Answered step by step

Verified Expert Solution

Question

1 Approved Answer

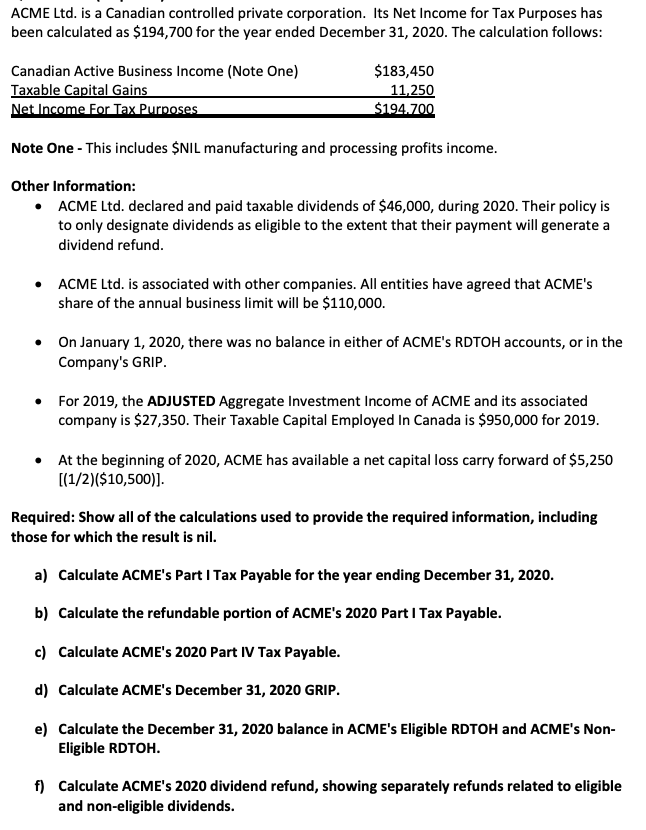

ACME Ltd. is a Canadian controlled private corporation. Its Net Income for Tax Purposes has been calculated as $194,700 for the year ended December

ACME Ltd. is a Canadian controlled private corporation. Its Net Income for Tax Purposes has been calculated as $194,700 for the year ended December 31, 2020. The calculation follows: Canadian Active Business Income (Note One) Taxable Capital Gains Net Income For Tax Purposes $183,450 11,250 $194.700 Note One - This includes $NIL manufacturing and processing profits income. Other Information: ACME Ltd. declared and paid taxable dividends of $46,000, during 2020. Their policy is to only designate dividends as eligible to the extent that their payment will generate a dividend refund. ACME Ltd. is associated with other companies. All entities have agreed that ACME's share of the annual business limit will be $110,000. On January 1, 2020, there was no balance in either of ACME's RDTOH accounts, or in the Company's GRIP. For 2019, the ADJUSTED Aggregate Investment Income of ACME and its associated company is $27,350. Their Taxable Capital Employed In Canada is $950,000 for 2019. At the beginning of 2020, ACME has available a net capital loss carry forward of $5,250 [(1/2)($10,500)]. Required: Show all of the calculations used to provide the required information, including those for which the result is nil. a) Calculate ACME's Part I Tax Payable for the year ending December 31, 2020. b) Calculate the refundable portion of ACME's 2020 Part I Tax Payable. c) Calculate ACME's 2020 Part IV Tax Payable. d) Calculate ACME's December 31, 2020 GRIP. e) Calculate the December 31, 2020 balance in ACME's Eligible RDTOH and ACME's Non- Eligible RDTOH. f) Calculate ACME's 2020 dividend refund, showing separately refunds related to eligible and non-eligible dividends.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate ACMEs Part I Tax Payable for the year ending December 31 2020 we need to determine the federal tax rate and apply it to the taxable income The federal tax rate for Canadian controlled p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started