Answered step by step

Verified Expert Solution

Question

1 Approved Answer

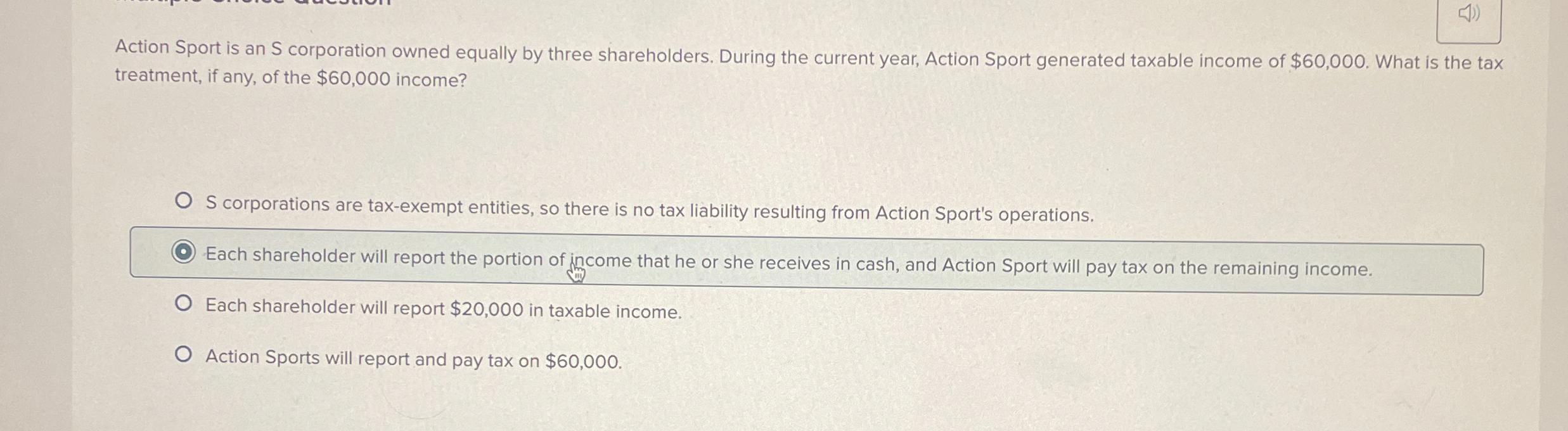

Action Sport is an S corporation owned equally by three shareholders. During the current year, Action Sport generated taxable income of $ 6 0 ,

Action Sport is an S corporation owned equally by three shareholders. During the current year, Action Sport generated taxable income of $ What is the tax

treatment, if any, of the $ income?

S corporations are taxexempt entities, so there is no tax liability resulting from Action Sport's operations.

Each shareholder will report the portion of income that he or she receives in cash, and Action Sport will pay tax on the remaining income.

Each shareholder will report $ in taxable income.

Action Sports will report and pay tax on $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started