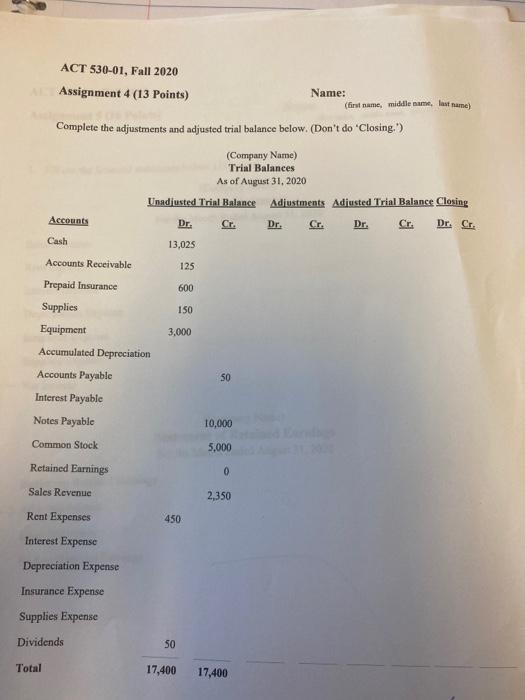

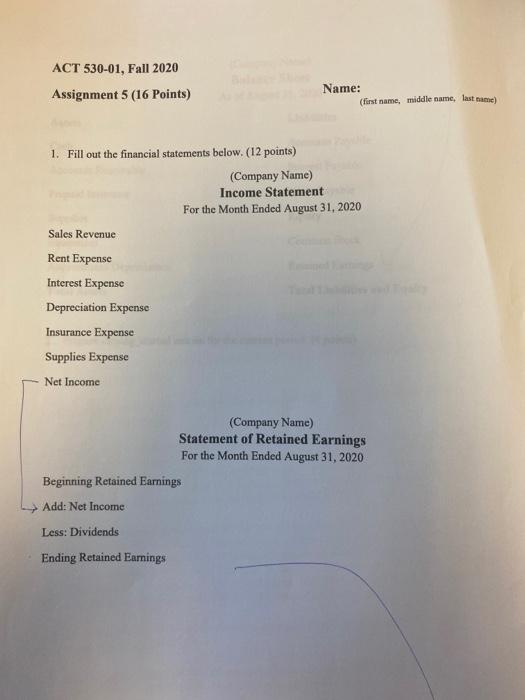

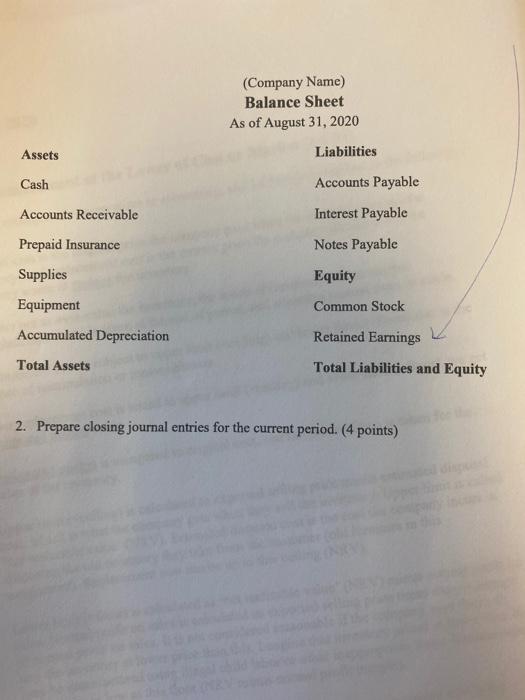

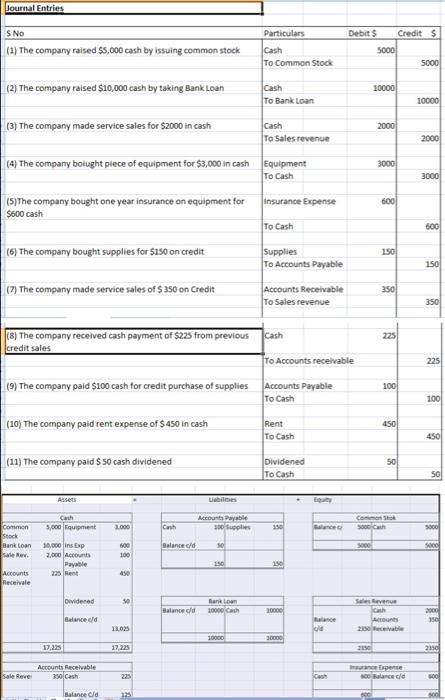

ACT 530-01, Fall 2020 Assignment 4 (13 Points) Name: (first name, middle name, last name) Complete the adjustments and adjusted trial balance below. (Don't do "Closing.) (Company Name) Trial Balances As of August 31, 2020 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Closing Dr. Dr. Cr. Dr. Cr 13,025 Accounts Dr. Cash Accounts Receivable 125 600 150 3,000 Prepaid Insurance Supplies Equipment Accumulated Depreciation Accounts Payable Interest Payable Notes Payable Common Stock 50 10,000 5,000 Retained Earnings 0 Sales Revenue 2,350 450 Rent Expenses Interest Expense Depreciation Expense Insurance Expense Supplies Expense Dividends 50 Total 17,400 17,400 ACT 530-01, Fall 2020 Assignment 5 (16 Points) Name: (first name, middle name, last name) 1. Fill out the financial statements below. (12 points) (Company Name) Income Statement For the Month Ended August 31, 2020 Sales Revenue Rent Expense Interest Expense Depreciation Expense Insurance Expense Supplies Expense Net Income (Company Name) Statement of Retained Earnings For the Month Ended August 31, 2020 Beginning Retained Earnings Add: Net Income Less: Dividends Ending Retained Earnings (Company Name) Balance Sheet As of August 31, 2020 Assets Liabilities Cash Accounts Payable Interest Payable Notes Payable Accounts Receivable Prepaid Insurance Supplies Equipment Accumulated Depreciation Total Assets Equity Common Stock Retained Earnings Total Liabilities and Equity 2. Prepare closing journal entries for the current period. (4 points) Journal Entries Particulars S No (1) The company raised $5,000 cash by issuing common stock Cash To Common Stock Debit $ Credits 5000 5000 (2) The company raised $10,000 cash by taking Bank Loan 10000 Cash To Bank Loan 10000 (3) The company made service sales for $2000 in cash 2000 Cash To Sales revenue 2000 (4) The company bolught piece of equipment for $3,000 in cash 3000 Equipment To Cash 3000 (5)The company bought one year insurance on equipment for $600 cash Insurance Expense 600 To Cash 600 (6) The company bought supplies for $150 on credit 150 Supplies To Accounts Payable 150 (7) The company made service sales of $ 350 on Credit 350 Accounts Receivable To Sales revenue 350 (8) The company received cash payment of $225 from previous Cash 225 credit sales To Accounts receivable 225 (9) The company paid $100 cash for credit purchase of supplies 100 Accounts Payable To Cash 100 (10) The company paid rent expense of $ 450 in cash 450 Rent To Cash 450 (11) The company paid $50 cash dividened 50 Dividened To Cash 50 Assets Como Common Cath 5.000 quiment 1000 Cash Acabile 300 Supplies Bank loan Balanced SO 5000 500 100 10.000 ins Exp 2.000 Accounts Payable 225 Rent 130 Accounts Receivale Dividend Seven Benton 10000 Balanced 30000 2000 150 Balanced A 11025 1000D 17,225 17.225 2350 Accounts Receivable 350 Cash brance Esperse w Balanced Sale Reve Balanced 125 500 ACT 530-01, Fall 2020 Assignment 4 (13 Points) Name: (first name, middle name, last name) Complete the adjustments and adjusted trial balance below. (Don't do "Closing.) (Company Name) Trial Balances As of August 31, 2020 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Closing Dr. Dr. Cr. Dr. Cr 13,025 Accounts Dr. Cash Accounts Receivable 125 600 150 3,000 Prepaid Insurance Supplies Equipment Accumulated Depreciation Accounts Payable Interest Payable Notes Payable Common Stock 50 10,000 5,000 Retained Earnings 0 Sales Revenue 2,350 450 Rent Expenses Interest Expense Depreciation Expense Insurance Expense Supplies Expense Dividends 50 Total 17,400 17,400 ACT 530-01, Fall 2020 Assignment 5 (16 Points) Name: (first name, middle name, last name) 1. Fill out the financial statements below. (12 points) (Company Name) Income Statement For the Month Ended August 31, 2020 Sales Revenue Rent Expense Interest Expense Depreciation Expense Insurance Expense Supplies Expense Net Income (Company Name) Statement of Retained Earnings For the Month Ended August 31, 2020 Beginning Retained Earnings Add: Net Income Less: Dividends Ending Retained Earnings (Company Name) Balance Sheet As of August 31, 2020 Assets Liabilities Cash Accounts Payable Interest Payable Notes Payable Accounts Receivable Prepaid Insurance Supplies Equipment Accumulated Depreciation Total Assets Equity Common Stock Retained Earnings Total Liabilities and Equity 2. Prepare closing journal entries for the current period. (4 points) Journal Entries Particulars S No (1) The company raised $5,000 cash by issuing common stock Cash To Common Stock Debit $ Credits 5000 5000 (2) The company raised $10,000 cash by taking Bank Loan 10000 Cash To Bank Loan 10000 (3) The company made service sales for $2000 in cash 2000 Cash To Sales revenue 2000 (4) The company bolught piece of equipment for $3,000 in cash 3000 Equipment To Cash 3000 (5)The company bought one year insurance on equipment for $600 cash Insurance Expense 600 To Cash 600 (6) The company bought supplies for $150 on credit 150 Supplies To Accounts Payable 150 (7) The company made service sales of $ 350 on Credit 350 Accounts Receivable To Sales revenue 350 (8) The company received cash payment of $225 from previous Cash 225 credit sales To Accounts receivable 225 (9) The company paid $100 cash for credit purchase of supplies 100 Accounts Payable To Cash 100 (10) The company paid rent expense of $ 450 in cash 450 Rent To Cash 450 (11) The company paid $50 cash dividened 50 Dividened To Cash 50 Assets Como Common Cath 5.000 quiment 1000 Cash Acabile 300 Supplies Bank loan Balanced SO 5000 500 100 10.000 ins Exp 2.000 Accounts Payable 225 Rent 130 Accounts Receivale Dividend Seven Benton 10000 Balanced 30000 2000 150 Balanced A 11025 1000D 17,225 17.225 2350 Accounts Receivable 350 Cash brance Esperse w Balanced Sale Reve Balanced 125 500