Answered step by step

Verified Expert Solution

Question

1 Approved Answer

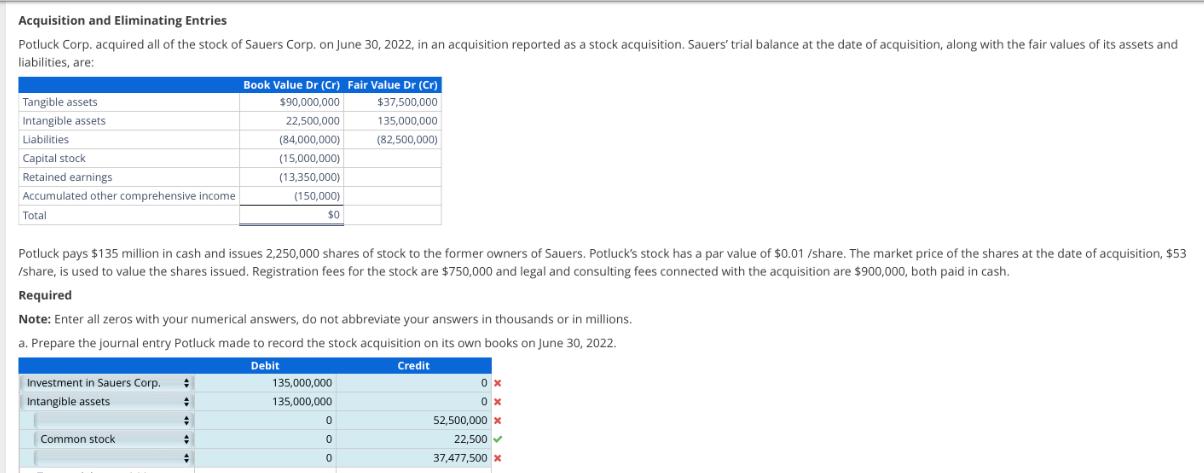

Acquisition and Eliminating Entries Potluck Corp. acquired all of the stock of Sauers Corp. on June 30, 2022, in an acquisition reported as a

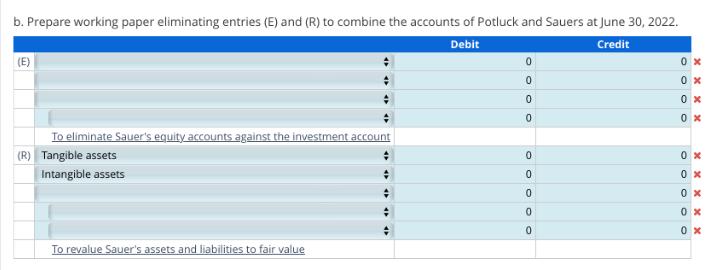

Acquisition and Eliminating Entries Potluck Corp. acquired all of the stock of Sauers Corp. on June 30, 2022, in an acquisition reported as a stock acquisition. Sauers' trial balance at the date of acquisition, along with the fair values of its assets and liabilities, are: Tangible assets Book Value Dr (Cr) Fair Value Dr (Cr) Intangible assets Liabilities Capital stock $90,000,000 22,500,000 (84,000,000) $37,500,000 135,000,000 (82,500,000) (15,000,000) Retained earnings (13,350,000) Accumulated other comprehensive income Total (150,000) $0 Potluck pays $135 million in cash and issues 2,250,000 shares of stock to the former owners of Sauers. Potluck's stock has a par value of $0.01 /share. The market price of the shares at the date of acquisition, $53 /share, is used to value the shares issued. Registration fees for the stock are $750,000 and legal and consulting fees connected with the acquisition are $900,000, both paid in cash. Required Note: Enter all zeros with your numerical answers, do not abbreviate your answers in thousands or in millions. a. Prepare the journal entry Potluck made to record the stock acquisition on its own books on June 30, 2022. Investment in Sauers Corp. Intangible assets Common stock Debit Credit 135,000,000 135,000,000 0 x 0 x 0 52,500,000 x 0 22,500 0 37,477,500 x b. Prepare working paper eliminating entries (E) and (R) to combine the accounts of Potluck and Sauers at June 30, 2022. Debit Credit (E) 0 0 0 0 0 x 0 x 0 x 0 x To eliminate Sauer's equity accounts against the investment account (R) Tangible assets 0 0 x Intangible assets 0 0 x 0 0 x 0 0 x 0 0 x To revalue Sauer's assets and liabilities to fair value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started