Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Acrobat you Brighton, Inc. is currently a C corporation. Brighton has 10 shareholders and has substantial amounts in retained earnings from previous years. Brighton's

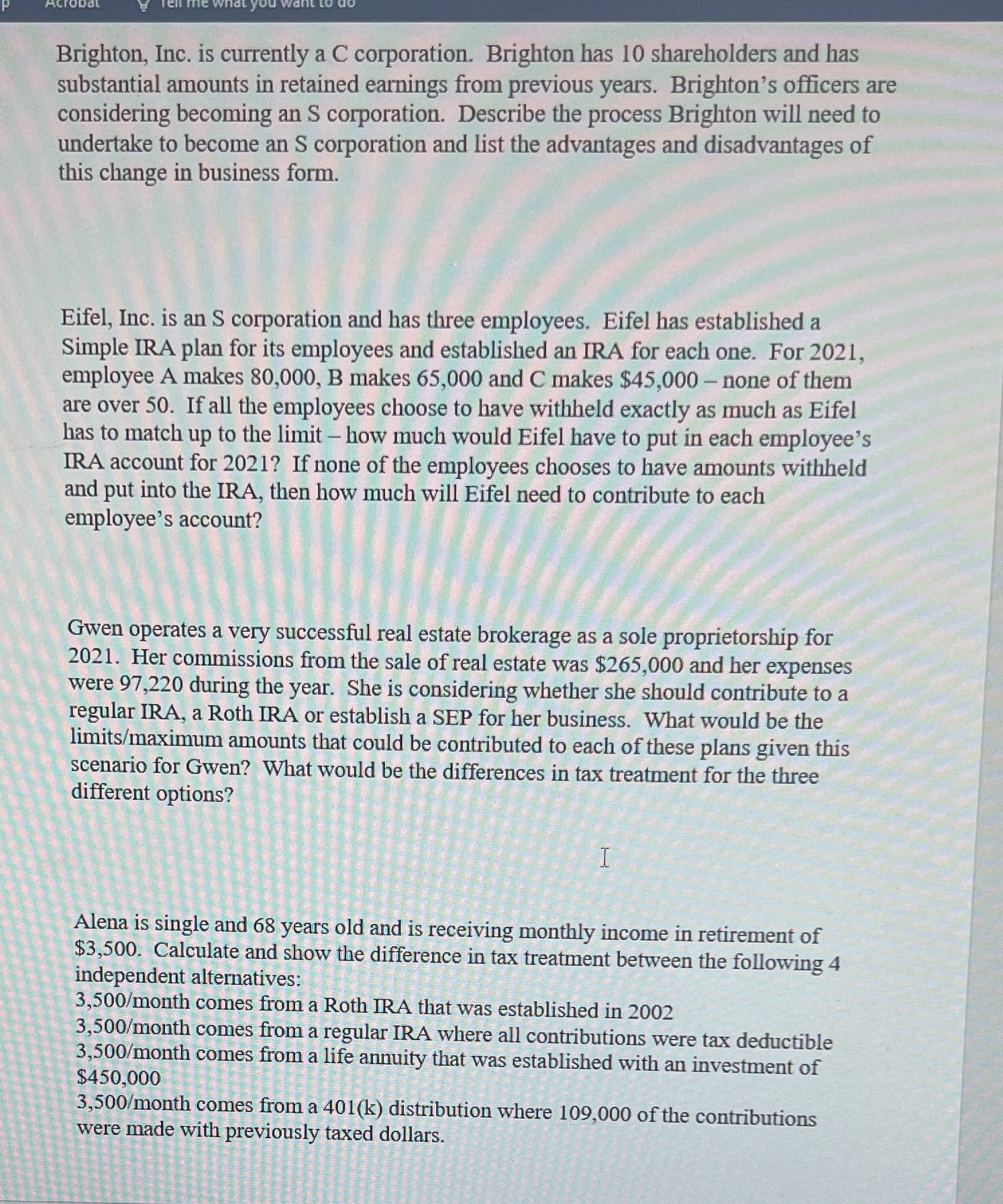

Acrobat you Brighton, Inc. is currently a C corporation. Brighton has 10 shareholders and has substantial amounts in retained earnings from previous years. Brighton's officers are considering becoming an S corporation. Describe the process Brighton will need to undertake to become an S corporation and list the advantages and disadvantages of this change in business form. Eifel, Inc. is an S corporation and has three employees. Eifel has established a Simple IRA plan for its employees and established an IRA for each one. For 2021, employee A makes 80,000, B makes 65,000 and C makes $45,000 - none of them are over 50. If all the employees choose to have withheld exactly as much as Eifel has to match up to the limit - how much would Eifel have to put in each employee's IRA account for 2021? If none of the employees chooses to have amounts withheld and put into the IRA, then how much will Eifel need to contribute to each employee's account? Gwen operates a very successful real estate brokerage as a sole proprietorship for 2021. Her commissions from the sale of real estate was $265,000 and her expenses were 97,220 during the year. She is considering whether she should contribute to a regular IRA, a Roth IRA or establish a SEP for her business. What would be the limits/maximum amounts that could be contributed to each of these plans given this scenario for Gwen? What would be the differences in tax treatment for the three different options? I Alena is single and 68 years old and is receiving monthly income in retirement of $3,500. Calculate and show the difference in tax treatment between the following 4 independent alternatives: 3,500/month comes from a Roth IRA that was established in 2002 3,500/month comes from a regular IRA where all contributions were tax deductible 3,500/month comes from a life annuity that was established with an investment of $450,000 3,500/month comes from a 401(k) distribution where 109,000 of the contributions were made with previously taxed dollars.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To become an S corporation Brighton Inc will need to undertake the following process Determine if they are eligible Brighton must meet the requireme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started