Question

Acquired $550,000 by signing a note payable with a local bank Sold 25,000 shares of $22 Common Stock for $1,500,000 Purchased Equipment for $300,000 Purchased

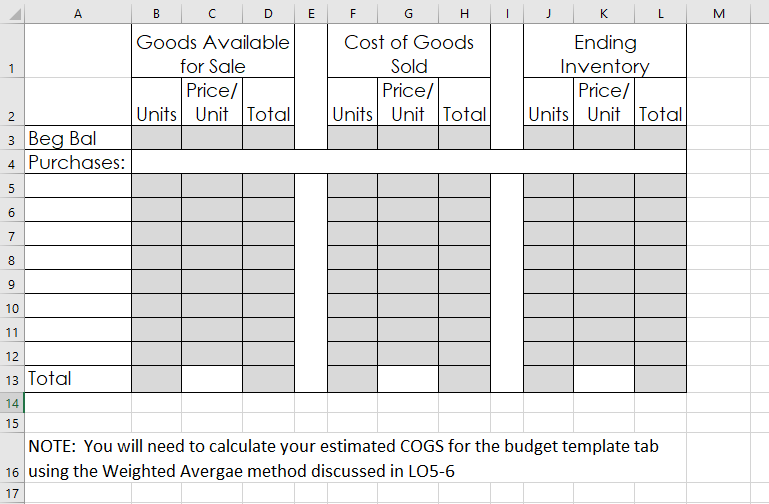

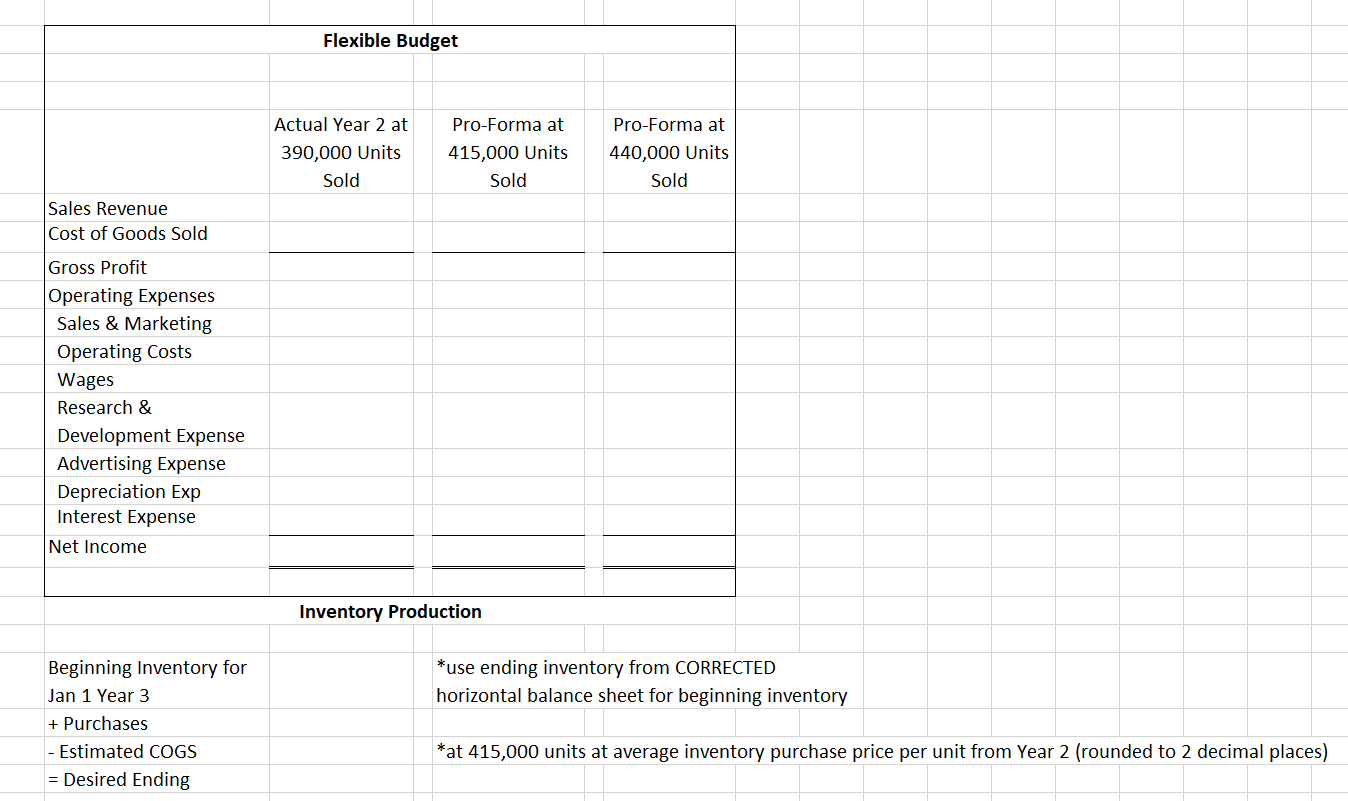

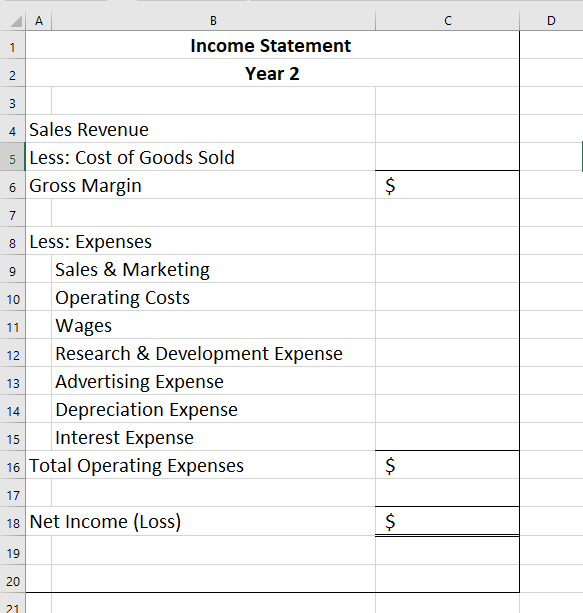

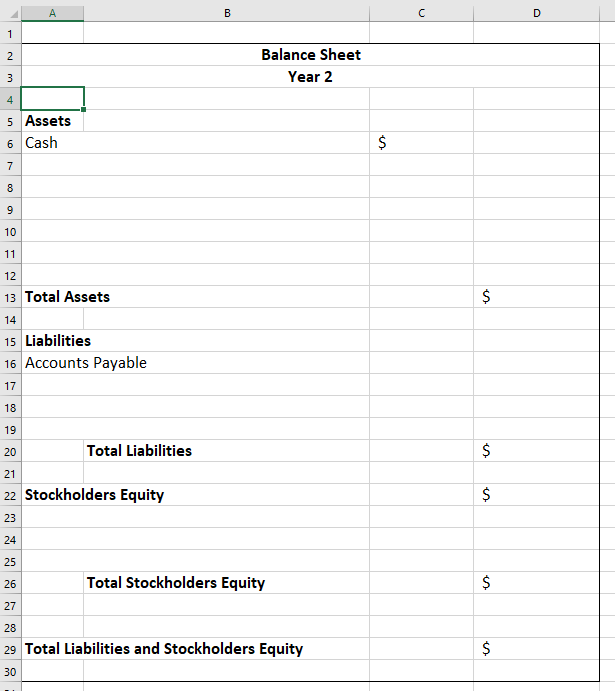

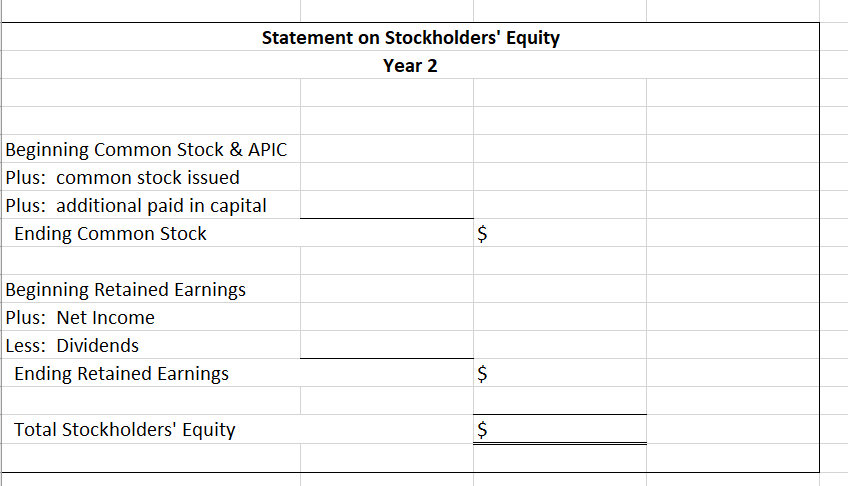

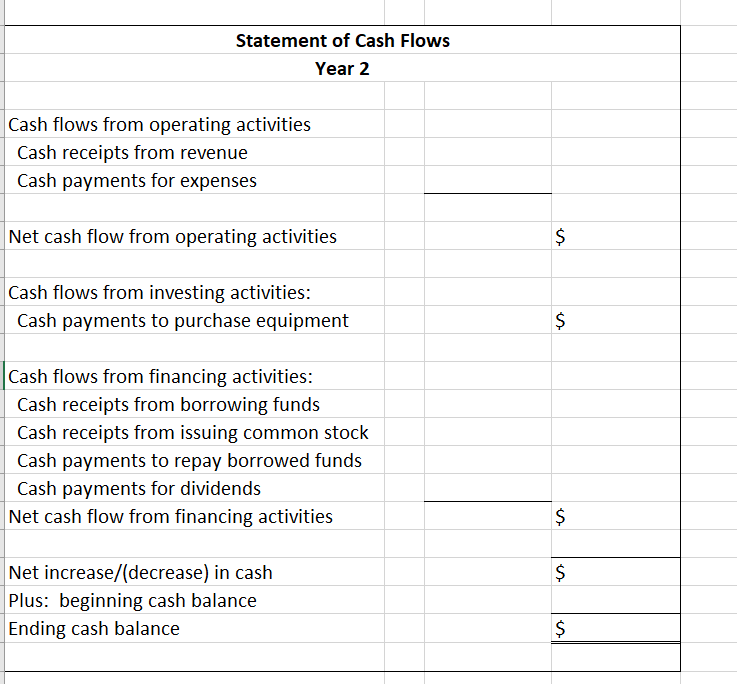

Acquired $550,000 by signing a note payable with a local bank Sold 25,000 shares of $22 Common Stock for $1,500,000 Purchased Equipment for $300,000 Purchased Inventory on Account - 25,000 Units at $1.15 per unit Sold 15,000 units at $3.50 on Account Record COGS for Sales on Account Collect $70,000 on Account Paid $117,250 of Accounts Payable Purchased Inventory on Account - 170,000 Units at $1.50 per unit Sold 175,000 units at $3.50 on Account Record COGS for Sales on Account Collect $472,500 on Account Paid $218,600 of Accounts Payable Purchased Inventory on Account - 275,000 Units at $1.35 per unit Sold 200,000 units at $3.50 on Account Record COGS for Sales on Account Collect $735,000 on Account Purchased Inventory on Account - 300,000 Units at $1.15 per unit Paid $494,150 of Accounts Payable Paid Sales & Marketing Expenses of $30,000 Paid Operating Expenses of $75,708 Record Wages Payable of $40,000 Paid Product Line Research & Development Expenses of $150,000 Paid Advertising Expenses of $87,500 Made the yearly required payment on the note payable. The note carries a 7% interest rate and requires payments of $50,000 plus interest each December 31. Record first year of depreciation expense on equipment purchased in Year 2 with salvage value of $38,000 & useful life of 7 Yrs Declared a $10,000 cash dividend for stockholders Paid a $10,000 cash dividend for stockholders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started