Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acme Co's market value of debt is $400,000 and the before-tax cost of Acme's debt is 8%. Acme's shares are trading at $12 per share,

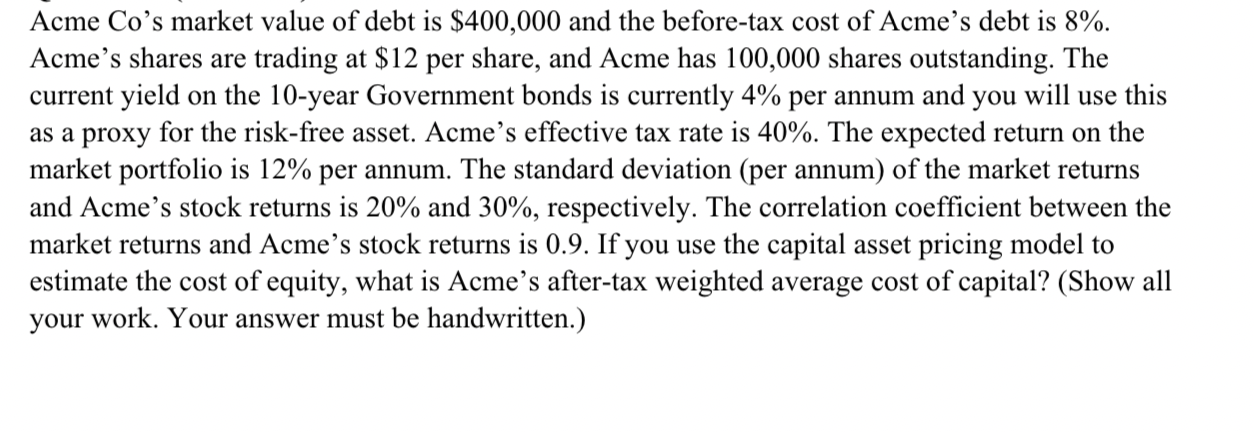

Acme Co's market value of debt is $400,000 and the before-tax cost of Acme's debt is 8%. Acme's shares are trading at $12 per share, and Acme has 100,000 shares outstanding. The current yield on the 10 -year Government bonds is currently 4% per annum and you will use this as a proxy for the risk-free asset. Acme's effective tax rate is 40%. The expected return on the market portfolio is 12% per annum. The standard deviation (per annum) of the market returns and Acme's stock returns is 20% and 30%, respectively. The correlation coefficient between the market returns and Acme's stock returns is 0.9. If you use the capital asset pricing model to estimate the cost of equity, what is Acme's after-tax weighted average cost of capital? (Show all your work. Your answer must be handwritten.)

Acme Co's market value of debt is $400,000 and the before-tax cost of Acme's debt is 8%. Acme's shares are trading at $12 per share, and Acme has 100,000 shares outstanding. The current yield on the 10 -year Government bonds is currently 4% per annum and you will use this as a proxy for the risk-free asset. Acme's effective tax rate is 40%. The expected return on the market portfolio is 12% per annum. The standard deviation (per annum) of the market returns and Acme's stock returns is 20% and 30%, respectively. The correlation coefficient between the market returns and Acme's stock returns is 0.9. If you use the capital asset pricing model to estimate the cost of equity, what is Acme's after-tax weighted average cost of capital? (Show all your work. Your answer must be handwritten.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started