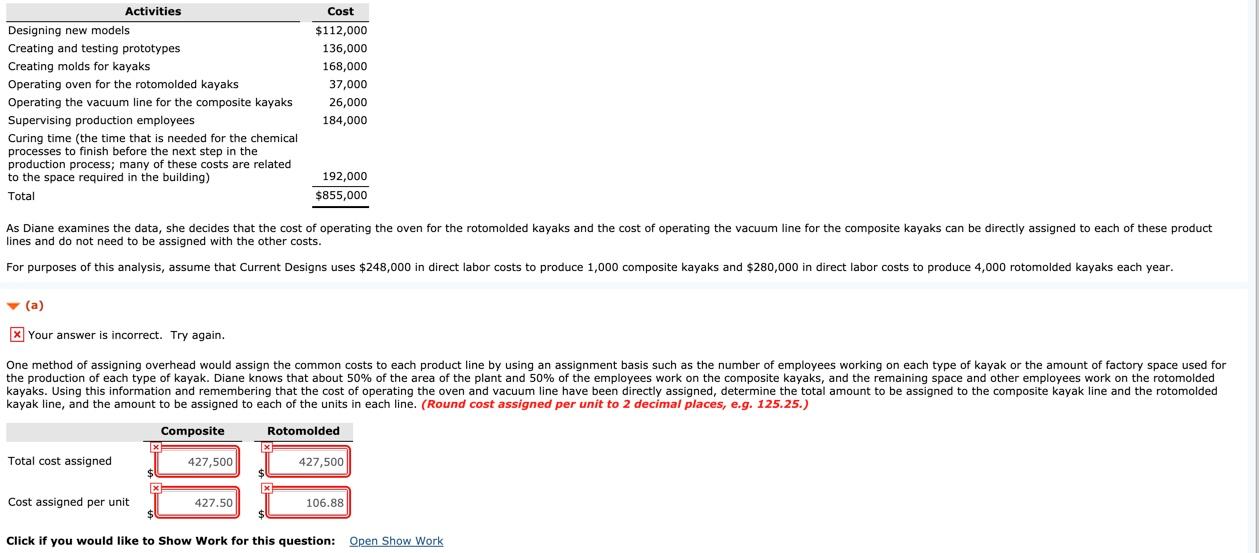

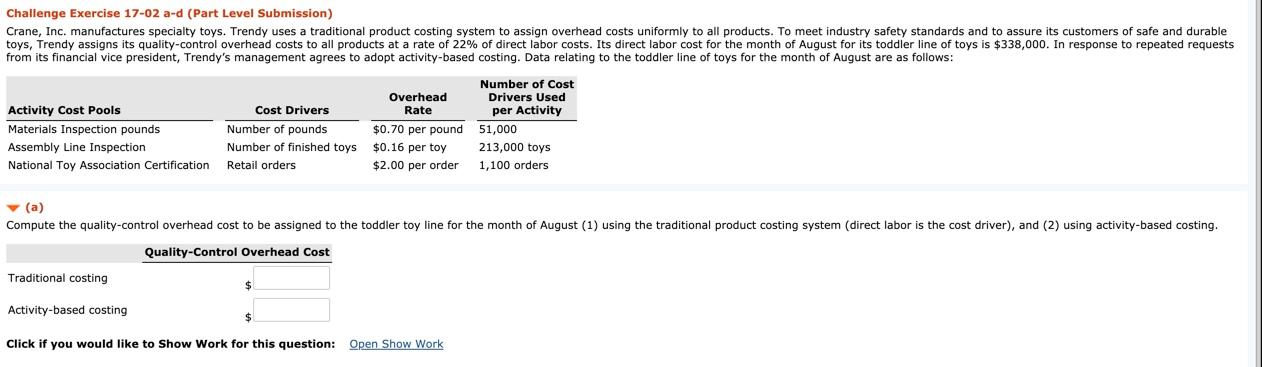

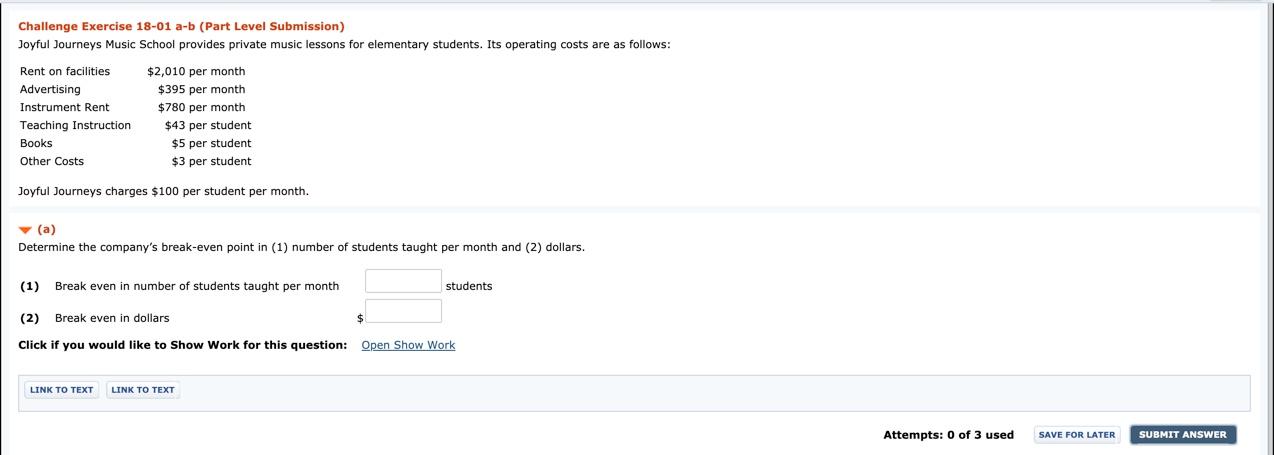

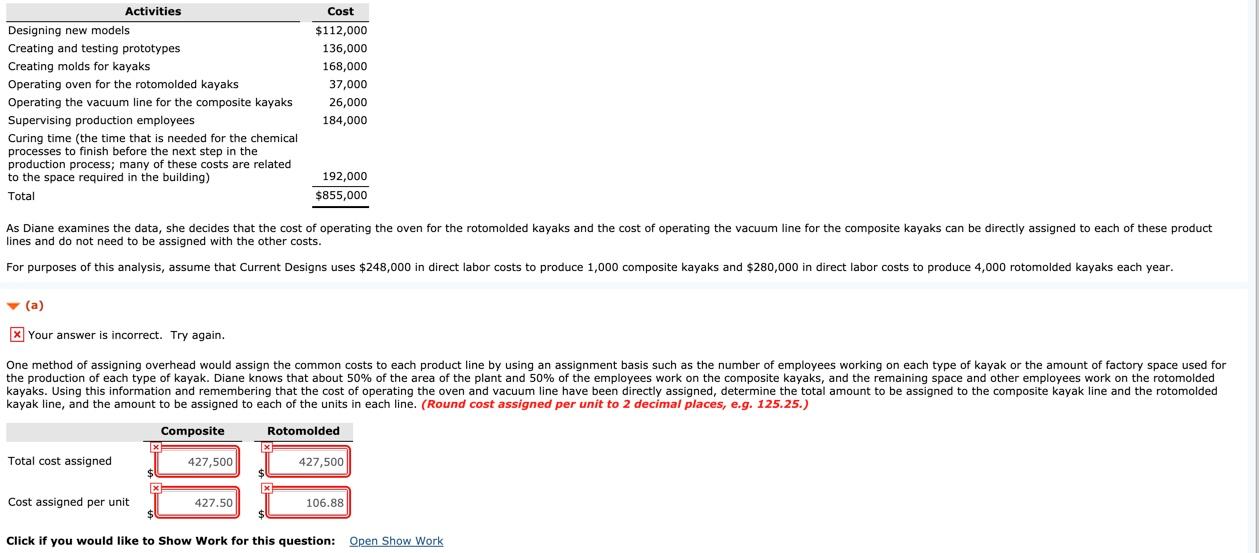

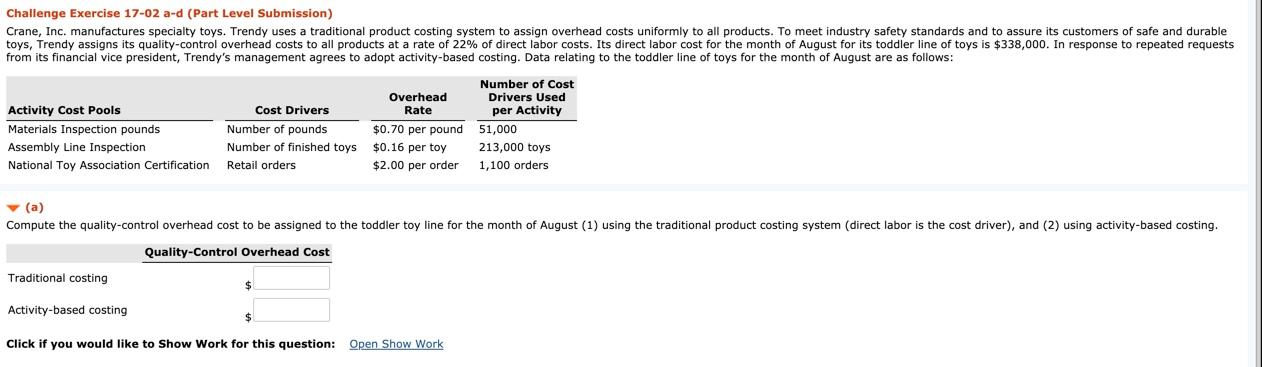

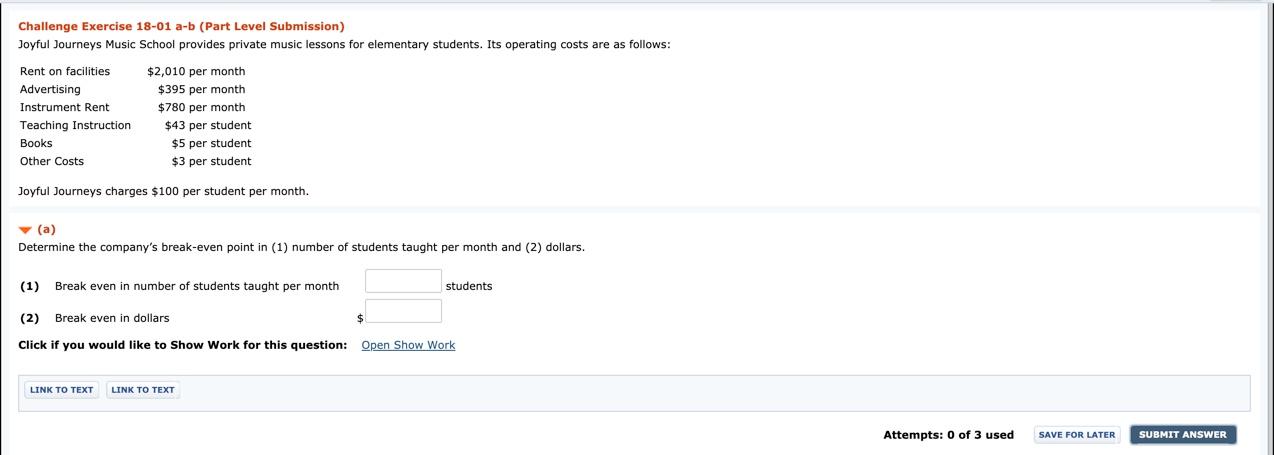

Activities Designing new models Creating and testing prototypes Creating molds for kayaks Operating oven for the rotomolded kayaks Operating the vacuum line for the composite kayaks Supervising production employees Curing time (the time that is needed for the chemical processes to finish before the next step in the production process; many of these costs are related to the space required in the building) Total Cost $112,000 136,000 168,000 37,000 26,000 184,000 192,000 $855,000 As Diane examines the data, she decides that the cost of operating the oven for the rotomolded kayaks and the cost of operating the vacuum line for the composite kayaks can be directly assigned to each of these product lines and do not need to be assigned with the other costs. For purposes of this analysis, assume that Current Designs uses $248,000 in direct labor costs to produce 1,000 composite kayaks and $280,000 in direct labor costs to produce 4,000 rotomolded kayaks each year. (a) x Your answer is incorrect. Try again. One method of assigning overhead would assign the common costs to each product line by using an assignment basis such as the number of employees working on each type of kayak or the amount of factory space used for the production of each type of kayak. Diane knows that about 50% of the area of the plant and 50% of the employees work on the composite kayaks, and the remaining space and other employees work on the rotomolded kayaks. Using this information and remembering that the cost of operating the oven and vacuum line have been directly assigned, determine the total amount to be assigned to the composite kayak line and the rotomolded kayak line, and the amount to be assigned to each of the units in each line. (Round cost assigned per unit to 2 decimal places, e.g. 125.25.) Composite Rotomolded Total cost assigned 427,500 427,50 X Cost assigned per unit 427.50 106.88 Click if you would like to Show Work for this question: Open Show Work Challenge Exercise 17-02 a-d (Part Level Submission) Crane, Inc. manufactures specialty toys. Trendy uses a traditional product costing system to assign overhead costs uniformly to all products. To meet industry safety standards and to assure its customers of safe and durable toys, Trendy assigns its quality control overhead costs to all products at a rate of 22% of direct labor costs. Its direct labor cost for the month of August for its toddler line of toys is $338,000. In response to repeated requests from its financial vice president, Trendy's management agrees to adopt activity-based costing. Data relating to the toddler line of toys for the month of August are as follows: Activity Cost Pools Materials Inspection pounds Assembly Line Inspection National Toy Association Certification Cost Drivers Number of pounds Number of finished toys Retail orders Overhead Rate $0.70 per pound $0.16 per toy $2.00 per order Number of Cost Drivers Used per Activity 51,000 213,000 toys 1,100 orders (a) Compute the quality control overhead cost to be assigned to the toddler toy line for the month of August (1) using the traditional product costing system (direct labor is the cost driver), and (2) using activity-based costing. Quality Control Overhead Cost Traditional costing Activity-based costing Click if you would like to Show Work for this question: Open Show Work Challenge Exercise 18-01 a-b (Part Level Submission) Joyful Journeys Music School provides private music lessons for elementary students. Its operating costs are as follows: Rent on facilities Advertising Instrument Rent Teaching Instruction Books Other Costs $2,010 per month $395 per month $780 per month $43 per student $5 per student $3 per student Joyful Journeys charges $100 per student per month. (a) Determine the company's break-even point in (1) number of students taught per month and (2) dollars. (1) Break even in number of students taught per month students (2) Break even in dollars Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT LINK TO TEXT Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER Activities Designing new models Creating and testing prototypes Creating molds for kayaks Operating oven for the rotomolded kayaks Operating the vacuum line for the composite kayaks Supervising production employees Curing time (the time that is needed for the chemical processes to finish before the next step in the production process; many of these costs are related to the space required in the building) Total Cost $112,000 136,000 168,000 37,000 26,000 184,000 192,000 $855,000 As Diane examines the data, she decides that the cost of operating the oven for the rotomolded kayaks and the cost of operating the vacuum line for the composite kayaks can be directly assigned to each of these product lines and do not need to be assigned with the other costs. For purposes of this analysis, assume that Current Designs uses $248,000 in direct labor costs to produce 1,000 composite kayaks and $280,000 in direct labor costs to produce 4,000 rotomolded kayaks each year. (a) x Your answer is incorrect. Try again. One method of assigning overhead would assign the common costs to each product line by using an assignment basis such as the number of employees working on each type of kayak or the amount of factory space used for the production of each type of kayak. Diane knows that about 50% of the area of the plant and 50% of the employees work on the composite kayaks, and the remaining space and other employees work on the rotomolded kayaks. Using this information and remembering that the cost of operating the oven and vacuum line have been directly assigned, determine the total amount to be assigned to the composite kayak line and the rotomolded kayak line, and the amount to be assigned to each of the units in each line. (Round cost assigned per unit to 2 decimal places, e.g. 125.25.) Composite Rotomolded Total cost assigned 427,500 427,50 X Cost assigned per unit 427.50 106.88 Click if you would like to Show Work for this question: Open Show Work Challenge Exercise 17-02 a-d (Part Level Submission) Crane, Inc. manufactures specialty toys. Trendy uses a traditional product costing system to assign overhead costs uniformly to all products. To meet industry safety standards and to assure its customers of safe and durable toys, Trendy assigns its quality control overhead costs to all products at a rate of 22% of direct labor costs. Its direct labor cost for the month of August for its toddler line of toys is $338,000. In response to repeated requests from its financial vice president, Trendy's management agrees to adopt activity-based costing. Data relating to the toddler line of toys for the month of August are as follows: Activity Cost Pools Materials Inspection pounds Assembly Line Inspection National Toy Association Certification Cost Drivers Number of pounds Number of finished toys Retail orders Overhead Rate $0.70 per pound $0.16 per toy $2.00 per order Number of Cost Drivers Used per Activity 51,000 213,000 toys 1,100 orders (a) Compute the quality control overhead cost to be assigned to the toddler toy line for the month of August (1) using the traditional product costing system (direct labor is the cost driver), and (2) using activity-based costing. Quality Control Overhead Cost Traditional costing Activity-based costing Click if you would like to Show Work for this question: Open Show Work Challenge Exercise 18-01 a-b (Part Level Submission) Joyful Journeys Music School provides private music lessons for elementary students. Its operating costs are as follows: Rent on facilities Advertising Instrument Rent Teaching Instruction Books Other Costs $2,010 per month $395 per month $780 per month $43 per student $5 per student $3 per student Joyful Journeys charges $100 per student per month. (a) Determine the company's break-even point in (1) number of students taught per month and (2) dollars. (1) Break even in number of students taught per month students (2) Break even in dollars Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT LINK TO TEXT Attempts: 0 of 3 used