Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACME Incorporated's accounting records show the following data for the year ended December 31, 2021: 1. Pre-tax accounting income is $ 300,000. The enacted

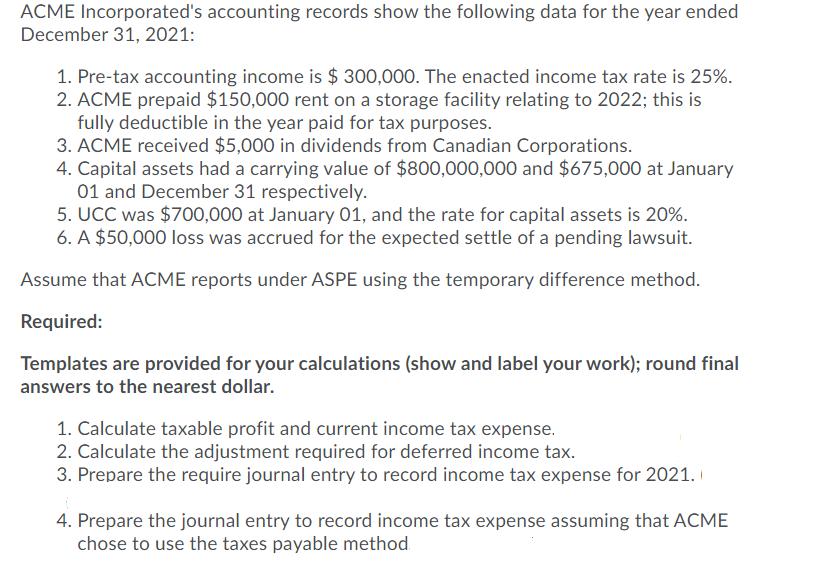

ACME Incorporated's accounting records show the following data for the year ended December 31, 2021: 1. Pre-tax accounting income is $ 300,000. The enacted income tax rate is 25%. 2. ACME prepaid $150,000 rent on a storage facility relating to 2022; this is fully deductible in the year paid for tax purposes. 3. ACME received $5,000 in dividends from Canadian Corporations. 4. Capital assets had a carrying value of $800,000,000 and $675,000 at January 01 and December 31 respectively. 5. UCC was $700,000 at January 01, and the rate for capital assets is 20%. 6. A $50,000 loss was accrued for the expected settle of a pending lawsuit. Assume that ACME reports under ASPE using the temporary difference method. Required: Templates are provided for your calculations (show and label your work); round final answers to the nearest dollar. 1. Calculate taxable profit and current income tax expense. 2. Calculate the adjustment required for deferred income tax. 3. Prepare the require journal entry to record income tax expense for 2021. 4. Prepare the journal entry to record income tax expense assuming that ACME chose to use the taxes payable method

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A Taxable Profit and the Incomet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started