Answered step by step

Verified Expert Solution

Question

1 Approved Answer

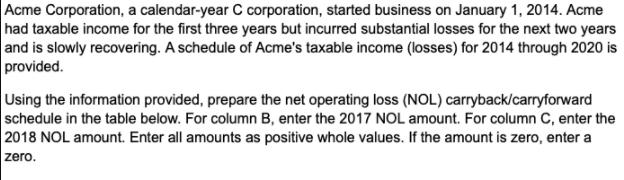

Acme Corporation, a calendar-year C corporation, started business on January 1, 2014. Acme had taxable income for the first three years but incurred substantial

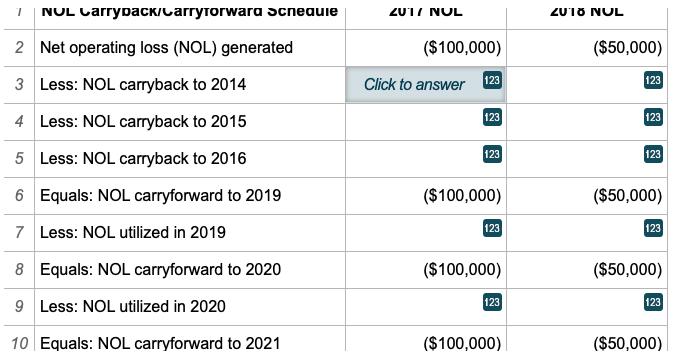

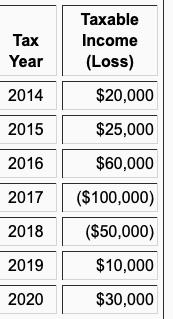

Acme Corporation, a calendar-year C corporation, started business on January 1, 2014. Acme had taxable income for the first three years but incurred substantial losses for the next two years and is slowly recovering. A schedule of Acme's taxable income (losses) for 2014 through 2020 is provided. Using the information provided, prepare the net operating loss (NOL) carryback/carryforward schedule in the table below. For column B, enter the 2017 NOL amount. For column C, enter the 2018 NOL amount. Enter all amounts as positive whole values. If the amount is zero, enter a zero. 7 NUL 2 Net operating loss (NOL) generated 3 Less: NOL carryback to 2014 4 Less: NOL carryback to 2015 5 Less: NOL carryback to 2016 6 7 Less: NOL utilized in 2019 Carrypack/CarryTorwara Scnequie Equals: NOL carryforward to 2019 8 9 Less: NOL utilized in 2020 10 Equals: NOL carryforward to 2021 Equals: NOL carryforward to 2020 2017 NUL ($100,000) Click to answer 123 123 123 ($100,000) 123 ($100,000) 123 ($100,000) 2018 NUL ($50,000) 123 123 123 ($50,000) 123 ($50,000) 123 ($50,000) Tax Year 2014 2015 2016 2017 2018 2019 2020 Taxable Income (Loss) $20,000 $25,000 $60,000 ($100,000) ($50,000) $10,000 $30,000

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A Net operating loss NOL carrybackcarryforward sched...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started