Question

ACQ agrees to acquire TGT in a stock and cash deal valued at $17ishare, or $5B including the assumption of debt. The deal consists

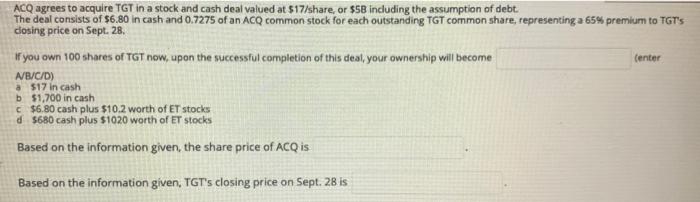

ACQ agrees to acquire TGT in a stock and cash deal valued at $17ishare, or $5B including the assumption of debt. The deal consists of $6.80 in cash and 0.7275 of an ACQ common stock for each outstanding TGT common share, representing a 65% premium to TGT's closing price on Sept. 28. If you own 100 shares of TGT now, upon the successful completion of this deal, your ownership will become (enter A/B/C/D) a $17 in cash b $1,700 in cash c $6.80 cash plus $10.2 worth of ET stocks d $680 cash plus $1020 worth of ET stocks Based on the information given, the share price of ACQ is Based on the information given, TGT's closing price on Sept. 28 is

Step by Step Solution

3.42 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Amounts are in 1 Deal for consideration is 17share Of which ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of corporate finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

2nd Edition

978-0470933268, 470933267, 470876441, 978-0470876442

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App