Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acort Industries owns assets that will have a market value of $44 million in one year. The current risk-free rate is 5%, and Acort's

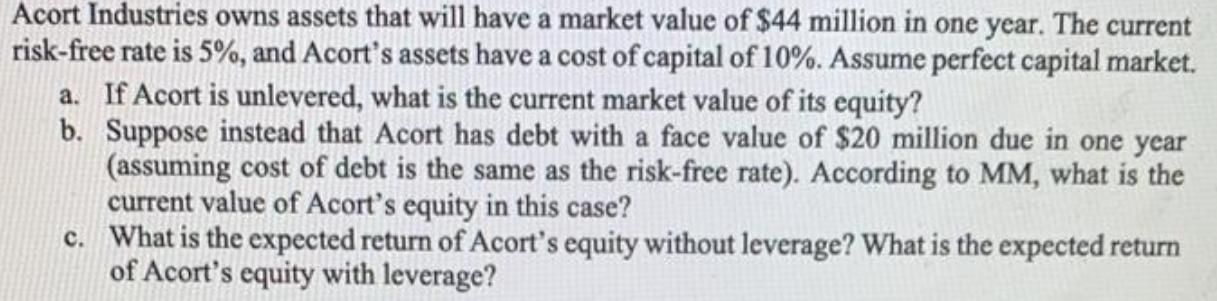

Acort Industries owns assets that will have a market value of $44 million in one year. The current risk-free rate is 5%, and Acort's assets have a cost of capital of 10%. Assume perfect capital market. a. If Acort is unlevered, what is the current market value of its equity? b. Suppose instead that Acort has debt with a face value of $20 million due in one year (assuming cost of debt is the same as the risk-free rate). According to MM, what is the current value of Acort's equity in this case? c. What is the expected return of Acort's equity without leverage? What is the expected return of Acort's equity with leverage?

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected return of Acorts equity with leverage we need to first calculate the lev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started