Answered step by step

Verified Expert Solution

Question

1 Approved Answer

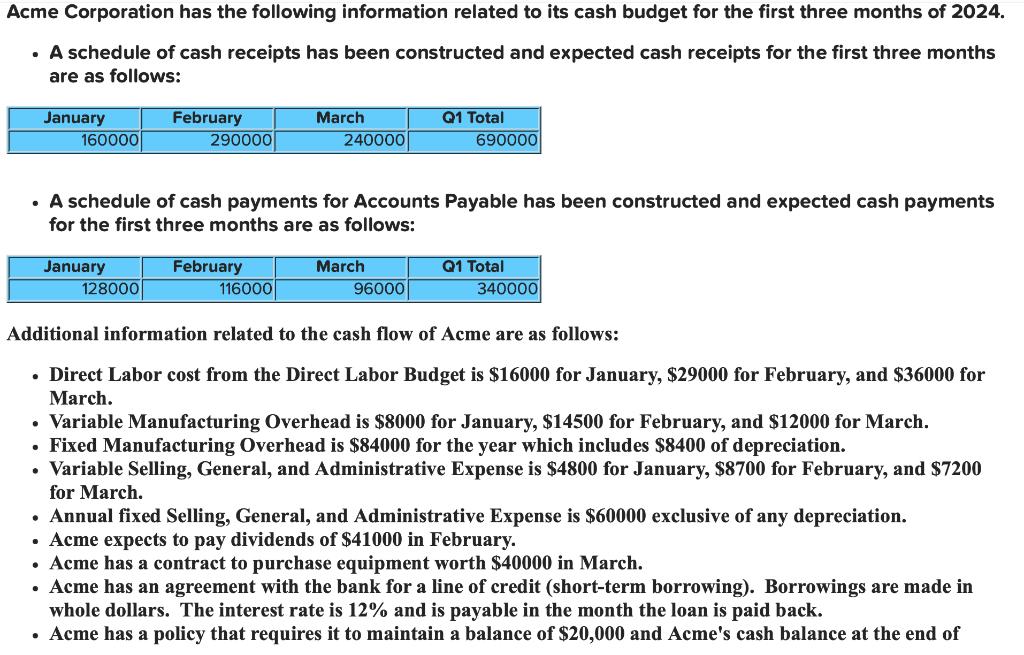

Acme Corporation has the following information related to its cash budget for the first three months of 2024. A schedule of cash receipts has

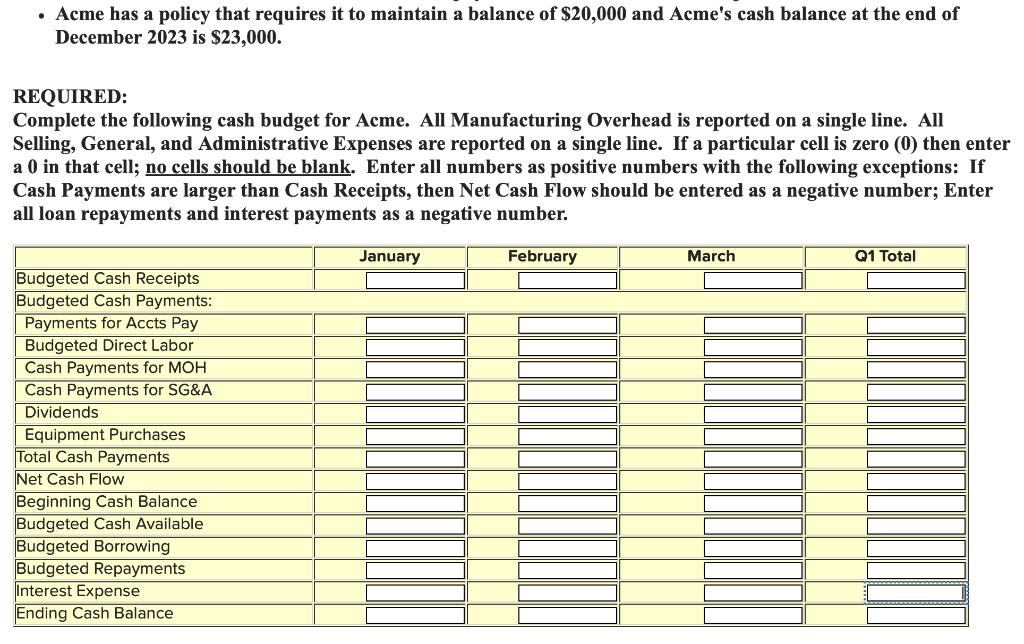

Acme Corporation has the following information related to its cash budget for the first three months of 2024. A schedule of cash receipts has been constructed and expected cash receipts for the first three months are as follows: January 160000 January February 290000 128000 A schedule of cash payments for Accounts Payable has been constructed and expected cash payments for the first three months are as follows: February March 116000 240000 March Q1 Total 690000 96000 Q1 Total 340000 Additional information related to the cash flow of Acme are as follows: Direct Labor cost from the Direct Labor Budget is $16000 for January, $29000 for February, and $36000 for March. Variable Manufacturing Overhead is $8000 for January, $14500 for February, and $12000 for March. Fixed Manufacturing Overhead is $84000 for the year which includes $8400 of depreciation. Variable Selling, General, and Administrative Expense is $4800 for January, $8700 for February, and $7200 for March. Annual fixed Selling, General, and Administrative Expense is $60000 exclusive of any depreciation. Acme expects to pay dividends of $41000 in February. Acme has a contract to purchase equipment worth $40000 in March. Acme has an agreement with the bank for a line of credit (short-term borrowing). Borrowings are made in whole dollars. The interest rate is 12% and is payable in the month the loan is paid back. Acme has a policy that requires it to maintain a balance of $20,000 and Acme's cash balance at the end of Acme has a policy that requires it to maintain a balance of $20,000 and Acme's cash balance at the end of December 2023 is $23,000. REQUIRED: Complete the following cash budget for Acme. All Manufacturing Overhead is reported on a single line. All Selling, General, and Administrative Expenses are reported on a single line. If a particular cell is zero (0) then enter a 0 in that cell; no cells should be blank. Enter all numbers as positive numbers with the following exceptions: If Cash Payments are larger than Cash Receipts, then Net Cash Flow should be entered as a negative number; Enter all loan repayments and interest payments as a negative number. January February Budgeted Cash Receipts Budgeted Cash Payments: Payments for Accts Pay Budgeted Direct Labor Cash Payments for MOH Cash Payments for SG&A Dividends Equipment Purchases Total Cash Payments Net Cash Flow Beginning Cash Balance Budgeted Cash Available Budgeted Borrowing Budgeted Repayments Interest Expense Ending Cash Balance March Q1 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the cash budget for Acme Corporation we need to calculate the values for each month and the cumulative totals Lets go step by step January ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started