Question

Acquisition : In June 2020, analysts at Citibank proposed a mega acquisition deal where FMG can take over South 32 (S32:ASX) at a price of

Acquisition: In June 2020, analysts at Citibank proposed a mega acquisition deal where FMG can take over South 32 (S32:ASX) at a price of $2.68 a share which implies a valuation of $12.4 billion, or a 30% premium, for South32. Citi also suggests that the deal will be settled by 40% cash and 60% equity.

Question: Identify the potential sources of synergies in the proposed acquisition ie. Where do the expected synergies (increases in value) come from? (needs calculation, *clearly highlight the expected synergies from the acquision)

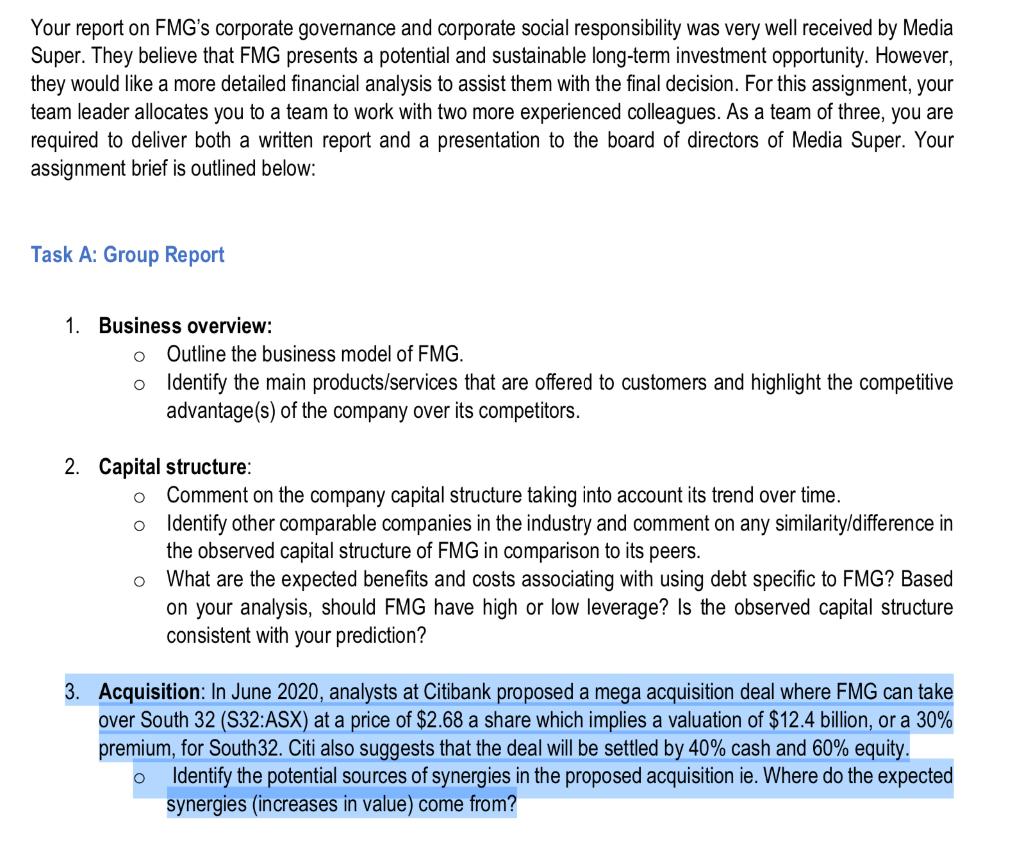

Your report on FMG's corporate governance and corporate social responsibility was very well received by Media Super. They believe that FMG presents a potential and sustainable long-term investment opportunity. However, they would like a more detailed financial analysis to assist them with the final decision. For this assignment, your team leader allocates you to a team to work with two more experienced colleagues. As a team of three, you are required to deliver both a written report and a presentation to the board of directors of Media Super. Your assignment brief is outlined below: Task A: Group Report 1. Business overview: O Outline the business model of FMG. o Identify the main products/services that are offered to customers and highlight the competitive advantage(s) of the company over its competitors. 2. Capital structure: O Comment on the company capital structure taking into account its trend over time. o Identify other comparable companies in the industry and comment on any similarity/difference in the observed capital structure of FMG in comparison to its peers. What are the expected benefits and costs associating with using debt specific to FMG? Based on your analysis, should FMG have high or low leverage? Is the observed capital structure consistent with your prediction? 3. Acquisition: In June 2020, analysts at Citibank proposed a mega acquisition deal where FMG can take over South 32 (S32:ASX) at a price of $2.68 a share which implies a valuation of $12.4 billion, or a 30% premium, for South32. Citi also suggests that the deal will be settled by 40% cash and 60% equity. O Identify the potential sources of synergies in the proposed acquisition ie. Where do the expected synergies (increases in value) come from?

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER POTENTIAL SOURCES OF SYNERGIES 1 MARKETING SYNERGY This synergy leads to decrease in marketin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started