Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acorn Construction Corporation had rapid expansion during the last half of the current year due to the housing recovery. The company has record income and

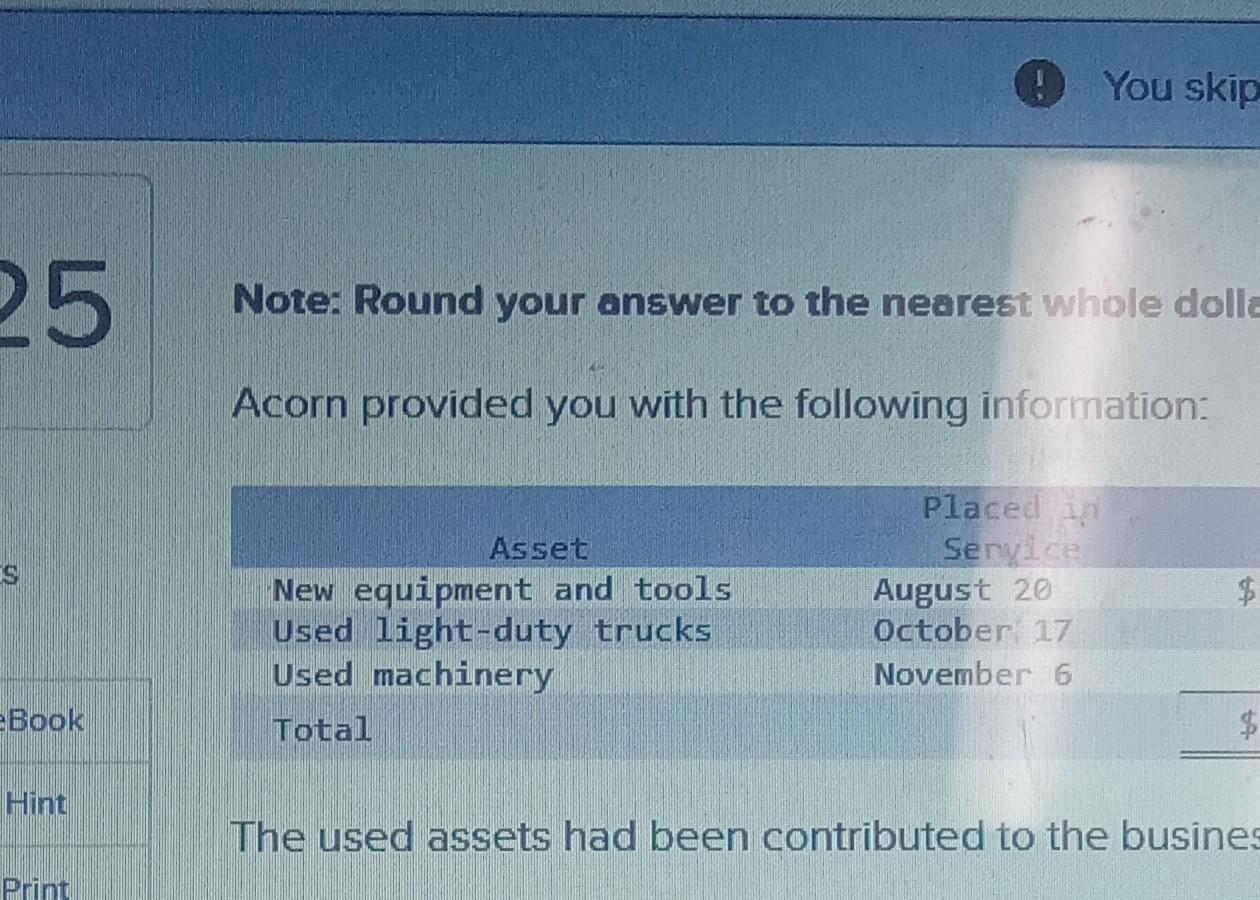

Acorn Construction Corporation had rapid expansion during the last half of the current year due to the housing recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. Use MACRS Table 1 to Table" 5. a. What is Acorn maximum cost recovery deduction in the current year.

Note: Round your answer to the nearest whole doll Acorn provided you with the following information: The used assets had been contributed to the busine Note: Round your answer to the nearest whole doll Acorn provided you with the following information: The used assets had been contributed to the busine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started