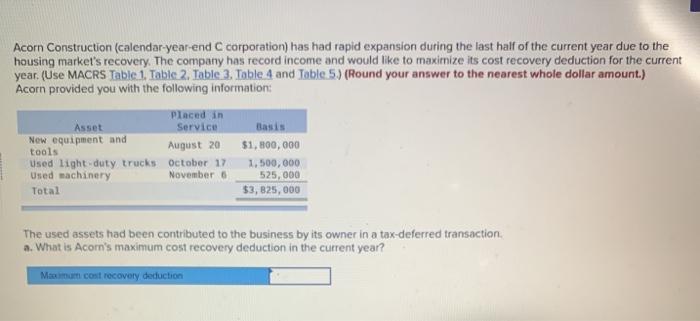

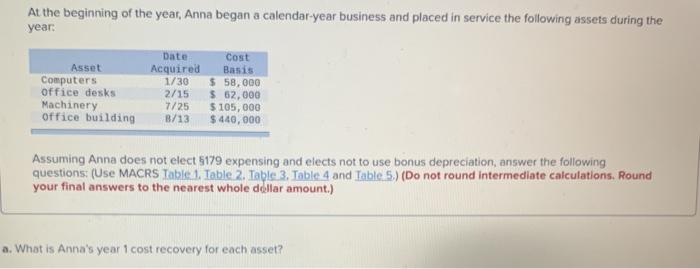

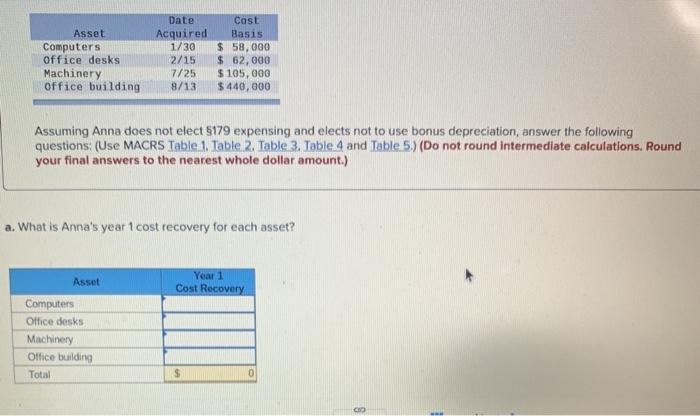

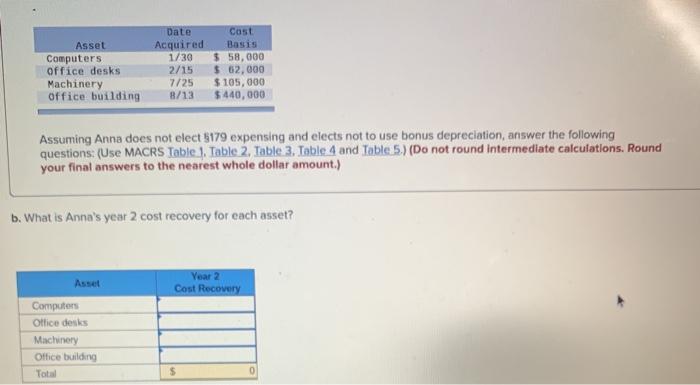

Acorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year . (Use MACRS Table 1. Table 2. Table 3. Toble 4 and Table 5.) (Round your answer to the nearest whole dollar amount.) Acorn provided you with the following information: Placed in Asset Service Basis New equipment and August 20 tools $1,800,000 Used light duty trucks October 17 1,500,000 Used machinery November 525,000 Total $3,025,000 The used assets had been contributed to the business by its owner in a tax-deferred transaction a. What is Acom's maximum cost recovery deduction in the current year? Muum cost recovery deduction At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: : Asset Computers office desks Machinery office building Date Cost Acquired Basis 1/30 $ 58,000 2/15 $ 62,000 7/25 $ 105,000 8/13 $440,000 Assuming Anna does not elect 5179 expensing and elects not to use bonus depreciation, answer the following questions (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table S.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Anna's year 1 cost recovery for each asset? Asset Computers Office desks Machinery office building Date Acquired 1/30 2/15 7/25 8/13 Cost Basis $ 58,000 $ 62,000 $ 105,000 $440,000 Assuming Anna does not elect 5179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) a. What is Anna's year 1 cost recovery for each asset? Asset Year 1 Cost Recovery Computers Office desks Machinery Office building Total $ 0 Asset Computers office desks Machinery office building Date Acquired 1/30 2/15 7/25 8/13 Cast Basis $ 58,000 $ 62,000 $ 105,000 $440,000 Assuming Anna does not elect 5179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) b. What is Anna's year 2 cost recovery for each asset? Year 2 Cost Recovery Computers Otlice desks Machinery Office building Total $