Answered step by step

Verified Expert Solution

Question

1 Approved Answer

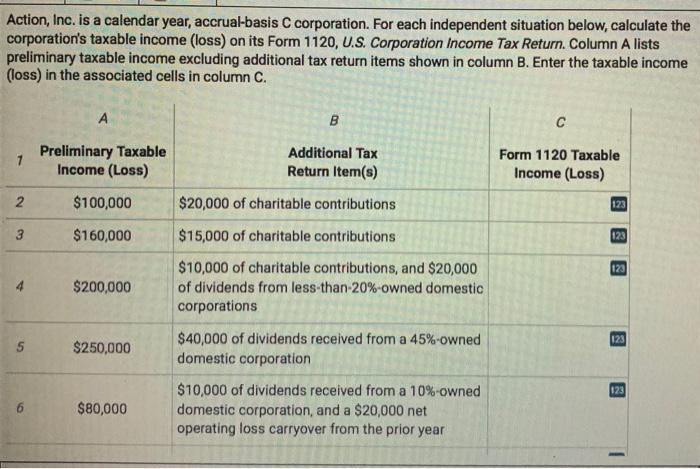

Action, Inc. is a calendar year, accrual-basis C corporation. For each independent situation below, calculate the corporation's taxable income (loss) on its Form 1120,

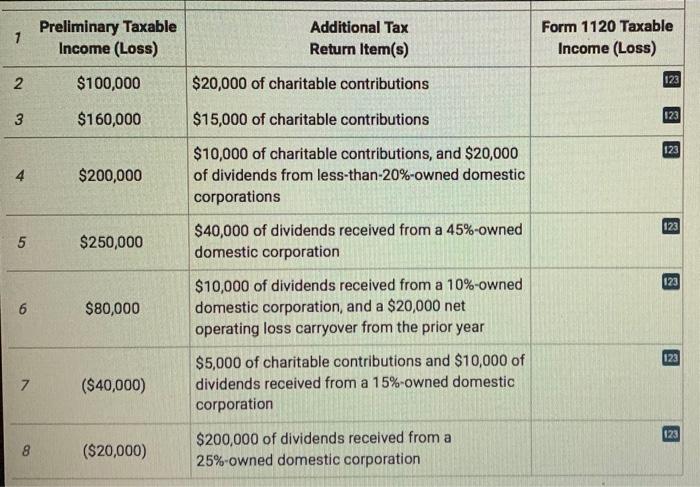

Action, Inc. is a calendar year, accrual-basis C corporation. For each independent situation below, calculate the corporation's taxable income (loss) on its Form 1120, U.S. Corporation Income Tax Return. Column A lists preliminary taxable income excluding additional tax return items shown in column B. Enter the taxable income (loss) in the associated cells in column C. A B Preliminary Taxable Income (Loss) Additional Tax Form 1120 Taxable Return Item(s) Income (Loss) $100,000 $20,000 of charitable contributions 123 $160,000 $15,000 of charitable contributions 123 $10,000 of charitable contributions, and $20,000 of dividends from less-than-20%-owned domestic 123 $200,000 corporations $40,000 of dividends received from a 45%-owned domestic corporation 123 5 $250,000 $10,000 of dividends received from a 10%-owned domestic corporation, and a $20,000 net operating loss carryover from the prior year 123 $80,000 19 Preliminary Taxable Income (Loss) Additional Tax Form 1120 Taxable Return Item(s) Income (Loss) $100,000 $20,000 of charitable contributions 123 3 $160,000 $15,000 of charitable contributions 123 123 $10,000 of charitable contributions, and $20,000 of dividends from less-than-20%-owned domestic corporations $200,000 $40,000 of dividends received from a 45%-owned domestic corporation 123 $250,000 $10,000 of dividends received from a 10%-owned domestic corporation, and a $20,000 net operating loss carryover from the prior year 123 $80,000 123 $5,000 of charitable contributions and $10,000 of 7. ($40,000) dividends received from a 15%-owned domestic corporation $200,000 of dividends received from a 25%-owned domestic corporation 123 ($20,000) 80

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started