Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Activity 01. Record business transactions using double entry book keeping and be able to extract a trial balance (Covers LO 01 and LO 02) Nilaa

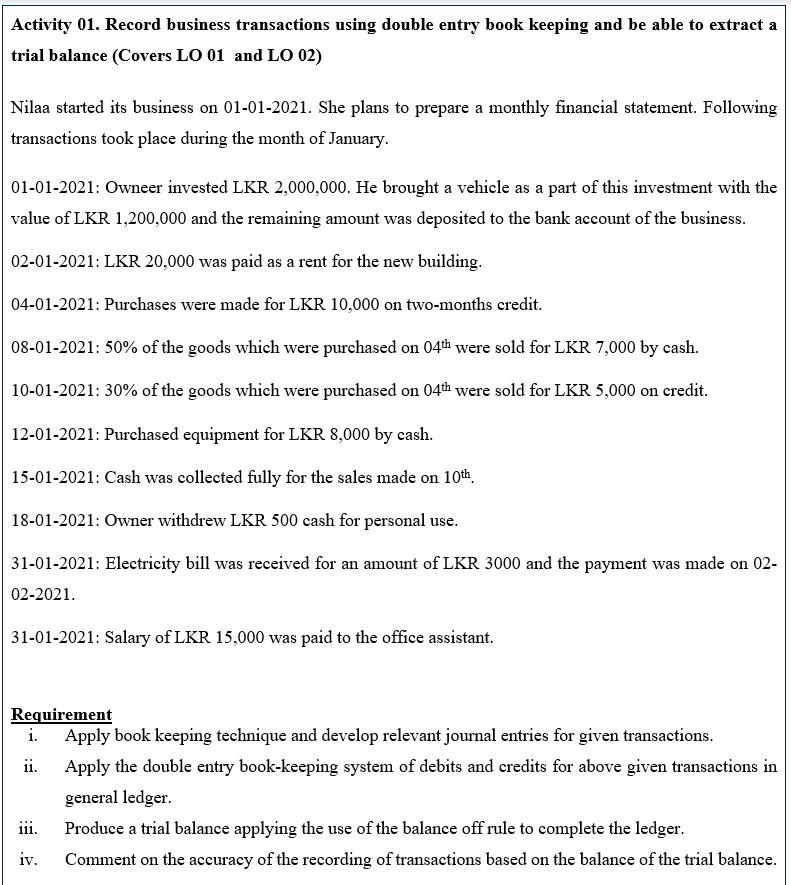

Activity 01. Record business transactions using double entry book keeping and be able to extract a trial balance (Covers LO 01 and LO 02) Nilaa started its business on 01-01-2021. She plans to prepare a monthly financial statement. Following transactions took place during the month of January. 01-01-2021: Owneer invested LKR 2,000,000. He brought a vehicle as a part of this investment with the value of LKR 1,200,000 and the remaining amount was deposited to the bank account of the business. 02-01-2021: LKR 20,000 was paid as a rent for the new building. 04-01-2021: Purchases were made for LKR 10,000 on two-months credit. 08-01-2021: 50% of the goods which were purchased on 04th were sold for LKR 7,000 by cash. 10-01-2021: 30% of the goods which were purchased on 04th were sold for LKR 5,000 on credit. 12-01-2021: Purchased equipment for LKR 8,000 by cash. 15-01-2021: Cash was collected fully for the sales made on 10th 18-01-2021: Owner withdrew LKR 500 cash for personal use. 31-01-2021: Electricity bill was received for an amount of LKR 3000 and the payment was made on 02- 02-2021. 31-01-2021: Salary of LKR 15,000 was paid to the office assistant. Requirement i. Apply book keeping technique and develop relevant journal entries for given transactions. ii. Apply the double entry book-keeping system of debits and credits for above given transactions in general ledger. 111. Produce a trial balance applying the use of the balance off rule to complete the ledger. iv. Comment on the accuracy of the recording of transactions based on the balance of the trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started