Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acme General Stores is considering a project to open a new store in a rural town. The company will invest cash at the beginning install

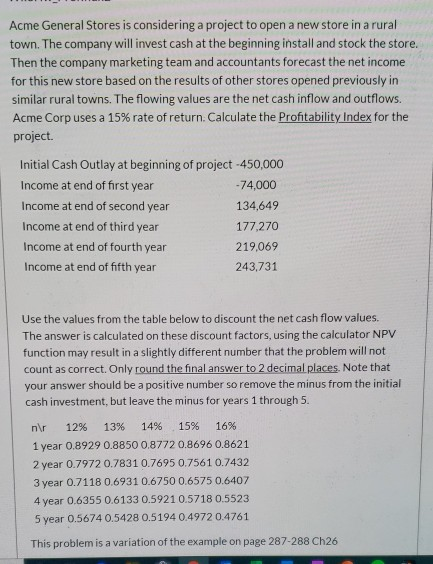

Acme General Stores is considering a project to open a new store in a rural town. The company will invest cash at the beginning install and stock the store. Then the company marketing team and accountants forecast the net income for this new store based on the results of other stores opened previously in similar rural towns. The flowing values are the net cash inflow and outflows. Acme Corp uses a 15% rate of return. Calculate the Profitability Index for the project. Initial Cash Outlay at beginning of project - 450,000 Income at end of first year -74,000 Income at end of second year 134,649 Income at end of third year 177.270 Income at end of fourth year 219,069 Income at end of fifth year 243,731 Use the values from the table below to discount the net cash flow values. The answer is calculated on these discount factors, using the calculator NPV function may result in a slightly different number that the problem will not count as correct. Only round the final answer to 2 decimal places. Note that your answer should be a positive number so remove the minus from the initial cash investment, but leave the minus for years 1 through 5. nr 12% 13% 14% 15% 16% 1 year 0.8929 0.8850 0.8772 0.8696 0.8621 2 year 0.7972 0.7831 0.7695 0.7561 0.7432 3 year 0.7118 0.6931 0.6750 0.6575 0.6407 4 year 0.6355 0.6133 0.5921 0.5718 0.5523 5 year 0.5674 0.5428 0.5194 0.4972 0.4761 This problem is a variation of the example on page 287 288 Ch26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started