Answered step by step

Verified Expert Solution

Question

1 Approved Answer

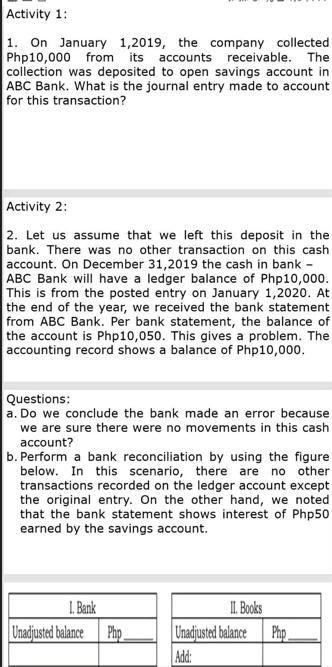

Activity 1: 1. On January 1,2019, the company collected Php10,000 from its accounts receivable. The collection was deposited to open savings account in ABC

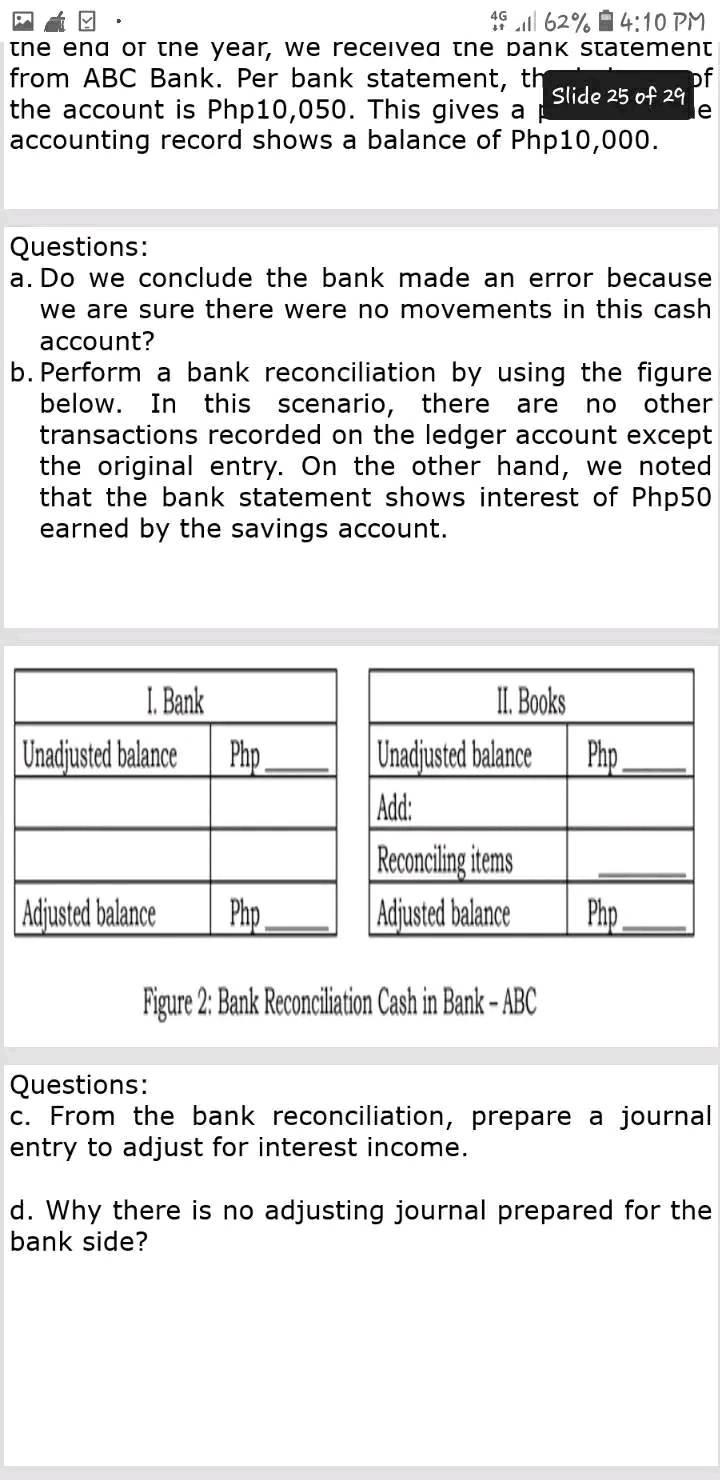

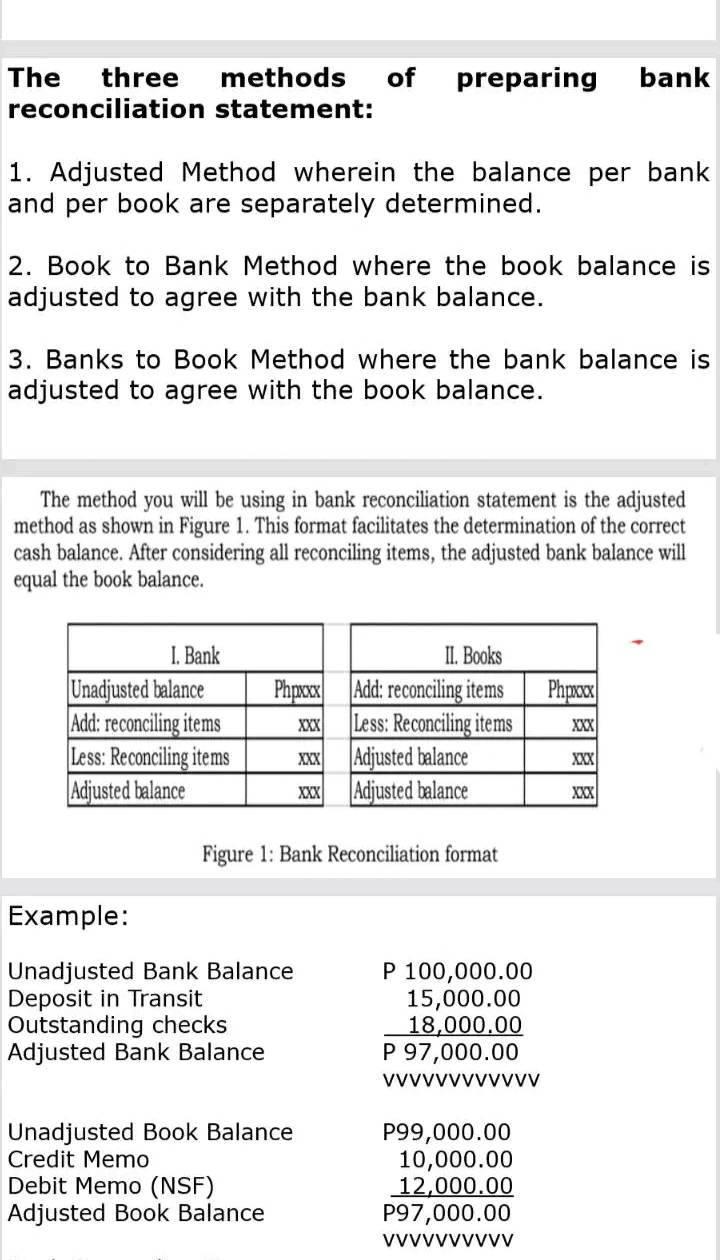

Activity 1: 1. On January 1,2019, the company collected Php10,000 from its accounts receivable. The collection was deposited to open savings account in ABC Bank. What is the journal entry made to account for this transaction? Activity 2: 2. Let us assume that we left this deposit in the bank. There was no other transaction on this cash account. On December 31,2019 the cash in bank - ABC Bank will have a ledger balance of Php10,000. This is from the posted entry on January 1,2020. At the end of the year, we received the bank statement from ABC Bank. Per bank statement, the balance of the account is Php10,050. This gives a problem. The accounting record shows a balance of Php10,000. Questions: a. Do we conclude the bank made an error because we are sure there were no movements in this cash account? b. Perform a bank reconciliation by using the figure below. In this scenario, there are no other transactions recorded on the ledger account except the original entry. On the other hand, we noted that the bank statement shows interest of Php50 earned by the savings account. 1. Bank Unadjusted balance Php II. Books Unadjusted balance Php Add: 46 62% 4:10 PM the end of the year, we received the bank statement from ABC Bank. Per bank statement, th Slide 25 of 29 the account is Php10,050. This gives a accounting record shows a balance of Php 10,000. Questions: a. Do we conclude the bank made an error because we are sure there were no movements in this cash account? b. Perform a bank reconciliation by using the figure below. In this scenario, there are no other transactions recorded on the ledger account except the original entry. On the other hand, we noted that the bank statement shows interest of Php50 earned by the savings account. I. Bank Unadjusted balance Php II. Books Adjusted balance Php. Unadjusted balance Add: Reconciling items Adjusted balance Figure 2: Bank Reconciliation Cash in Bank - ABC Php Php. Questions: c. From the bank reconciliation, prepare a journal entry to adjust for interest income. d. Why there is no adjusting journal prepared for the bank side? The three methods of preparing bank reconciliation statement: 1. Adjusted Method wherein the balance per bank and per book are separately determined. 2. Book to Bank Method where the book balance is adjusted to agree with the bank balance. 3. Banks to Book Method where the bank balance is adjusted to agree with the book balance. The method you will be using in bank reconciliation statement is the adjusted method as shown in Figure 1. This format facilitates the determination of the correct cash balance. After considering all reconciling items, the adjusted bank balance will equal the book balance. I. Bank Unadjusted balance Add: reconciling items Less: Reconciling items Adjusted balance Phpxxx XXX Example: Unadjusted Bank Balance Deposit in Transit Outstanding checks Adjusted Bank Balance II. Books Add: reconciling items Less: Reconciling items Figure 1: Bank Reconciliation format Unadjusted Book Balance Credit Memo Debit Memo (NSF) Adjusted Book Balance XXX Adjusted balance XXX Adjusted balance P 100,000.00 15,000.00 18,000.00 P 97,000.00 vvvvvvvvvvvv P99,000.00 10,000.00 12,000.00 P97,000.00 vvvvvvvvvv Phpxxx XXX XXX XXX

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 The transaction involves collecting accounts receivable money owed to you by your customers and depositing it into a savings account The two accounts affected by this transaction are Accounts Receiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started