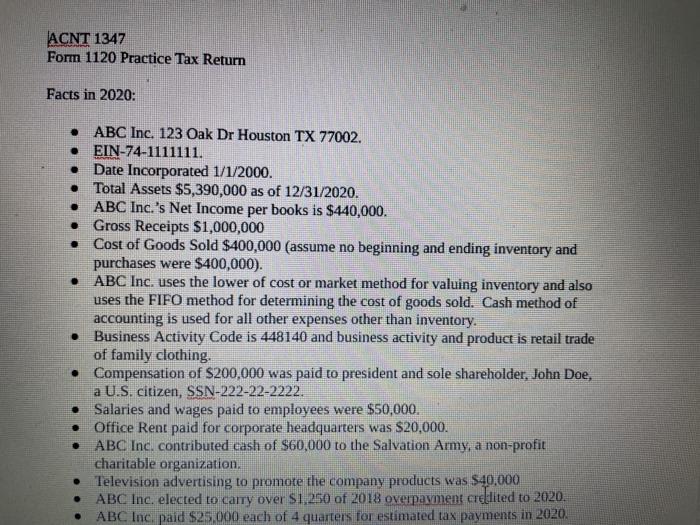

ACNT 1347 Form 1120 Practice Tax Retur Facts in 2020: . ABC Inc. 123 Oak Dr Houston TX 77002. EIN-74-1111111. Date Incorporated 1/1/2000. Total Assets $5,390,000 as of 12/31/2020. ABC Inc.'s Net Income per books is $440,000. Gross Receipts $1,000,000 Cost of Goods Sold $400,000 (assume no beginning and ending inventory and purchases were $400,000). ABC Inc. uses the lower of cost or market method for valuing inventory and also uses the FIFO method for determining the cost of goods sold. Cash method of accounting is used for all other expenses other than inventory. Business Activity Code is 448140 and business activity and product is retail trade of family clothing. Compensation of $200,000 was paid to president and sole shareholder, John Doe, a U.S. citizen, SSN-222-22-2222. Salaries and wages paid to employees were $50,000. Office Rent paid for corporate headquarters was $20,000. ABC Inc, contributed cash of $60,000 to the Salvation Army, a non-profit charitable organization, Television advertising to promote the company products was $40,000 ABC Inc. elected to carry over $1.250 of 2018 overpayment crellited to 2020. ABC Inc. paid $25,000 each of 4 quarters for estimated tax payments in 2020. ACNT 1347 Form 1120 Practice Tax Retur Facts in 2020: . ABC Inc. 123 Oak Dr Houston TX 77002. EIN-74-1111111. Date Incorporated 1/1/2000. Total Assets $5,390,000 as of 12/31/2020. ABC Inc.'s Net Income per books is $440,000. Gross Receipts $1,000,000 Cost of Goods Sold $400,000 (assume no beginning and ending inventory and purchases were $400,000). ABC Inc. uses the lower of cost or market method for valuing inventory and also uses the FIFO method for determining the cost of goods sold. Cash method of accounting is used for all other expenses other than inventory. Business Activity Code is 448140 and business activity and product is retail trade of family clothing. Compensation of $200,000 was paid to president and sole shareholder, John Doe, a U.S. citizen, SSN-222-22-2222. Salaries and wages paid to employees were $50,000. Office Rent paid for corporate headquarters was $20,000. ABC Inc, contributed cash of $60,000 to the Salvation Army, a non-profit charitable organization, Television advertising to promote the company products was $40,000 ABC Inc. elected to carry over $1.250 of 2018 overpayment crellited to 2020. ABC Inc. paid $25,000 each of 4 quarters for estimated tax payments in 2020