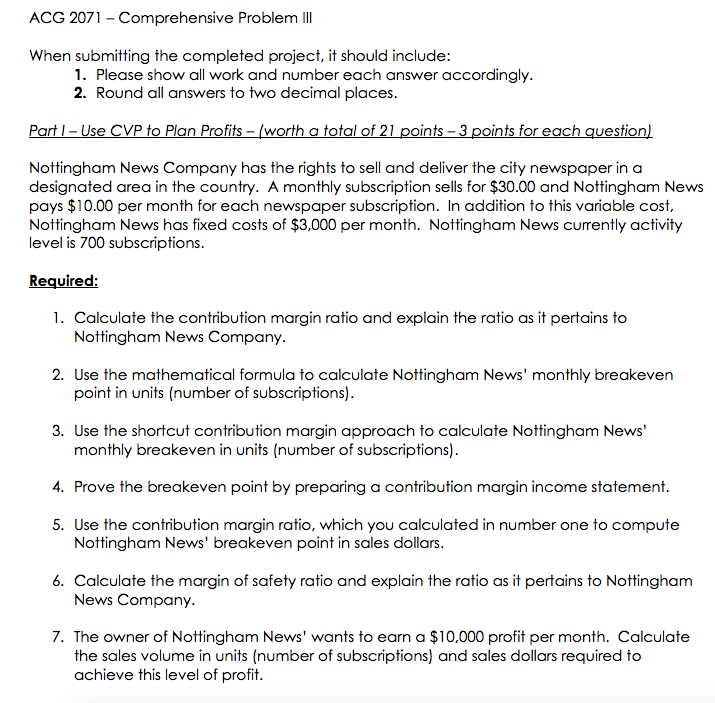

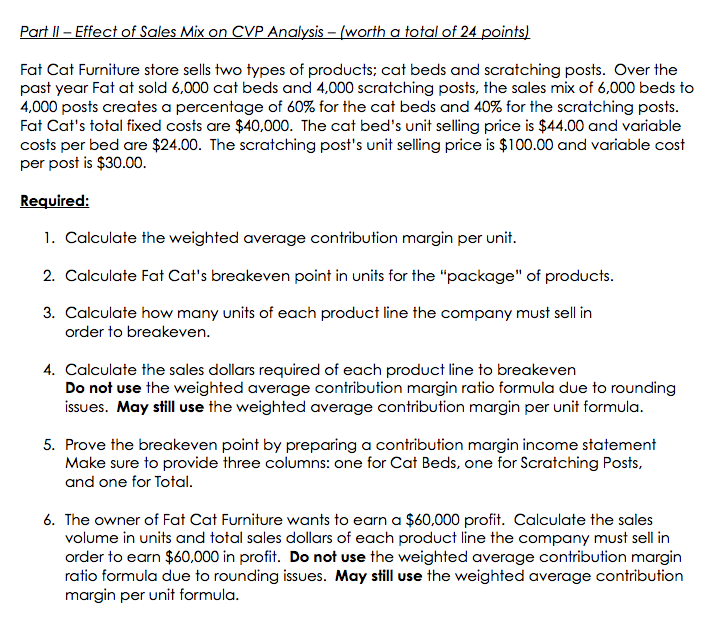

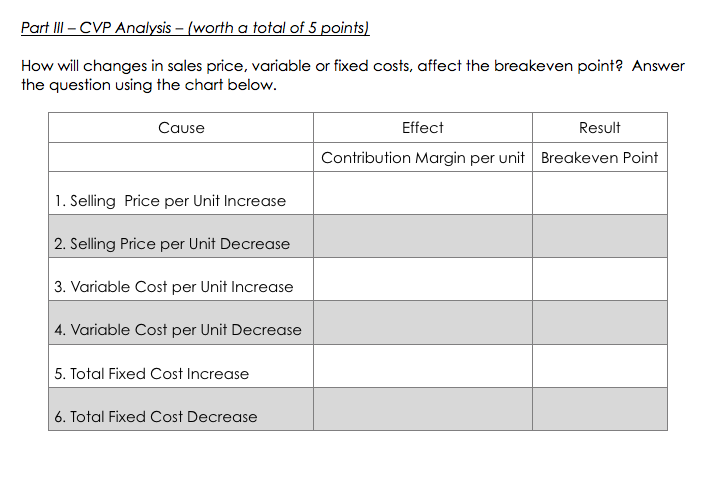

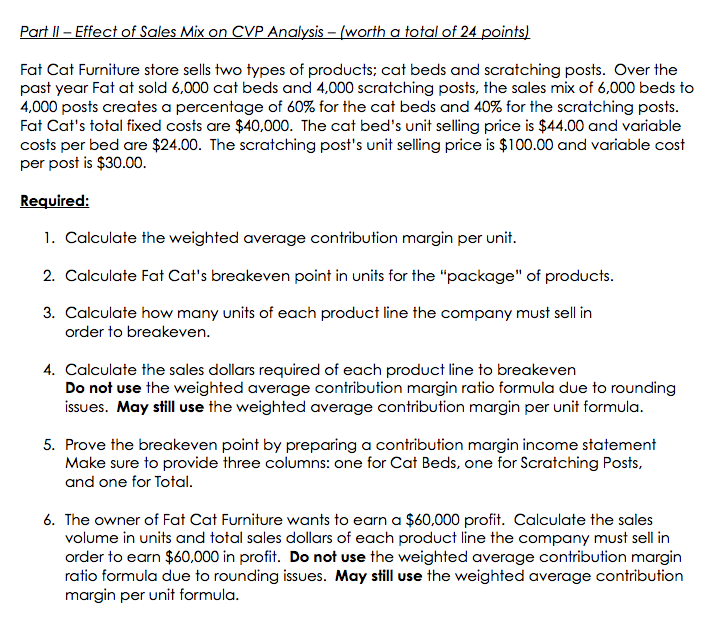

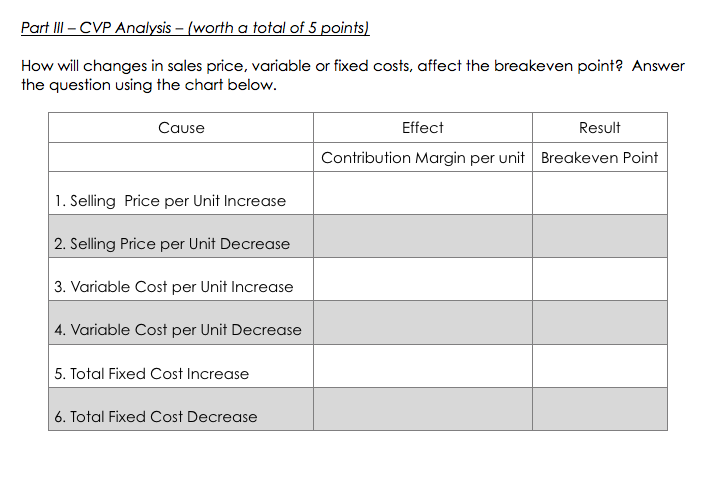

ACG 2071 - Comprehensive Problem III When submitting the completed project, it should include: 1. Please show all work and number each answer accordingly. 2. Round all answers to two decimal places. Part 1 - Use CVP to Plan Profits (worth a total of 21 points 3 points for each question) Nottingham News Company has the rights to sell and deliver the city newspaper in a designated area in the country. A monthly subscription sells for $30.00 and Nottingham News pays $10.00 per month for each newspaper subscription. In addition to this variable cost, Nottingham News has fixed costs of $3,000 per month. Nottingham News currently activity level is 700 subscriptions. Required: 1. Calculate the contribution margin ratio and explain the ratio as it pertains to Nottingham News Company. 2. Use the mathematical formula to calculate Nottingham News' monthly breakeven point in units (number of subscriptions). 3. Use the shortcut contribution margin approach to calculate Nottingham News' monthly breakeven in units (number of subscriptions). 4. Prove the breakeven point by preparing a contribution margin income statement. 5. Use the contribution margin ratio, which you calculated in number one to compute Nottingham News' breakeven point in sales dollars. 6. Calculate the margin of safety ratio and explain the ratio as it pertains to Nottingham News Company. 7. The owner of Nottingham News' wants to earn a $10,000 profit per month. Calculate the sales volume in units (number of subscriptions) and sales dollars required to achieve this level of profit. Part II Effect of Sales Mix on CVP Analysis (worth a total of 24 points) Fat Cat Furniture store sells two types of products; cat beds and scratching posts. Over the past year Fat at sold 6,000 cat beds and 4,000 scratching posts, the sales mix of 6,000 beds to 4,000 posts creates a percentage of 60% for the cat beds and 40% for the scratching posts. Fat Cat's total fixed costs are $40,000. The cat bed's unit selling price is $44.00 and variable costs per bed are $24.00. The scratching post's unit selling price is $100.00 and variable cost per post is $30.00. Required: 1. Calculate the weighted average contribution margin per unit. 2. Calculate Fat Cat's breakeven point in units for the "package" of products. 3. Calculate how many units of each product line the company must sell in order to breakeven. 4. Calculate the sales dollars required of each product line to breakeven Do not use the weighted average contribution margin ratio formula due to rounding issues. May still use the weighted average contribution margin per unit formula. 5. Prove the breakeven point by preparing a contribution margin income statement Make sure to provide three columns: one for Cat Beds, one for Scratching Posts, and one for Total. 6. The owner of Fat Cat Furniture wants to earn a $60,000 profit. Calculate the sales volume in units and total sales dollars of each product line the company must sell in order to earn $60,000 in profit. Do not use the weighted average contribution margin ratio formula due to rounding issues. May still use the weighted average contribution margin per unit formula. Part III - CVP Analysis (worth a total of 5 points) How will changes in sales price, variable or fixed costs, affect the breakeven point? Answer the question using the chart below. Cause Effect Result Contribution Margin per unit Breakeven Point 1. Selling Price per Unit Increase 2. Selling Price per Unit Decrease 3. Variable Cost per Unit Increase 4. Variable Cost per Unit Decrease 5. Total Fixed Cost Increase 6. Total Fixed Cost Decrease