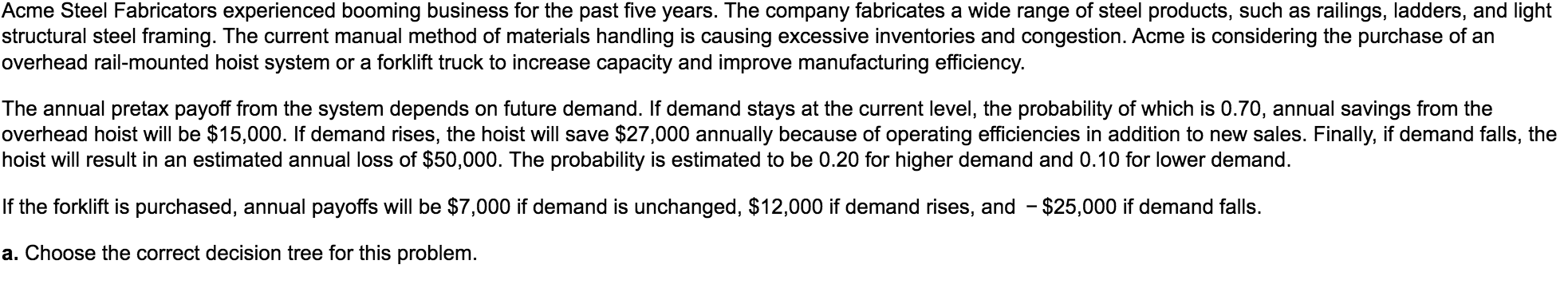

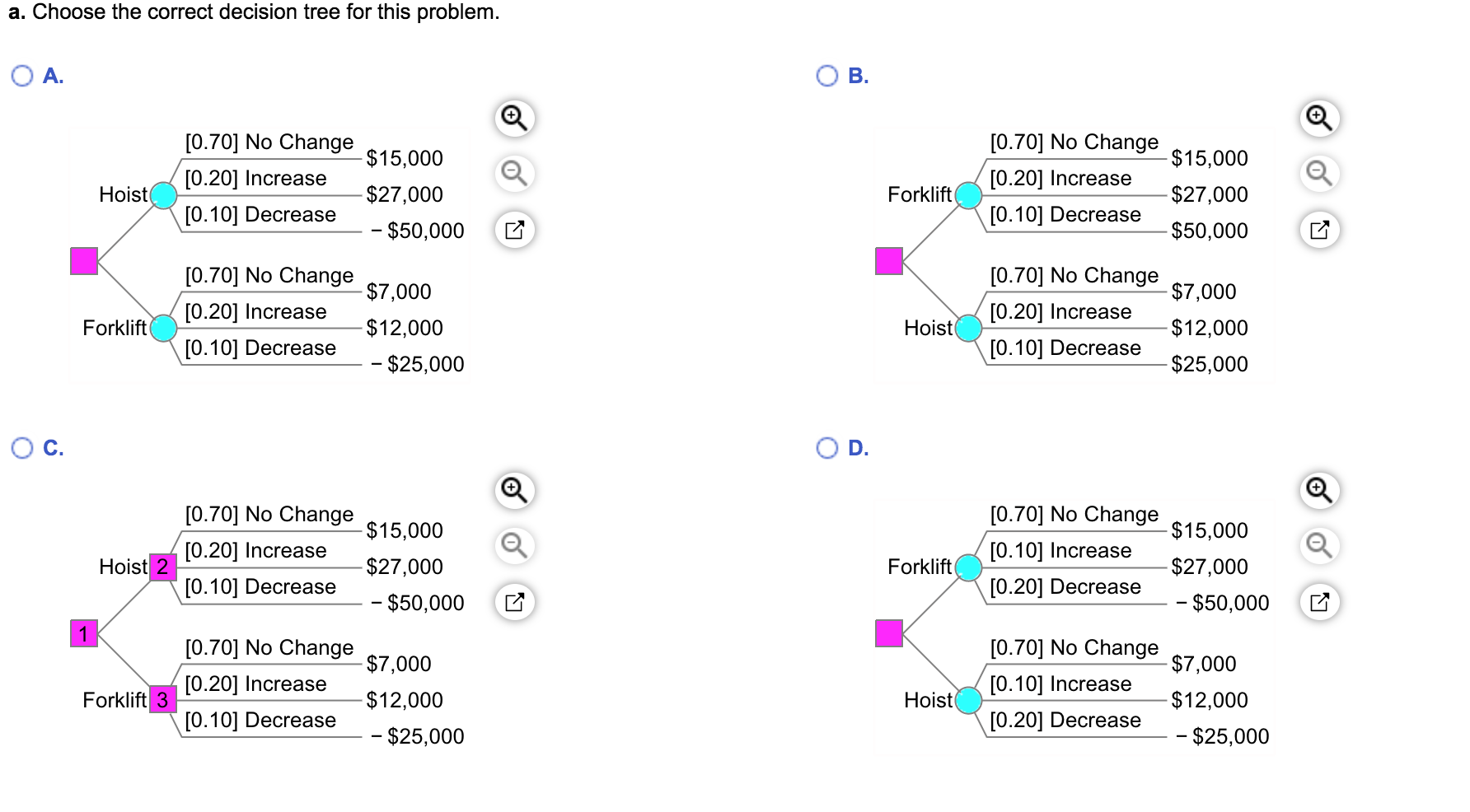

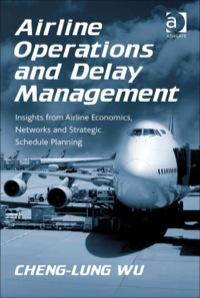

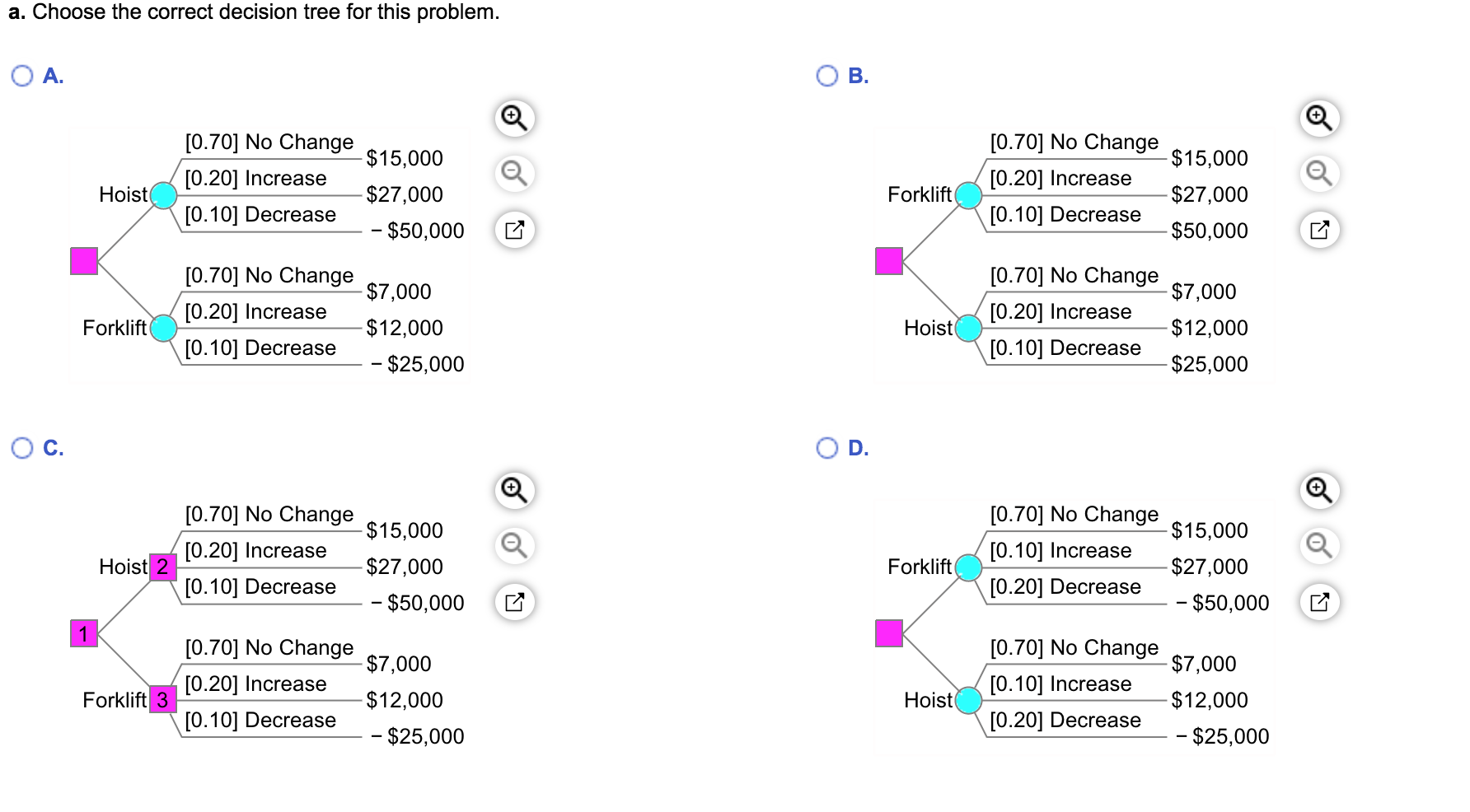

Acme Steel Fabricators experienced booming business for the past five years. The company fabricates a wide range of steel products, such as railings, ladders, and light ttructural steel framing. The current manual method of materials handling is causing excessive inventories and congestion. Acme is considering the purchase of an jverhead rail-mounted hoist system or a forklift truck to increase capacity and improve manufacturing efficiency. The annual pretax payoff from the system depends on future demand. If demand stays at the current level, the probability of which is 0.70 , annual savings from the overhead hoist will be $15,000. If demand rises, the hoist will save $27,000 annually because of operating efficiencies in addition to new sales. Finally, if demand falls, the oist will result in an estimated annual loss of $50,000. The probability is estimated to be 0.20 for higher demand and 0.10 for lower demand. f the forklift is purchased, annual payoffs will be $7,000 if demand is unchanged, $12,000 if demand rises, and - $25,000 if demand falls. Choose the correct decision tree for this problem. a. Choose the correct decision tree for this problem. A. Acme Steel Fabricators experienced booming business for the past five years. The company fabricates a wide range of steel products, such as railings, ladders, and light ttructural steel framing. The current manual method of materials handling is causing excessive inventories and congestion. Acme is considering the purchase of an jverhead rail-mounted hoist system or a forklift truck to increase capacity and improve manufacturing efficiency. The annual pretax payoff from the system depends on future demand. If demand stays at the current level, the probability of which is 0.70 , annual savings from the overhead hoist will be $15,000. If demand rises, the hoist will save $27,000 annually because of operating efficiencies in addition to new sales. Finally, if demand falls, the oist will result in an estimated annual loss of $50,000. The probability is estimated to be 0.20 for higher demand and 0.10 for lower demand. f the forklift is purchased, annual payoffs will be $7,000 if demand is unchanged, $12,000 if demand rises, and - $25,000 if demand falls. Choose the correct decision tree for this problem. a. Choose the correct decision tree for this problem. A