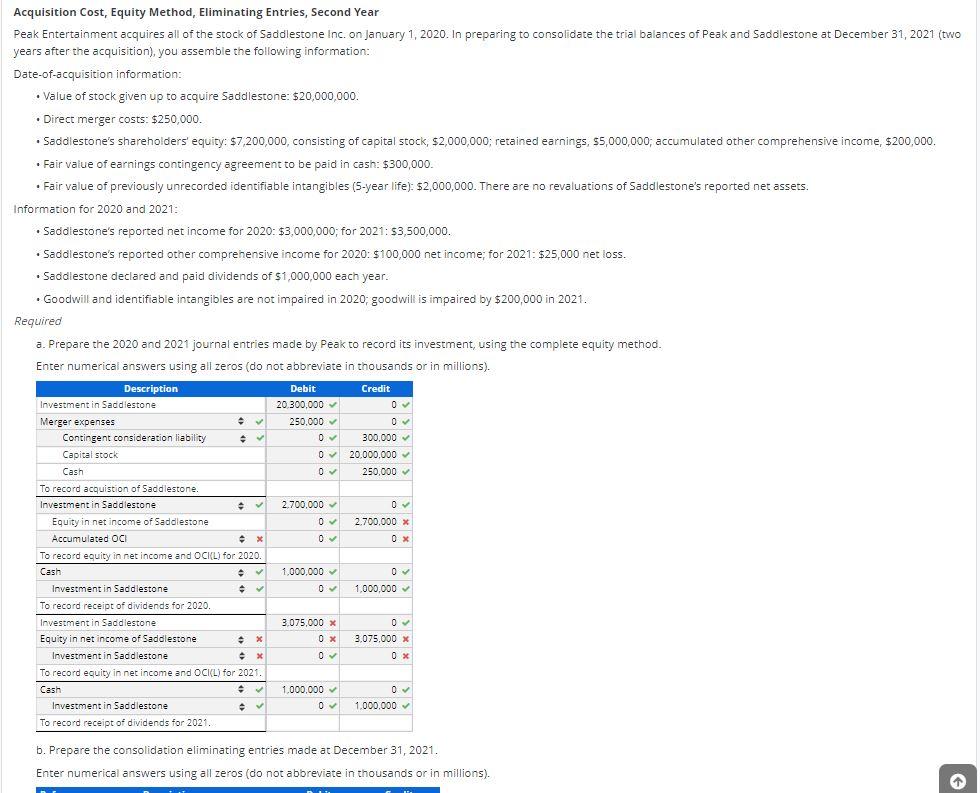

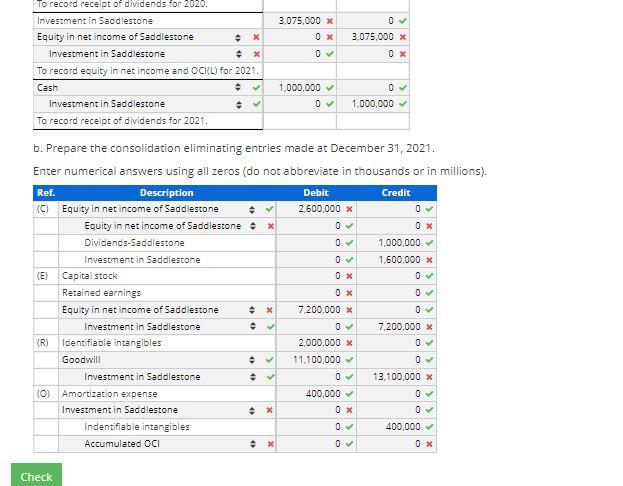

. . . . . . Acquisition Cost, Equity Method, Eliminating Entries, Second Year Peak Entertainment acquires all of the stock of Saddlestone Inc. on January 1, 2020. In preparing to consolidate the trial balances of Peak and Saddlestone at December 31, 2021 (two years after the acquisition), you assemble the following information: Date-of-acquisition information: Value of stock given up to acquire Saddlestone: $20,000,000. Direct merger costs: $250,000. Saddlestone's shareholders' equity: $7,200,000, consisting of capital stock, $2,000,000; retained earnings, 55,000,000; accumulated other comprehensive income, $200,000. Fair value of earnings contingency agreement to be paid in cash: $300,000. . Fair value of previously unrecorded identifiable intangibles (5-year life): $2,000,000. There are no revaluations of Saddlestone's reported net assets. Information for 2020 and 2021: Saddlestone's reported net income for 2020: $3,000,000; for 2021: $3,500,000. Saddlestone's reported other comprehensive income for 2020: $100,000 net income for 2021: $25,000 net loss. Saddlestone declared and paid dividends of $1,000,000 each year. . Goodwill and identifiable intangibles are not impaired in 2020, goodwill is impaired by $200,000 in 2021. Required a. Prepare the 2020 and 2021 journal entries made by Peak to record its investment, using the complete equity method. Enter numerical answers using all zeros (do not abbreviate in thousands or in millions). Description Debit Credit Investment in Saddlestone 20.300,000 0 Merger expenses 250,000 0 Contingent consideration liability 0 300.000 Capital stock 0 20.000.000 Cash 0 250,000 To record acquistion of Saddlestone Investment in Saddlestone 2.700.000 0 Equity in net income of Saddlestone 0 2.700.000 X Accumulated OCI + X 0 0X To record equity in net income and OCKL) for 2020 Cash a 1,000,000 Investment in Saddlestone 1,000,000 To record receipt of dividends for 2020. , Investment in Saddlestone 3,075,000 x 0 Equity in net income of Saddlestone X 0X 3.075.000 x Investment in Saddlestone X 0 0 % To record equity in net income and OCICL) for 2021. Cash + 1,000,000 0 Investment in Saddlestone 0 1.000.000 To record receipt of dividends for 2021. b. Prepare the consolidation eliminating entries made at December 31, 2021. Enter numerical answers using all zeros (do not abbreviate in thousands or in millions). 3.075,000 x OX 3.075.000 x To record receipt of dividends for 2020. Investment in Saddlestone Equity in net income of Saddlestone X Investment in Saddlestone To record equity in net income and OCKL) for 2021. Cash Investment in Saddlestone To record receipt of dividends for 2021. 1,000,000 0 1,000,000 m b. Prepare the consolidation eliminating entries made at December 31, 2021. Enter numerical answers using all zeros (do not abbreviate in thousands or in millions). Ref. Description Debit Credit (C) Equity in net income of Saddlestone 2.600.000 x Equity in net income of Saddlestone x 0 0 X Dividends-Saddlestone 0 1,000,000 Investment in Saddlestone 0 1,600.000 X Capital stock 0 % 0 Retained earnings Equity in net income of Saddlestone X 7.200.000 X 0 Investment in Saddlestone 0 7.200.000 X KR) Identifiable intangibles 2.000.000 x 0 Goodwill 11,100,000 0 Investment in Saddlestone 13,100,000 X (0) Amortization expense 400,000 0 Investment in Saddlestone x 0 X 0 Indentifiable intangibles 0 400,000 Accumulated OCI 0 % ( 4) Check